Dynamics 365 Tutorials, Dynamics AX Business Intelligence, Dynamics Operations Training, Microsoft Dynamics 365 Developer (F&S) Training Series, Microsoft Dynamics AX

Recalculate Values for Replacement Cost of Fixed Asset Groups in Dynamics 365 Finance and Operations

Recalculate Replacement Cost for Fixed Asset Groups in D365

Replacement Cost | Fixed Asset Groups | Asset Planning

An analysis of repair and maintenance (R&M) discloses that US companies are spending more than $100 billion on renovating and restoring vital equipment and facilities. Calculating and recalculating replacement cost correctly is a way to ensure business’ smooth running. This allows you to get the exact cost to restore the same production capacity for the coming months or even years.

In the case of fixed asset value groups, you can get the exact cost required to build the same warehouse or any building according to present rates. The replacement cost of fixed asset groups can be ignored while assuming that the warehouse is okay and possess no obsolescence.

This sort of estimation is helpful when you are selling your old warehouse building calling for repairs. Hence, the other business buying your warehouse will calculate the replacement cost first then will make a fair deal. Once the buyer purchases your facility, it is his right to deduct the replacement cost for an old building and offer the final value he will be willing to pay.

Let’s try again with an example this time. Your firm bought an oil refinery costing $2,500 a decade ago. Today, that oil refinery costs $1,000, considering the depreciation. So now, the replacement cost for the refinery came out to be $1,500. In this case, you have to decide whether it’s a good idea to replace the old refinery and buy a new refinery or get along with using the existing one.

Preferably, the firm should take in the replacement cost management as it will add value to the business in the coming days.

What is a Replacement Cost?

The replacement cost is required to make an asset perform better or in similar way. For example, firms often decide to return their purchases when there is an increase in repair and maintenance costs beyond the acceptance level in a specific time. In doing so, the firm involves the insurance company to comply with the requirements. As explained above, you can get it by calculating the value of your asset today followed by its usage life.

The primary function of the insurance company is to see which of the replacements would be more cost efficient, either buying new machinery or repairing an old one. It would help if you also got depreciation inquiries as it will have a notable impact on the decision to continue using old assets with the new ones. Not surprisingly, sometimes, it becomes a challenge to estimate the correct market value of the specific investment. Therefore, it may lead firms to make wrong decisions.

How does D365 Recalculate Replacement cost?

There is a production firm in a remote location in one building. The building in which the manufacturing firm operates is thirty years old, and the firm bought the building for $5,000 thirty years ago. However, today it would cost $15,000 to rebuild the same structure. Hence, the replacement cost for the installation is $15,000.

Likewise, the replacement cost of all machinery is $8,000. Therefore, to replace the firm today, your firm will spend $15,000+$8,000=$23,000.

Now comes a bit tricky part, the recalculation. To recalculate replacement cost and value for your fixed asset groups, you must know the increased replacement cost or insured value percentage. Once you are sure of the portion, you can perform the periodic update to get the recalculated value.

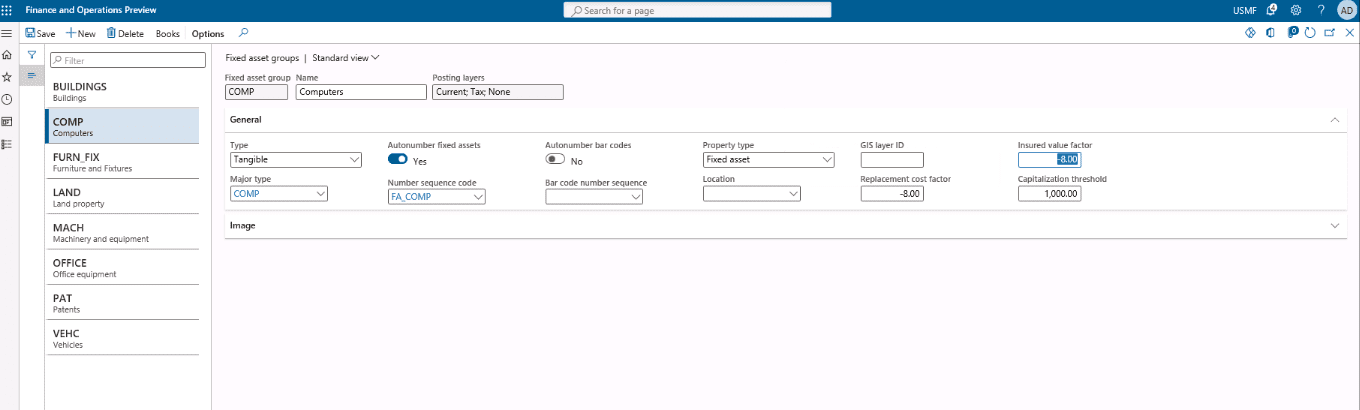

Dynamics 365 Finance and Operations allows you to specify the percentage in the replacement cost and insured cost factor in the fields on the page for fixed asset groups. In addition, when you determine increasing factors for fixed asset groups while using the updated replacement cost and insured value page, you can choose to recalculate the replacement cost and insured value for the only specific fixed asset in a group.

D365 Financial Management uses the following formulas to update the replacement cost:

[(Asset group’s replacement cost factor / 100) + 1] * Asset’s existing replacement cost[(Asset group’s insured value factor / 100) + 1] * Asset’s existing insured value.

SUMMARY

A business’s replacement cost is the amount of money costs to replace a key asset, such as a piece of machinery, investment security, or another item, with one of equal or greater worth. A replacement cost, often known as a “replacement value,” varies based on factors such as the market value of components required to reconstruct or repurchase the asset, as well as the costs of preparing assets for use.

How to Calculate Replacement Cost Based on Industry Trends

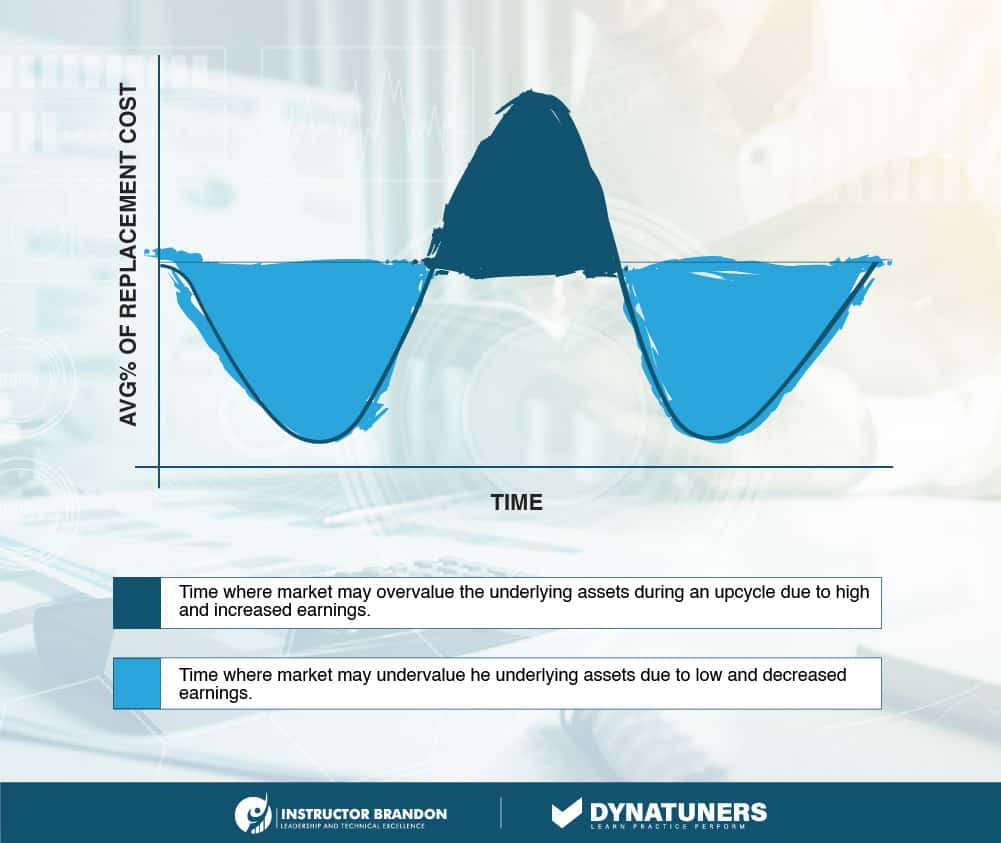

You should value the assets based on what they will bring at liquidation if the market trend is on the downside. As it will be challenging to find a customer during the downturn in the market, there are chances that you might have to sell your assets at scrap rates.

Our skilled developers here at Instructor Brandon encode an analytical system setup and create the best workspace to sell your replacement assets and minimize the replacement cost percentage.

If you opt to sell your assets when the market is steady or growing, the investments in use will require repairs when worn out; thus, your firm should evaluate them at the cost of replacement.

With this and many other cost-reflecting graphs, we can provide our clients with the best assistance for Microsoft Dynamics AX.

Replacement Cost for different Line Sectors

In the notes, you might come across some problematic debt indicators. This could be a seemingly non-surprising occurrence for a new business, as it is more likely to have bad debts. In comparison, the cost of replicating accounts receivable expects to be greater than the company’s balance sheet amount.

For Inventory

If inventory has been stacking up, equaling 200 days’ worth of cost of products sold this year against 150 days last year, the additional 50 days may indicate items that will never sell or will sell only at closeout rates.

Also, if the corporation accounts for inventory using LIFO (Last-In-First-Out), in that case, the stock’s actual value will be greater than the Balance Sheet figure by the amount known as the LIFO Reserve (the amount by which the depreciated cost of any item exceeds the old).

For Property & Equipment

Property: Buildings, for example, will possess financial reporting of more than its book value.

Equipment: The gap between the equipment’s replacement cost and the quantity on the Balance Sheet is significant for two reasons:

- The company’s depreciation rules may have little similarity to the asset’s true economic worth. For example, telecom infrastructure may survive for decades, but the corporation would have depreciated it to zero in a relatively short period.

- In case of inflation, you can calculate depreciation cost using the plant’s historical cost, which is presently excessively high. As a result, our depreciation statistics in the Income Statement may be significantly lower than those of a firm that has recently opened a new facility. However, newcomers may have more cutting-edge tools in a high-tech, inventive industry.

SUMMARY

Calculating replacement costs for your business’ assets and property can help you make an analytical decision in the future. However, there are different ways to calculate replacement costs for other line sectors. The above heading describes how you can get the calculation done for your business’ replenishment.

Replacement Cost vs. Market Value

Many marketers get confused between replacement cost and market cost when making specific calculations. In actuality, the cost of repairing or rebuilding your house at current construction material and labor rates is known as cost of replacement. If your warehouse is destroyed in a fire, for example, your insurance will compensate you for the cost of reconstructing it in the same style and quality as it was before (up to your coverage limits).

In contrast, the market value of your property is the amount it is worth on the real estate market. The state’s worth, its location appeal, the land on which it’s built, and the amount that comparable properties in the neighborhood are selling for, all affect market value. The market worth is usually higher than its replacing cost; however, this varies based on the property’s age and location.

| Factors Affecting Cost/Value | Replacement Cost Vs. Market Value | |

| Replacement Cost | Market Value | |

| Age of property |

. |

· |

| Size of property |

· |

· |

| Labor cost |

. |

|

| Construction cost |

. |

|

| Demonetization cost |

· |

|

| Architecture style |

· |

· |

| Land value |

· |

|

| Property supply and demand |

· |

|

| Labor and construction supply demand |

· |

|

SUMMARY

The contrast between the market value and the cost replacement of your assets is a vital understanding that can help you make any critical decision without compromising the growth of your business in future.

Recalculate Replacement Cost Values for Fixed Asset Groups in Dynamics 365

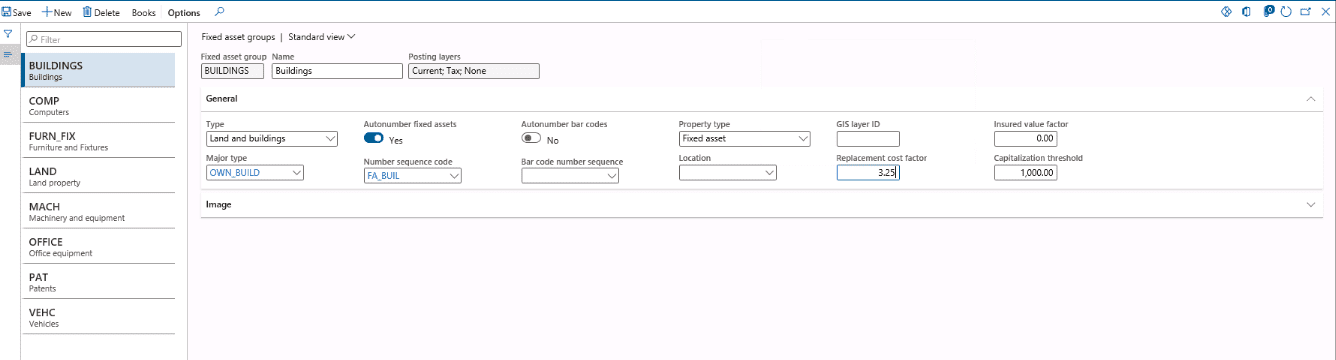

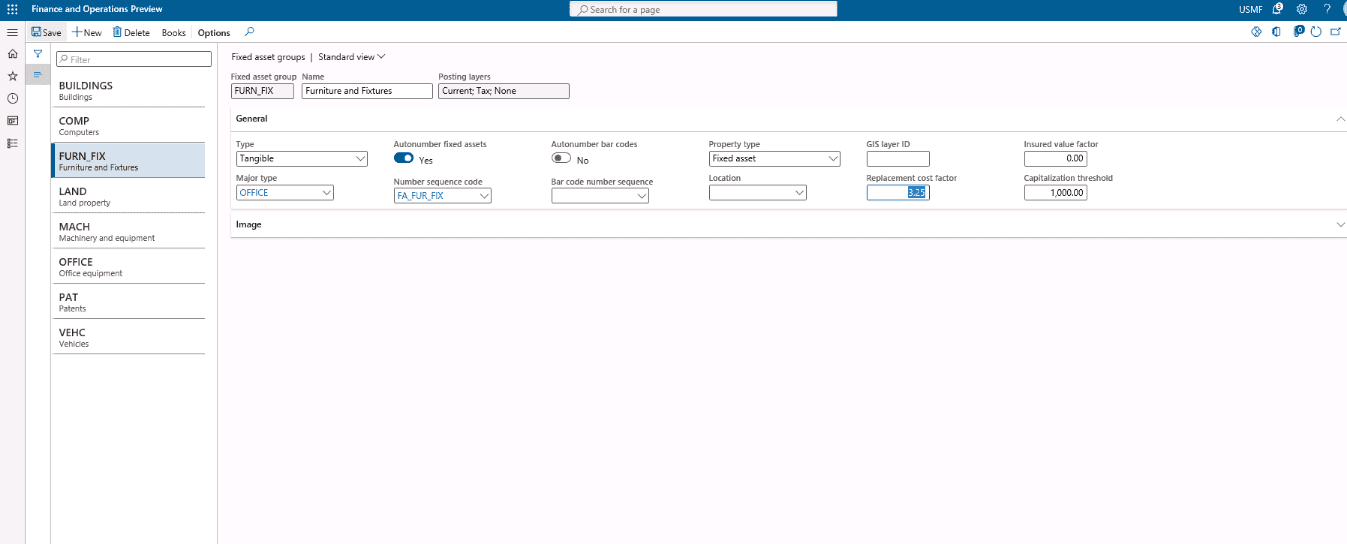

Consider the following changes to fixed assets:

- Increase the cost of replacement of all fixed assets, except computers, by 3.25 percent.

- Increase the cost of replacement of all office furniture by an additional 1 percent.

- Decrease the cost of replacement and insured value of all computers by 10 percent.

You make the following changes:

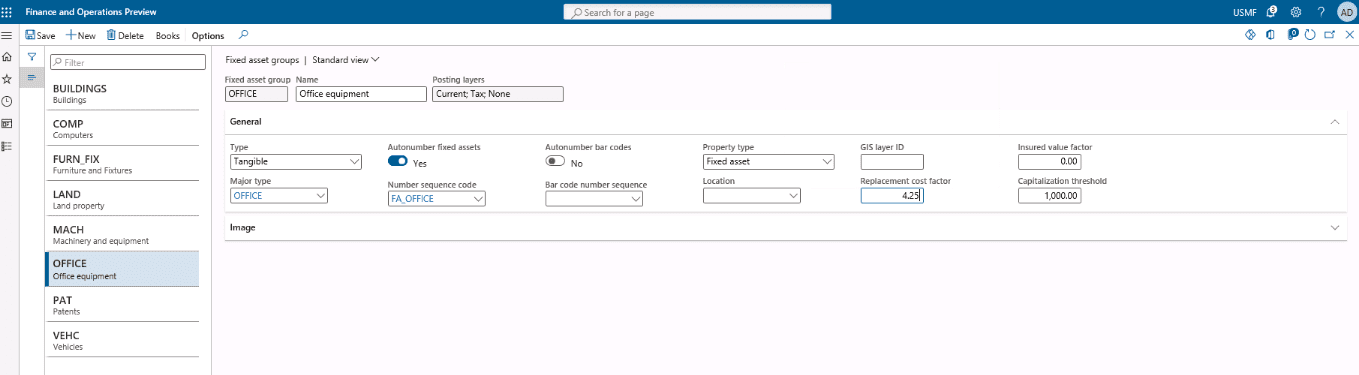

Step 1

In the Fixed asset groups page, for all fixed asset groups except the Office Furniture group and Computers group, you type 3.25 and 0 in the Insured value factor field.

Step 2

For the Office Furniture group, you type 4.25 and 0 in the Insured value factor field.

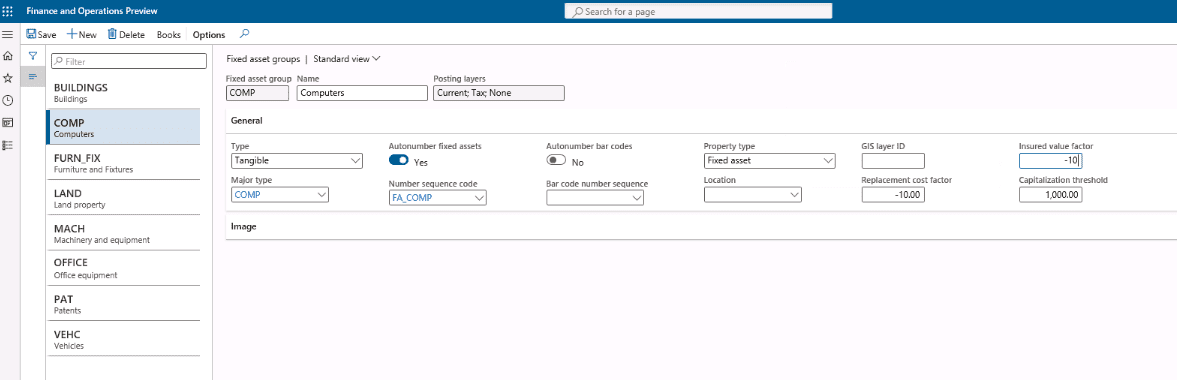

Step 3

For the Computers group, you type -10 and -10 in the Insured value factor field.

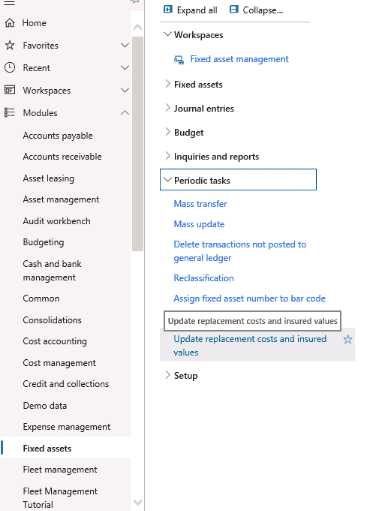

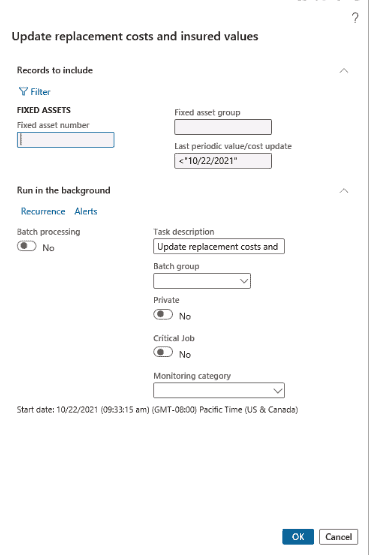

Step 4

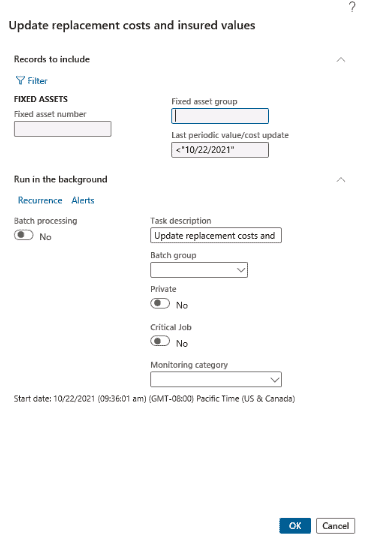

In the Update replacement costs and insured values page, you click OK to perform the recalculation for all fixed assets.

Step 5

The next day, computers decrease 8 percent instead of 10 percent, so correct the replacement costs and insured values.

Step 6

Enter replacement cost and insured value factors for the Computers group in the Replacement cost factor and Insured value factor fields in the Fixed asset groups This will both reset the assets back to their original value (before the 10 percent decrease) and apply the 8 percent decrease to the original value.

Step 7

Use the Update replacement costs and insured values page to recalculate the values, depending on the factors that you entered.

SUMMARY

To recalculate replacement costs and guaranteed values for fixed asset groupings, first define the percentage by which existing quantiles and insured values should be changed, and then run the periodic update to recalculate the values. In the Fixed asset groupings page, you provide the percentage in the Replacement cost factor and Insured value factor columns. Although you specify these parameters for the fixed asset group, you may choose to recalculate the replacement cost and insured value for only individual fixed assets in a group when you utilize the Update replacement costs and insured values page.

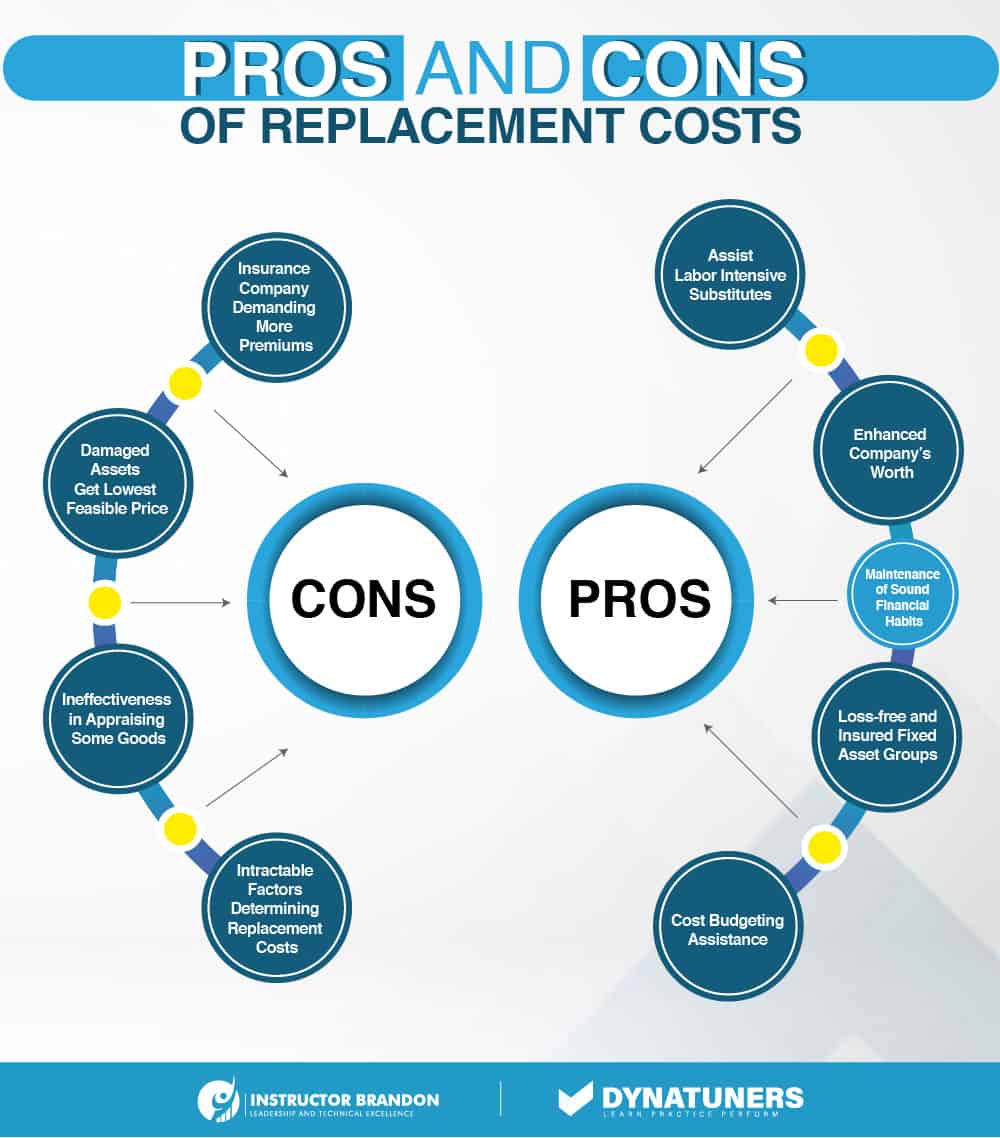

Advantages and Disadvantages of Replacement Cost

While there are several upsides to replacement costs, there are some downsides as well. Here are both of them explained in detail:

Advantages

- It’s a pretty straightforward strategy that anyone with a basic understanding of profit and loss may use.

- The corporation may calculate the asset’s current worth and depreciation and then decide whether they need a replacement or not.

- They also assist the corporation in cost budgeting and, as a result, maintain a sound financial accounting of planning funds ahead of time so that the company may gain.

- It assists the insurance company in settling claims. The replacement cost coverage can help so that policy holders do not suffer losses, and the guaranteed sum will be equal to the item’s cost.

- It also aids in the company’s search for labor-intensive substitutes. The organization’s HR policy also analyses the replacement technique while making a decision.

- Companies can use the cost replacement to boost the company’s worth. Because the one-time price of any physical asset is less than its cost, the corporation can utilize it to increase the asset’s balance sheet number.

Disadvantages

- An insurance provider frequently demands a more significant premium. As a result, it is troublesome for policymakers to pay such high rates to have their assets accounting protected.

- In case, if a corporation uses the cost of replacement basis to settle its claims with the insurance company, it may have to accept the loss because the smaller amount of the asset is typically settled, but if the firm uses the actual cash worth of the acquisition, it will be in a neutral position.

- It is ineffective in appraising some goods, such as antiques, for which specific treatment is necessary.

- A variety of things determine this cost: market conditions, demand changes, asset service life, and many more. As a result, each parameter must be met to obtain an accurate replacement value, and all of these characteristics are not always available inside the business.

SUMMARY

Replacement cost approach can help business’ a great deal. You can use cost replacement by the insurance company to determine the item’s replacement cost under consideration. The policy is written so that the policyholder benefits from the insurance company, although claims are occasionally settled for less than the asset’s true worth.

At Instructor Brandon | Dynatuners, we always seek innovative methods to improve your competitiveness and suit your Microsoft Dynamics 365 requirements. Our offerings are founded on defined procedures, industry experience, and product understanding. If you’re interested to consult with our technical solutions experts on how we may help you to address on calculation costing error and its solution or to get more information on calculating replacement costs in Dynamics 365, don’t hesitate to Contact Us.

[sc_fs_multi_faq headline-0=”h2″ question-0=”How do you determine the cost of replacing fixed assets? ” answer-0=”The following calculations are used when you utilize the update replacement costs and insured values page to compute the replacement cost and insured value of assets: Replacement cost factor for asset category / 100 + 1 x Existing replacement cost of the asset ” image-0=”” headline-1=”h2″ question-1=”What is asset replacement? ” answer-1=”A business may consider replacing an inefficient fixed asset that it now owns and runs with a more efficient one in order to minimize operating expenses. The corporation may utilize differential analysis to determine the cost of maintaining the original asset vs. the cost of replacing it. ” image-1=”” headline-2=”h2″ question-2=”What does replacement of fixed capital mean in economic terms? ” answer-2=”Fixed capital assets such as equipment and buildings lose value during production. Consumption of fixed capital refers to the decline in value of fixed assets owing to regular wear and tear and predicted obsolescence. This is sometimes referred to as current replacement cost. ” image-2=”” count=”3″ html=”true” css_class=””]

2792

2792