Dynamics 365 Reporting, Dynamics 365 Tutorials, Dynamics Operations Training, Microsoft Dynamics 365 Developer (F&S) Training Series

D365 Automated Royalty Agreements: Moving Beyond Error-Prone Manual Calculations

This blog post highlights issues that plague manual management of royalty agreements and explains D365 features which can help organizations address these issues. The write-up will also highlight how D365 facilitates the tracking and analysis of royalty-related data, which is virtually impossible to do with manual management.

Royalty Contracts: Breaking Down Key Terms

Sales Order | Dynamics 365 Finance and Operations | Automating Data Validation | Procurement Invoicing

A royalty contract is a legal and binding agreement between two parties whereby one party attains the right to use the other’s intellectual property in return for financial compensation.

The financial compensation paid out to the intellectual property owner is called royalty. Typically, companies calculate royalty payments as a percentage of revenue generated instead of paying out lump sum amounts.

The licensor — a company or an individual — is the intellectual property owner who grants usage rights. At the same time, the person or enterprise that pays for the rights to use intellectual property is called the licensee.

The terms of royalty agreements generally include:

- The percentage amounts

- The period

- The duration of usage

- The territorial scope of the contract

Royalty contracts are crucial to maintaining a healthy market exchange of ideas and innovations. And, at the same time, ensure that innovators receive adequate compensation for their efforts.

Consider a smartphone manufacturer who wants to revamp their phone’s exterior. But instead of creating a new design, they choose to deploy an existing one. The phone manufacturer cannot arbitrarily copy the exterior. Rather, the producer will have to enter into a royalty agreement with the designer to obtain the legal rights to his design.

Another typical example of royalty payments is the money mining enterprises pay to people who own the mined land.

4 Types of Intellectual Property

Several types of intellectual property exist, including patents, copyrights, trademarks, and trade secrets.

Copyright

The written word or any other form of authorship can be copyrighted.

Trademarks

Companies register special symbols and their logos as trademarks.

Patents

Patents represent scientific inventions.

Trade Secrets

Trade secrets are confidential corporate information.

While these categories differ based on the type of idea, the laws protecting them from theft are more or less similar. The figure below represents the four main types of intellectual property.

The figure above represents the four main types of intellectual property.

SUMMARY

Enterprises have to pay out financial compensation – called royalties – in return for the legal rights to someone’s intellectual property. These bilateral agreements are called royalty contracts. Using someone’s intellectual property without paying royalties is illegal and can open organizations to legal action under intellectual property violation laws. Enterprise Resource Planning (ERP) tools like D365 help automate the otherwise cumbersome royalty management process.

Manually Calculating Royalties: A Thing of the Past

Royalty contracts are complicated legal agreements and can be tough to decipher.

Enterprises that have to pay royalties for thousands of products and multiple licensors have to deal with layers of complex transactions. For this reason, manual royalty calculations are prone to several kinds of mistakes.

Here are some key challenges organizations might face with manual royalty contract management.

Cumbersome Calculations

Calculating royalties is rarely a straightforward process. Royalty contracts tend to involve several legal conditions and clauses that factor into the final calculation. Maneuvering these conditions while manually computing royalties can be extremely frustrating and time-consuming.

Organizations with many royalties to manage might have to employ teams working around the clock to calculate royalties; this is a blatant waste of time and human resources.

Moreover, your enterprise can end up missing payment deadlines just because accountants with calculators could not come up with a final number on time.

D365 allows you to bypass this cumbersome process by instantaneously computing royalties in real time.

Human Accounting Errors

Human accounting errors are one of the most common issues companies face while managing royalty agreements.

People tasked with managing royalty accounts might get lost while manually calculating monthly royalty payouts. And erroneous calculations can result in over or underpayments, negatively impacting the company’s overall financial processes.

In extreme cases, faulty calculations can cause companies to miss out on royalty payments altogether, and missed payments expose companies to a host of financial and legal liabilities.

D365’s automated royalty calculator removes the chances of human accounting errors.

Hidden Costs

Royalty fees are not part of the actual manufacturing or sales process. Therefore, when an enterprise sells a product governed by a royalty contract, the incoming revenues do not represent actual revenues because the amount has not been adjusted for royalty payouts, creating a skewed financial picture. As a result, managers have a hard time ascertaining accurate profit margins.

D365 royalty contract management adjusts incoming revenues for hidden expenses incurred as royalty payouts. Royalty payments are recorded, calculated, and compiled in real time. As a result, managers can attain a more accurate picture of their profits.

Additional Expenses on Large Workforces

Large-scale enterprises which sell products at scale have to calculate royalties per product; this can be an overwhelming task. As a result, large enterprises employ scores of accountants who have to spend hours crunching numbers just to get a single receipt out.

Moreover, manually tracking and managing royalties is very time-consuming and can divert time, energy, and focus from core business processes.

In comparison, D365’s royalty contract management systems do not require large workforces to operate them. In addition, once an automated royalty contract management system is set up, royalties can be calculated with the clicks of a few buttons. So, be ready to let go of redundant staff members and save up on salary costs.

A Complete Lack of Data Analysis and Tracking

Manual processes are hard to track and analyze. After all, manual processes preserve data in the form of physical files and documents. And extracting data trends from physical documentation is virtually impossible.

You could also try manually typing in the data to digital files and importing them into a database management system, and then applying queries to extract trends. But this in itself is a very tedious and redundant process.

For this reason, organizations that manually calculate royalties tend to skip analyzing royalty data once payments have gone through; this limits their ability to identify gaps in their royalty management approach.

D365, on the other hand, automatically creates data trends that can be tracked and analyzed.

SUMMARY

In short, manually managing royalty contracts is not just sluggish but is also ineffective in many ways. You have to put in extremely large amounts of time, effort, and resources to get a result that is still prone to several errors. Moreover, it is almost impossible to gather intelligent insights from physical documentation, leaving you with limited information on how to improve your payment processes.

D365 offers modern solutions to these age-old problems and gives you more accurate results in shorter periods.Automating your royalty contract management using Dynamics 365 mitigates the effects of human accounting errors. Moreover, users can easily set up contract conditions so that the results are in line with the negotiated agreements. In short, Dynamics 365 for Finance and Operations takes care of your royalty payments, freeing you up to focus on core business tasks

Automate your Royalty Contract Management to Dodge Incurring Additional Financial Liabilities

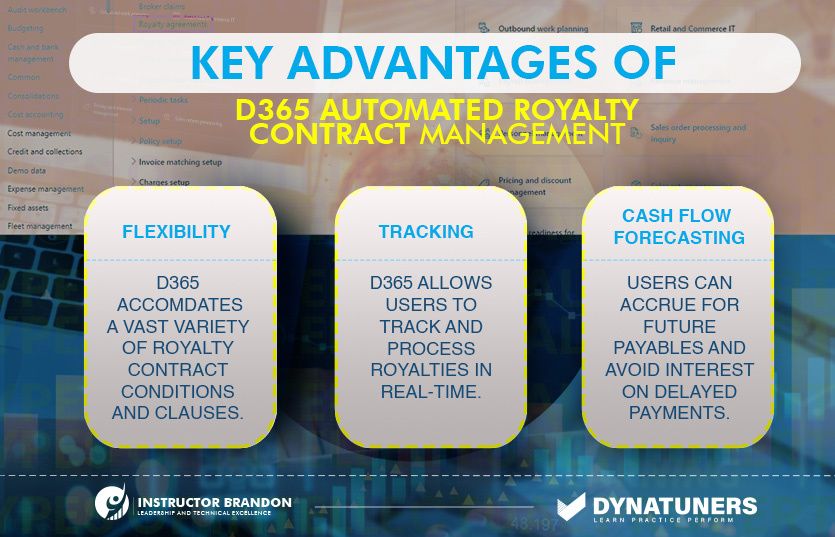

The following are some key advantages of using D365 to manage your royalty contracts.

D365 Royalty Contract Management: Key Advantages

Set up Complex Contract Conditions

Dynamics 365 Finance and Operations allows users to set up a variety of royalty contract clauses as parameters. In simple terms, you can easily translate your entire royalty contract into D365 fields.

As a result, the royalty payment is computed in line with legal and contractual requirements.

This feature ensures that there are no irregularities in royalty amounts. As a result, companies do not have to worry about under or overpaying licensees.

Moreover, closely following contract clauses also ensure that companies do not miss out on royalty payments protecting them from incurring additional financial liabilities in the form of late fees or interest payments.

Save Time, Expense, and Energy with Seamless Processing

As soon as a contractual condition is met, D365 calculates the royalty and generates a receipt to be approved by the relevant manager.

Once the receipt is approved, it is transferred to the accounts payable tab and represents a negative balance or pending liabilities on the company; this entire process is executed in real-time and does not require human intervention. No human intervention means absolutely no chances of human errors. And it goes without saying that computers make calculations at a speed that normal human cannot hope to achieve, so you’ll save up a lot of time.

Real-Time Tracking and Better Data Analysis

D365 allows users to track royalties in real-time. As soon as D365 generates a sales order for a product associated with a royalty contract, the ERP calculates the royalty without delay. Moreover, users can view the royalty amount under the royalty transactions tab.

Real-time tracking makes the royalty payment process transparent and facilitates oversight.

Moreover, managers can also dig up historical trends from the data to better understand their royalty management process and introduce changes to increase efficiency.

Cash Flow Forecast

D365 for Finance and Operations supports cash flow forecasting. So, royalties appear in a company’s accounts statement before being formally paid to the licensee.

The financial analysis reports accurately reflect the negative balances as royalty refunds; this helps avoid confusion about the company’s overall finances.

The following table summarizes the core advantages D365 royalty contract management offers over other similar tools in the market.

SUMMARY

D365 offers a host of features that help streamline enterprise royalty contract management. Flexible setup options mean that users can translate complex conditions into Microsoft D365 fields so that royalty calculations align with the negotiated contract. Moreover, the tool is exceptionally rapid in computations, which helps save time, energy, and effort.

Lastly, Dynamics 365 features like cash flow forecasting and real-time royalty tracking facilitate seamless data analysis and help managers oversee payments effectively.

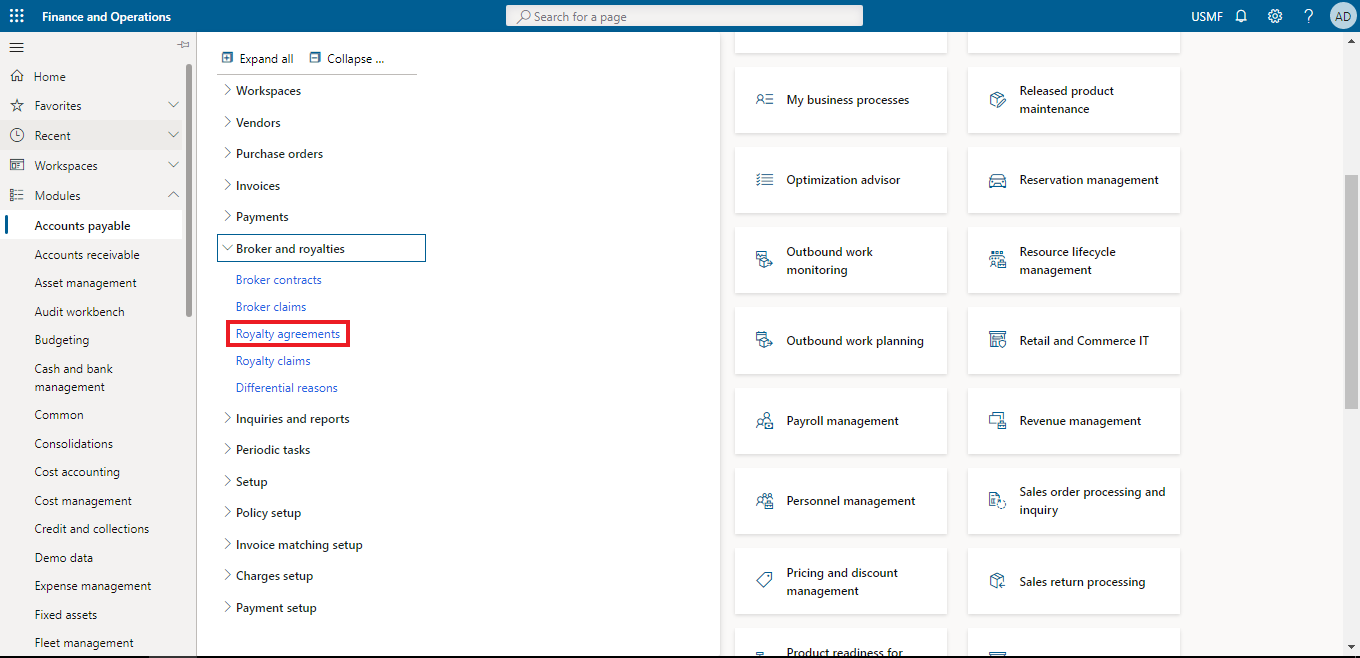

Setting Up Royalty Agreements in D365 : A Step-by-Step Guide

Step 1.1: To access Royalty agreements, go to Accounts Payable > Broker and royalties > Royal agreements.

Step 1.2: The lower section of the page shows the products eligible for the royalty fee.

Step 1.3: The upper portion shows the details regarding the agreement’s conditions signed with the licensor.

Step 1.4: The Cumulate sales by period talk about the royalty amount period.

Step 1.5: The Approval required option must be set to yes so that the royalty charges to the invoice.

Step 1.6: Accrual and expense accounts specify account numbers that receive the accrued amounts.

Step 1.7: You can set up Royalty rates on the Royalty amounts tab.

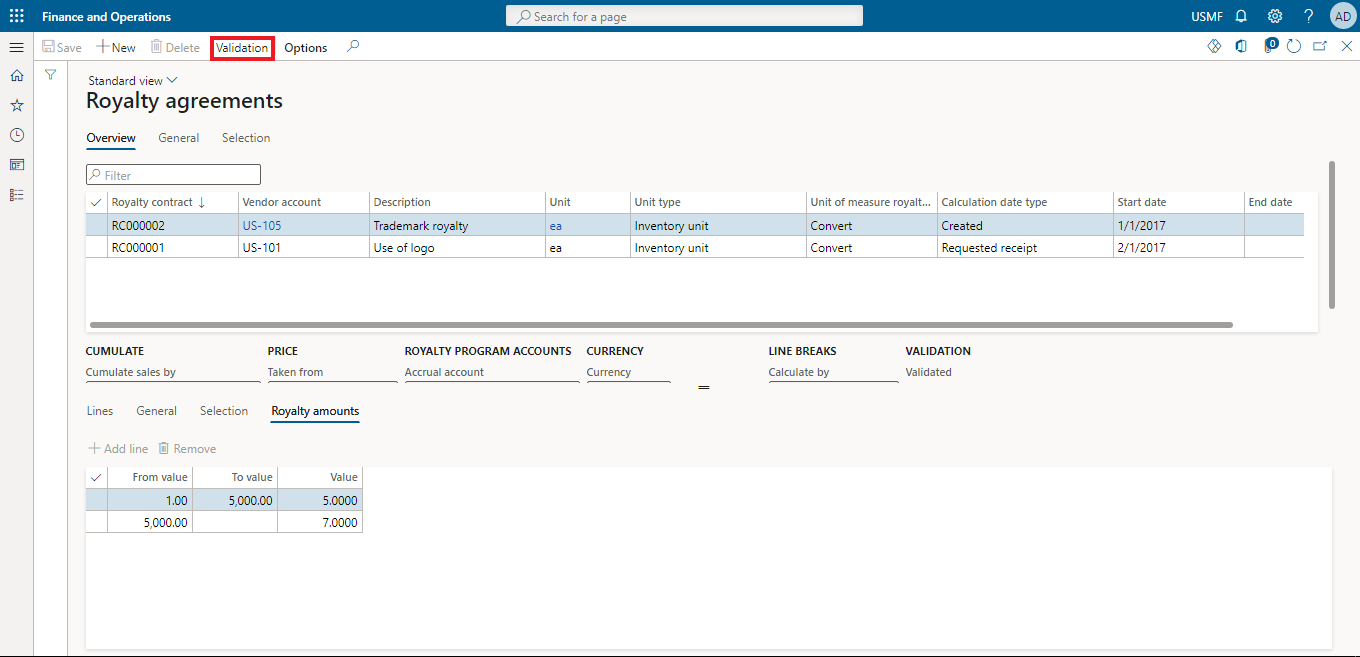

Validate a Royalty Agreement

Before you apply a royalty to a sales order, you have to validate it first. Use this procedure to validate a royalty agreement.

Step 2.1: Click Accounts payable > Common > Royalties > Royalty agreements.

Step 2.2: In the Royalty agreements form, select the valid agreement and click Validation.

Step 2.3: In the Validate royalty contract dialog box, select your work identification number in the Validated by field and click OK.

Enable Price Details Option

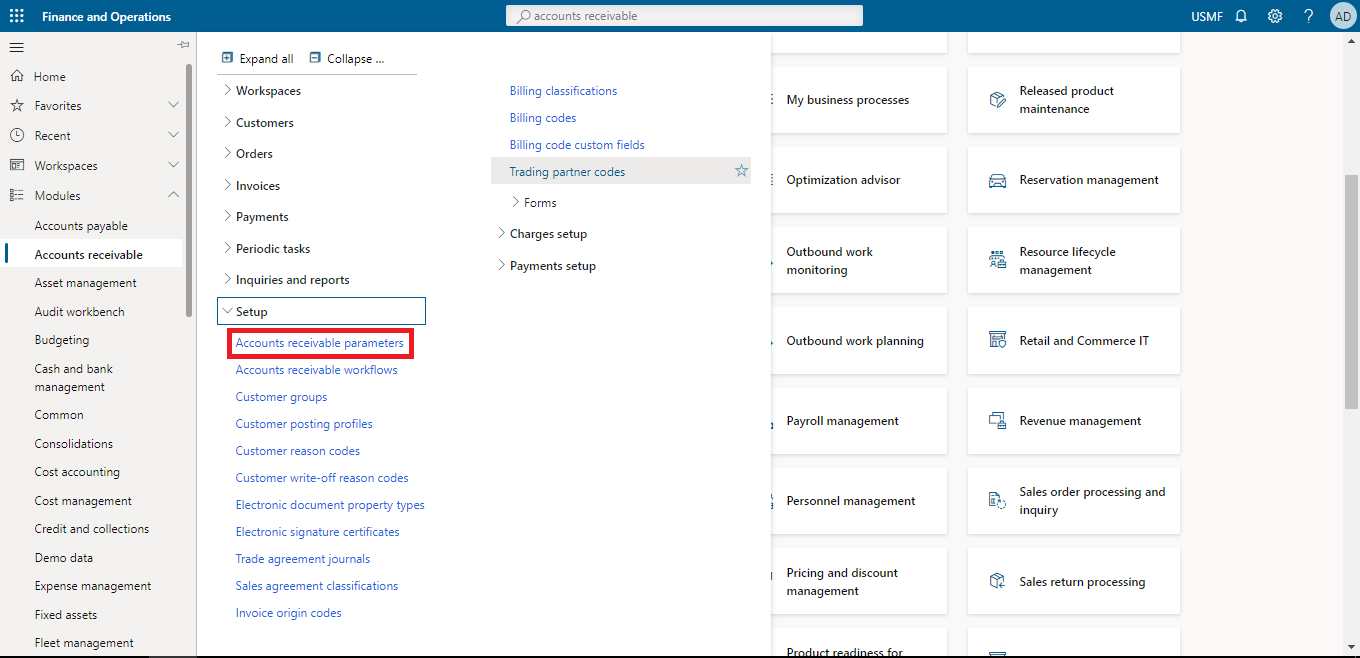

Step 3.1: To activate the Price Details tab, Go to Accounts receivable > Setup > Account Receivables Parameters.

Step 3.2: Go to the Prices tab and the Price Details option.

Step 3.3: Under price details tab, there is Enable Price Details option.

Step 3.4: It is set to No turn the button to Yes.

Selling Products that Qualify for Royalty and Generating a Claim

We use this functionality for products that are eligible for royalty. If the products are eligible, then D365 will generate the amount for use in the future.

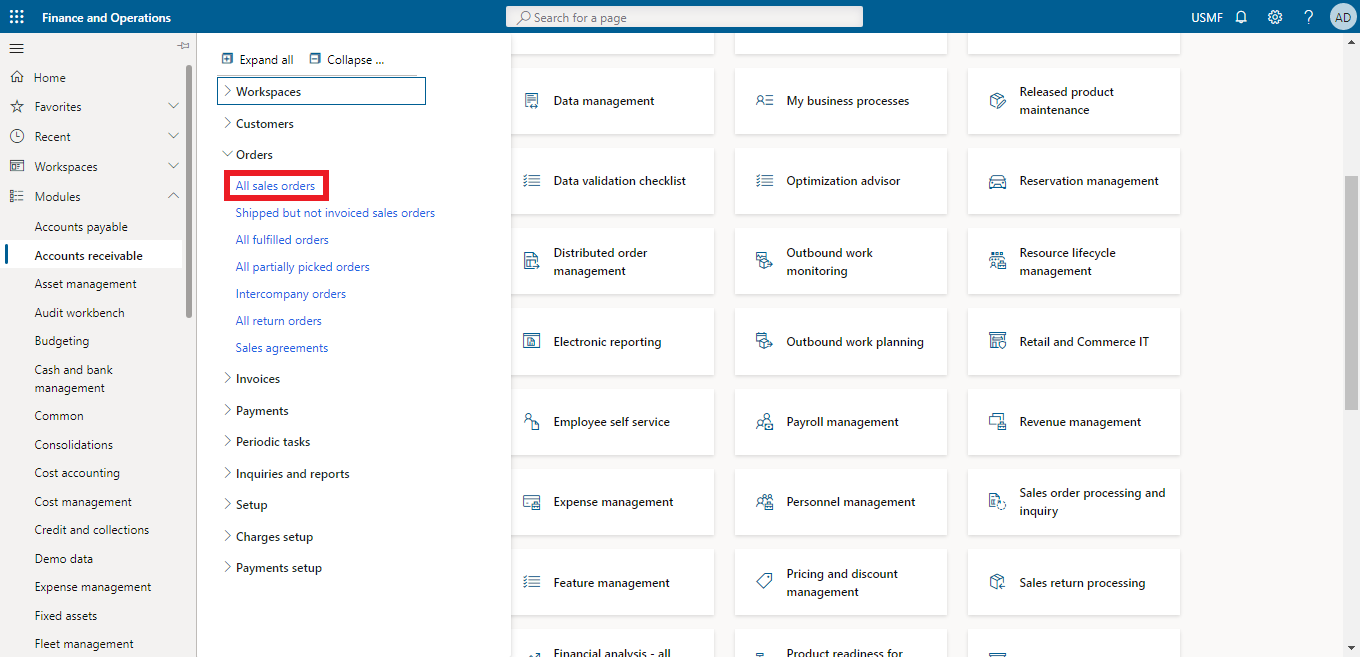

Step 4.1: Select the sales order or product which qualifies for a royalty fee.

Step 4.2: First, enable the price details option from accounts receivable parameters.

Step 4.3: Go to Accounts Payable > Orders > All Sales Orders.

Step 4.4: Select the order of the products which are qualified for the royalty.

Step 4.5: Tap on the inventory and then view > price details.

Step 4.6: A form will appear, showing the many details tab.

Process Claims

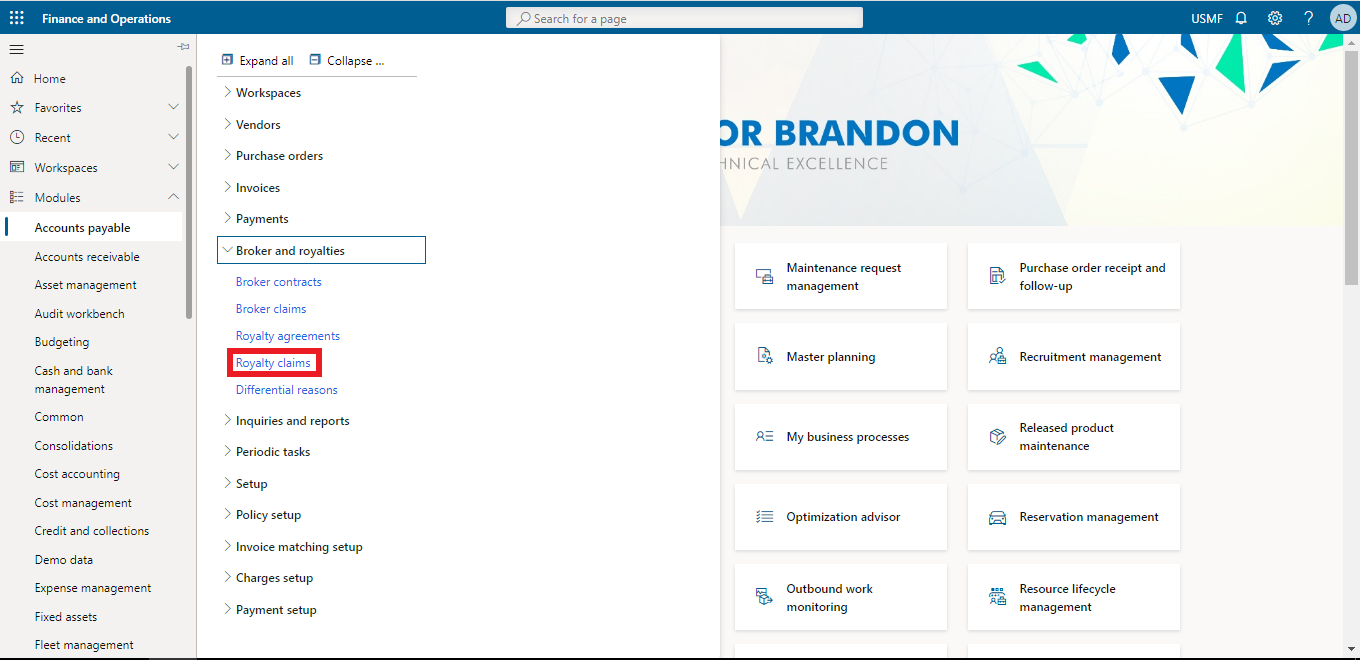

Step 5.1: Go to Accounts payable > Broker and Royalties > Royalty claims.

Step 5.2: It shows all the details.

Following is a list of key terms users must know before automating their royalty contract management using D365.

Microsoft Dynamics 365 Parameters |

|||

| Sr. | Parameter | What Does It Mean? | |

| 1. | Cumulate Sales By | Specifies the period that a royalty amount will be calculated for, based on cumulative sales. | |

| 2. | Approval Required | When this option is set to Yes, a royalty program owner must approve the claims. | |

| 3. | Accrual Account | Account number that will receive accrued amounts. | |

| 4. | Royalty Amount | The royalty fee per product unit | |

| 5. | Sales | Details about the originating sales invoice such as invoice number, net amount, and quantity. | |

Get a quick D365 Expert Assistance for updating your contract terms

D365 Royalty Agreements: Behind the Scenes

It can be complex to grasp the entire computational process of managing your automated royalty agreements. Below is a step-by-step breakdown of how D365 computes simple and complex royalty agreement conditions.

A Simple Case of Paying Out a Single Royalty to the Same Vendor

- D365 generates a royalty claim immediately after the sale of a product linked to a royalty contract. Afterward, the royalty claim moves to the approval stage.

- Therefore, the licensee or someone working on their behalf must monitor royalty claims and continuously give approvals where necessary.

- Once a legitimate authority approves a royalty payment, it passes it on to the accounts payable tab. Afterward, D365 forwards it as a regular purchase invoice.

- D365 credits the vendor account and generates a vendor invoice.

- D365 automatically resets the royalty amounts, and the process starts again.

The graphical illustration will help readers better understand D365 Royalty management workflow.

A Complex Case of Paying Out Multiple Royalties to the SAME Vendor

The process flow mentioned above elaborates on how Microsoft Dynamics 365 executes a simple royalty contract management workflow. But real-life royalty transactions are far from simple. For example, sometimes organizations have to pay out multiple royalties on the same product or to the same vendor. In this case, D365 will accrue the amount and send it to the general ledger before paying it out to the owner of the royalty. For more Dynamics 365 case studies, follow our blog.

The steps below mention how D365FO calculates multiple royalties for the same vendor cumulatively:

- Start by clicking the cumulate button in the action pane while setting the royalty contract – the rest of the setup will remain the same.

- Once a user selects the cumulate option, Microsoft D365 shifts to and creates an accrual journal. Users can access this journal from the royalty transactions tab.

- The accrual journal specifies the accumulated amount for a single vendor.

- The rest of the process is relatively similar. D365 the accrual journal in the accounts payable tab. Afterward, MS Dynamics 365 processes the accrual journal as a purchase invoice.

Conclusion: Royalty Agreements

D365 for finance and operations helps enterprises transcend some of the main challenges they face with traditional royalty management by automating the entire process.

All you need to do is set up the contract once in the Enterprise Resource Planning (ERP) tool. Once you set up an agreement, D365 calculates complicated royalty contracts in real-time, prompts approval, cumulates royalty amounts, manages payable accounts, and creates client invoices all in one go.

In addition to ensuring that you meet all your royalty contract obligations, special features in D365 also allow tracking and forecasting royalties. In simple terms, the tool will fully take care of your payments and allow you to maintain a record of all payments. Moreover, managers can create historical trends from these records to further improve their organization’s royalty management.

And the best part, you do not require an army of employees to manage your royalty obligations properly. So, not only is D365’s royalty management more effective, but it also helps you save money.

At Instructor Brandon | Dynatuners, we always seek innovative methods to improve competitiveness to suit your Microsoft Dynamics 365 requirements. Our offerings are based on defined procedures, industry experience, and product understanding.

If you’re interested in consulting with our technical solution experts on designing, implementing, and updating D365 Royalty Agreements, don’t hesitate to Contact Us.

[sc_fs_multi_faq headline-0=”h2″ question-0=”What are Royalty Agreements and why are they important? ” answer-0=”Royalty contracts represent an agreement between two parties whereby one agrees to pay out financial compensation to the other in return for the legal right to use their intellectual property. Royalties are important to maintain a healthy flow of ideas in the market and to ensure that innovators are properly compensated for their efforts. If an organization uses someone’s intellectual property without signing a royalty agreement it becomes liable to legal action and can be persecuted under intellectual property violation laws. ” image-0=”” headline-1=”h2″ question-1=”What is cash flow forecasting in D365 automated royalty agreement management? ” answer-1=”Royalties are future liabilities a company needs to pay out. In simple words, royalties represent accrued debt. Calculating profits or revenues without adjusting them for royalties gives an inaccurate measure of an enterprise’s overall accounts. D365 cash flow forecasting feature adjusts a company’s revenues in accordance with pending royalties so that managers get a more accurate picture of their overall profits. ” image-1=”” headline-2=”h2″ question-2=”What is the cumulate tab in D365 royalty contract management? ” answer-2=”The “cumulate sales by” button represents the period for which the contract calculates royalties. D365 will calculate the accumulated royalties for that period and pay out the total once the period ends. The cumulate sales button becomes important when you have to pay out multiple royalties on the same product. ” image-2=”” count=”3″ html=”true” css_class=””]

6185

6185