Dynamics 365 Reporting, Dynamics 365 Tutorials, Dynamics Operations Training, Microsoft Dynamics 365 Developer (F&S) Training Series

D365 Financial Reports Part 2: Insights into Report Schedules Setup

Report Scheduling for D365 Financial Reports

Report Scheduling | Streamline Financial Data | Dynamics 365 Finance and Operations

To generate d365 financial reports, open the report definition and on the toolbar, select Generate. The Report Queue Status page opens and indicates the location of your report in the queue.

We all learn the importance of scheduling through time and experience. In almost all circumstances, a company’s ability to schedule its supply chain and financial operations determines its long-term profitability. A clever approach is useless without a solid plan. Brilliant managers can occasionally deliver brief excellence, but it will not last for a significant time. Only a highly differentiated financial report with a premium command can rival the market in terms of margins.

Financial Schedule

One thing that separates successful businesses from the world is their understanding the importance of scheduling.

So, what is the significance of scheduling? First, scheduling is the critical control point between the future and the past, or, to put it another way, between planning and reporting.

It is the last step before execution and determines whether you make or lose money. Therefore, a solid schedule is based on the primary profit drivers leading to your goals.

However, the calendar is always reactive, and businesses often overlook the fundamental profit drivers. Due to previous difficulties, missed communication, or misleading promises, the schedule is more of a hotlist.

A World of Financial Reporting

We live in a data-driven society, and the ability to use financial insights to your advantage will set you apart from the crowd. Reporting tools like D365 Finance are becoming of great help to streamline financials. Working with a monthly, weekly, and daily financial report template will provide you with a well-rounded and complete account analysis of every critical area based on your individual aims, goals, and objectives.

These reports are required by your company to help support particular financial objectives and to provide relevant information to investors, decision-makers, and creditors, primarily if you work as a financial agency and need to establish an interactive client dashboard.

How Financial Reports can be helpful?

However, it can also assist your company in determining:

- If your company can effectively generate cash and how that income is utilized

- To uncover specific business transaction information

- Monitor your financial results to discover potential concerns that are affecting your profitability

- Create financial ratios that demonstrate your company’s position

- Determine whether your company can pay off all of your debts

On the other hand, Daily reports have little impact because most financial KPIs require mid-to-long-term monitoring and do not provide reliable information if reviewed daily.

At Dynatuners, we assist our clients with a project report scheduling tool that allows to automate d365 financial reports based on your own schedule.

You control when and how frequently your system generates d365 financial reports. The system’s report generator emails these reports, often in PDF format, to the people you’ve specified. This saves you a lot of time when putting together reports, but it also assures that a statement is never lost. It also encourages you to review critical reports regularly throughout the project.

So, while you’re deep in project detail, your automatic report pings through, reminding you to take a step back and look at the big picture.

What financial reporting KPIs do you want in effect?

KPIs for Financial Reporting |

||||

| Goals & Objectives | Critical Success Factors | Key Performance Indicators | Metrics | Measures |

| Increase Revenue | Increase qualified Leads by 20% over the next six months | % of converted website visitors | Leads by Source | Leads |

| Provide Information | % of new visitors | Average Pages/Visitors | Segments | |

| Track Cashflow | Increased Ranking | Campaign segments | Pageviews | |

| Analyze equity | Increased equity ratio | The conversion rate of visitors to leads | Ranks | |

SUMMARY

Fixing the scheduling necessitates the application of everything we know about the product, business processes, systems, and behaviors. In addition, the schedule must be profitable and should satisfy your organizational needs based on planning guidelines for each cycle step.

The Component for Scheduling D365 Financial Reports

The clarity of the financial data being reported and reviewed by owners and managers is one of the essential qualities of financial management. A few simple figures can sometimes provide a picture of a company’s financial status, while more thorough knowledge is missing at other times. Analyzing and assessing information in a financing schedule style will help you better understand your company’s financial accounts.

Payable Schedule

The accounts payable schedule is a complete record of all the vendors your company owes money. For example, if your company buys raw materials and services from other organizations, you’ve probably been offered terms and aren’t paying for everything in cash. Outstanding debts are a liability that one must pay and must be in some sort of record. The accounts payable schedule lists who must be paid and how much money is owed.

Receivable Schedule

Similarly, the accounts receivable schedule shows how much income you should expect from outstanding invoices. Customers organize invoices, making it easy to see if a specific customer has multiple unpaid invoices. If a customer is going behind on payments to you, this report may indicate the necessity for collection calls or the reduction of extended credit.

Inventory Schedule

Inventory refers to the number of goods a firm has available to sell to its clients and the raw materials that are either waiting to be used in the production process or are currently in use. These supplies and the finished product are accounted for as inventory, which is a company asset.

If a corporation sells a service, it may incur fees while delivering that service. Inventory includes any revenues linked with that cost that has not yet been received. An inventory schedule will outline how all of these inventoried assets will be distributed.

Fixed Asset Schedule

A fixed asset schedule is a complete list of all fixed assets in the general ledger. The program will include the asset’s number, description, gross cost, and the accumulated depreciation. Fixed assets are frequently separated into divisions to make account reconciliation easier to manage. For example, fixed assets are buildings, machinery, computer equipment, automobiles, and furniture.

Other Financial Schedule Types

Other types of schedules are likely to be encountered when paying your business taxes. For example, the IRS has several forms referred to as schedules. These documents, which explain the numerical information you submit on your return, are frequently needed to be filed with your annual tax return information.

First of all Schedule A for itemized deductions; Schedule B for interest and dividend information; then Schedule C for company income or loss; and Schedule SE for Self-Employment Tax information are all typical schedules or forms.

The report schedule comprises various tasks, ranging from changing accounting procedures to completing bank reconciliations. The following are critical questions to guide the project schedule’s content:

Report Scheduling Tasks & Activities |

|

| Key Question | Activity |

| What must be done? | Activity to meet the requirements of the financial framework to prepare the report. |

| How can it be done? | Activity to enable the use of technology that includes data from external resources. |

| Who is going to do it? | External/internal resources and responsible officers. |

| When should it be done? | Different parties should review your report, discuss milestone dates and dependencies. |

| How to treat the risk? | Incorporate risk treatment activities when required. |

SUMMARY

While most people think of scheduling as a time set to complete a task, a plan usually refers to a report or a supporting document that gives specific information that explains the contents of another simplified document. Above, we presented the standard components of d365 financial reports.

How to Schedule Report Generation in Dynamics 365

Create a Report Schedule

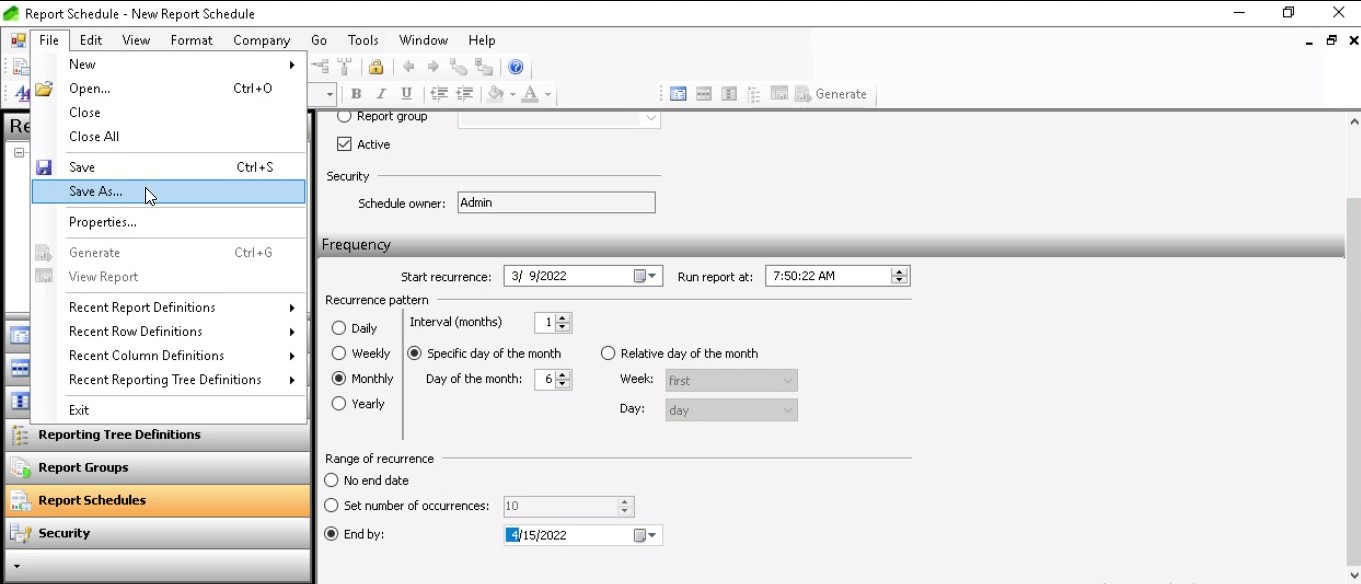

Step 1

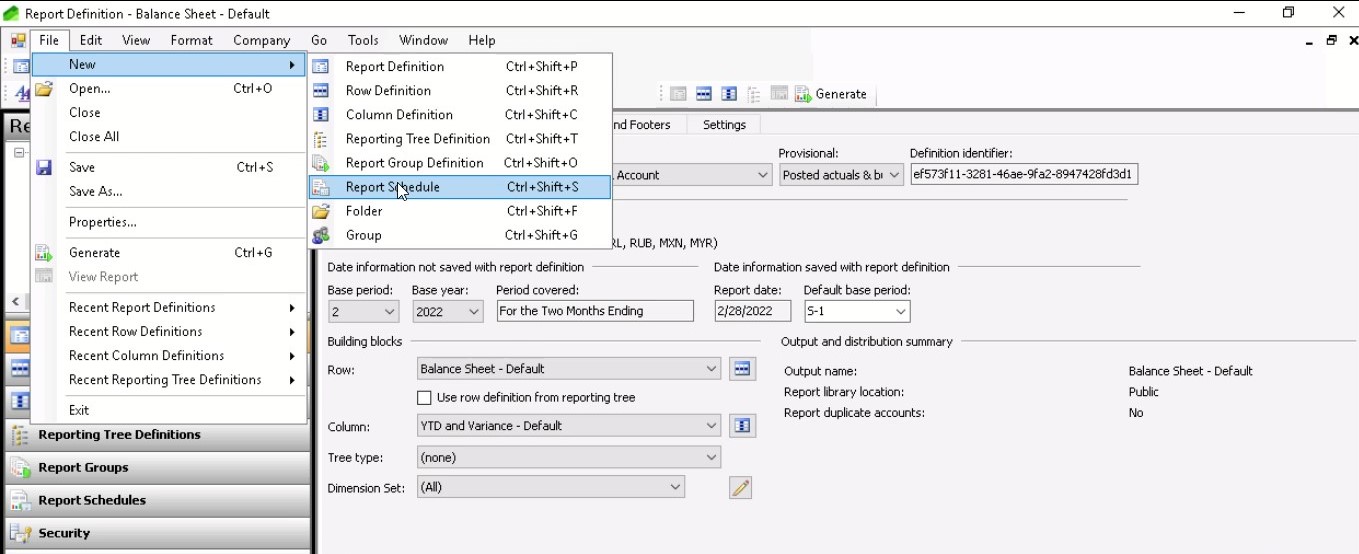

In Report Designer, select New and then select Report schedule.

Step 2

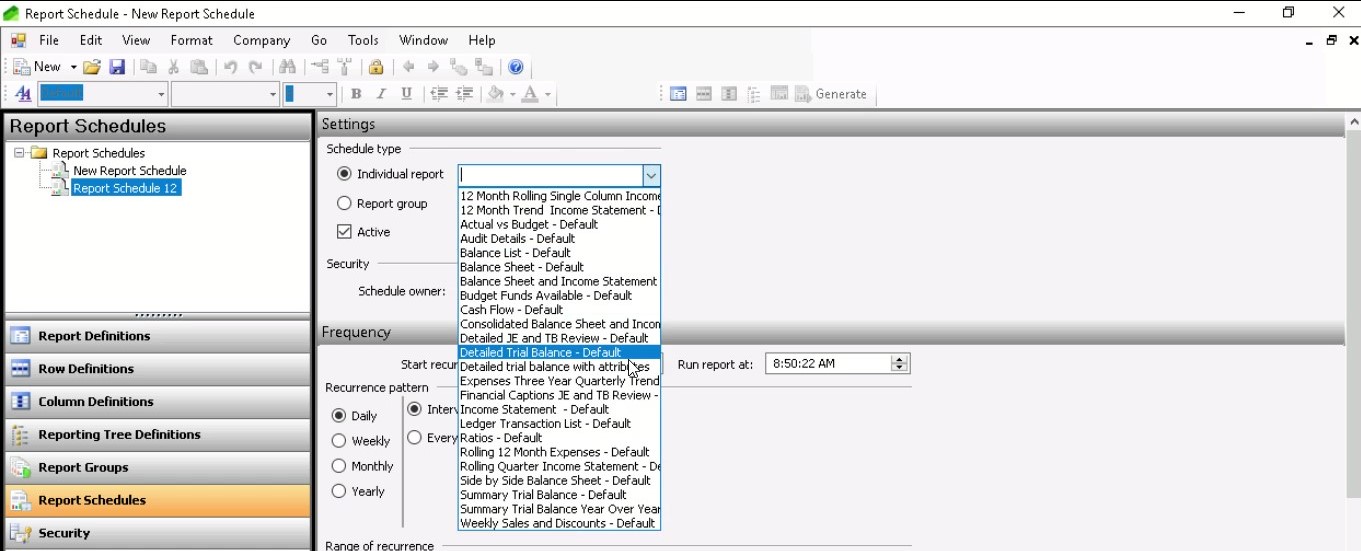

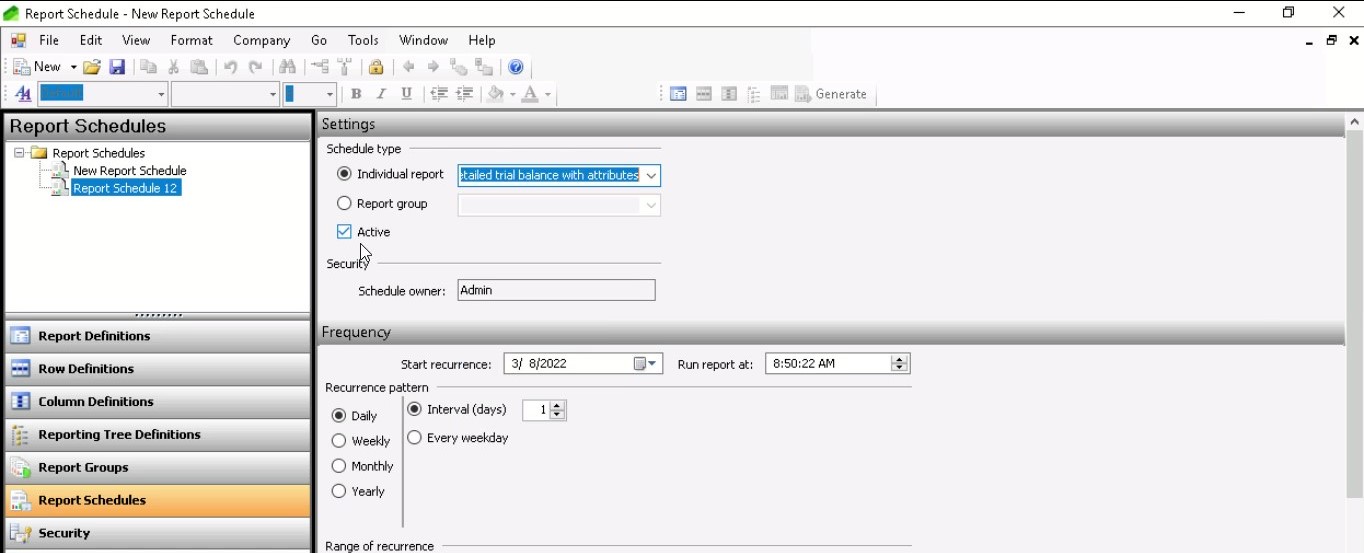

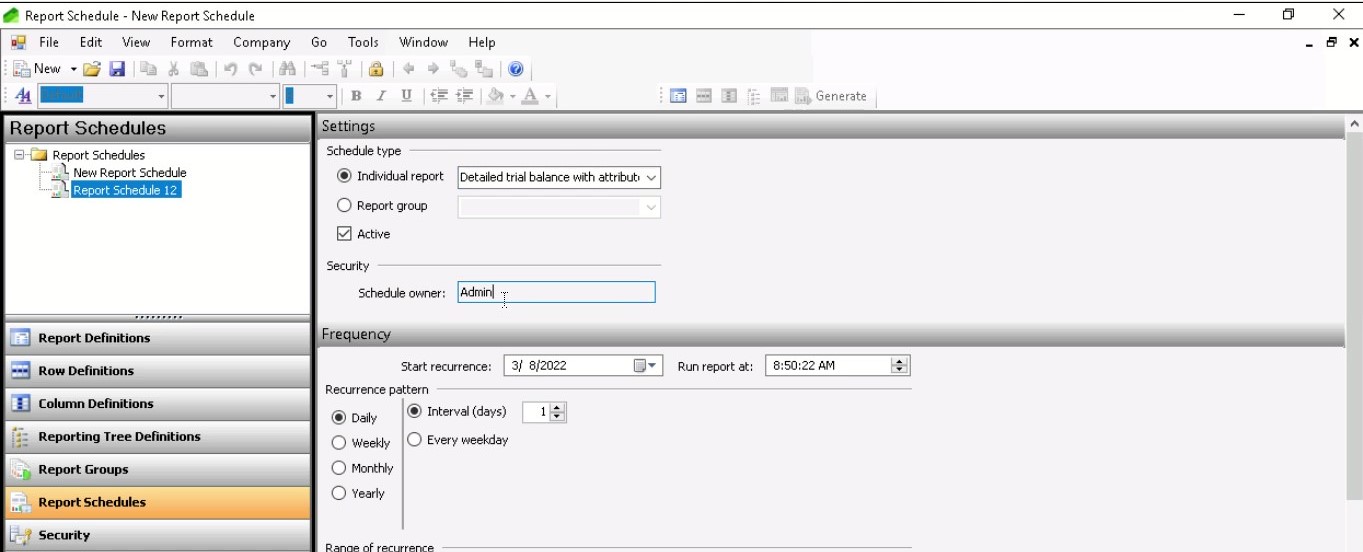

Under Settings, select an individual report or a report group to schedule.

Step 3

Select the Active check box to turn on the report schedule.

Step 4

Select the Permissions button to enter company credentials. By default, your login information is used for the company that you are logged in to.

Step 5

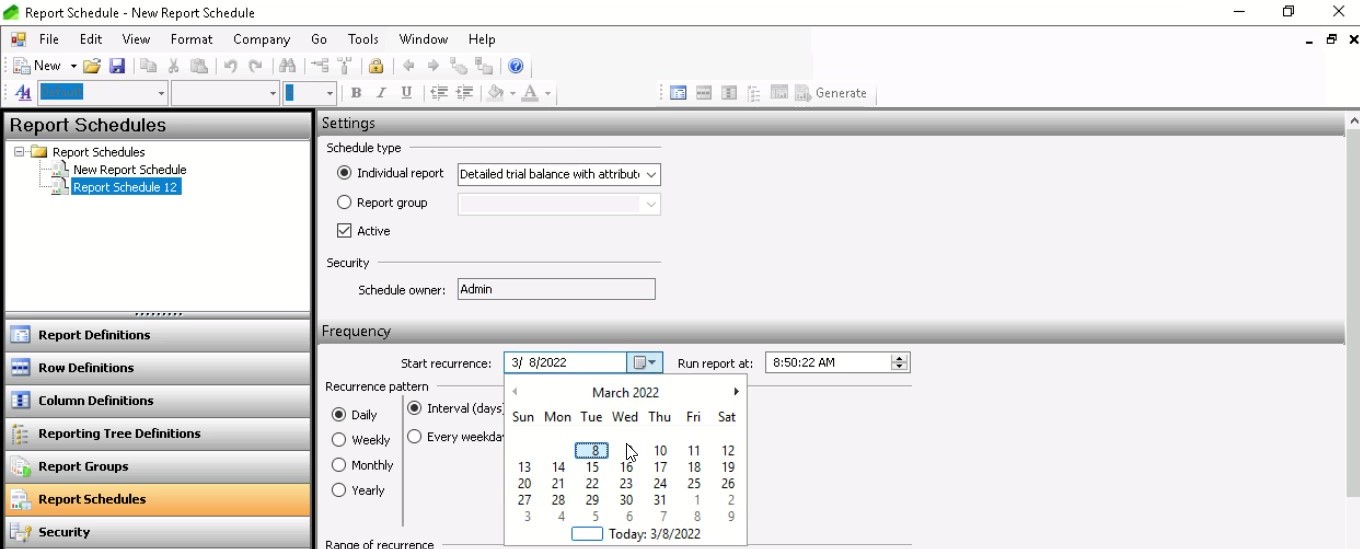

Under Frequency, in the Start recurrence field, select the date when the schedule is to start.

Step 6

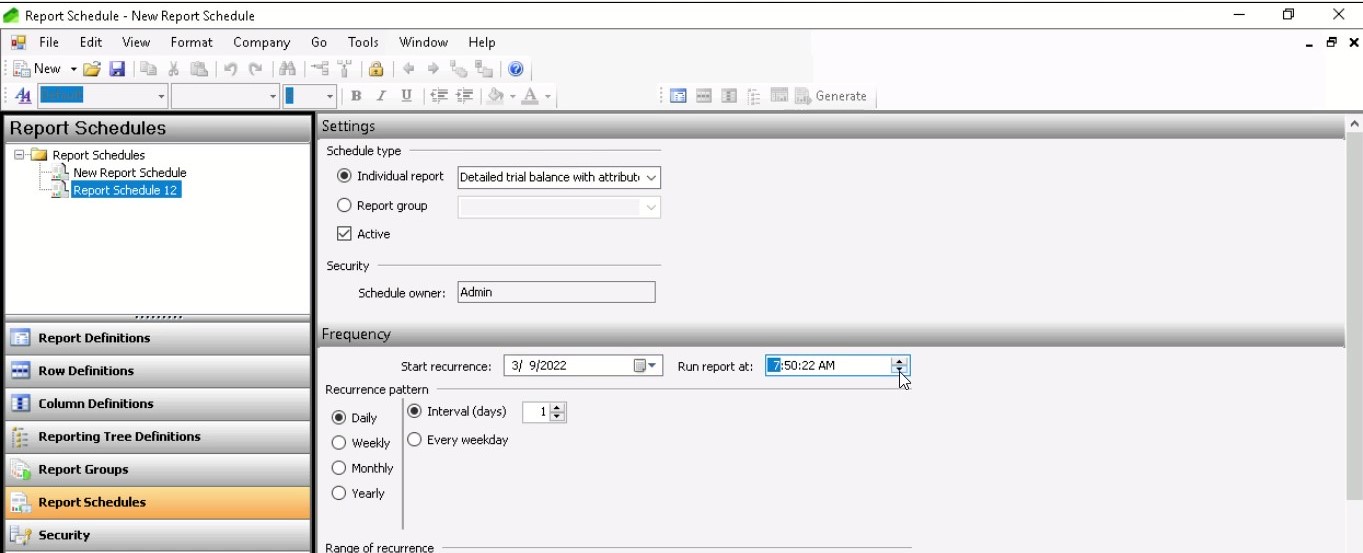

In the Run report at field, select the time when the report should run.

Step 7

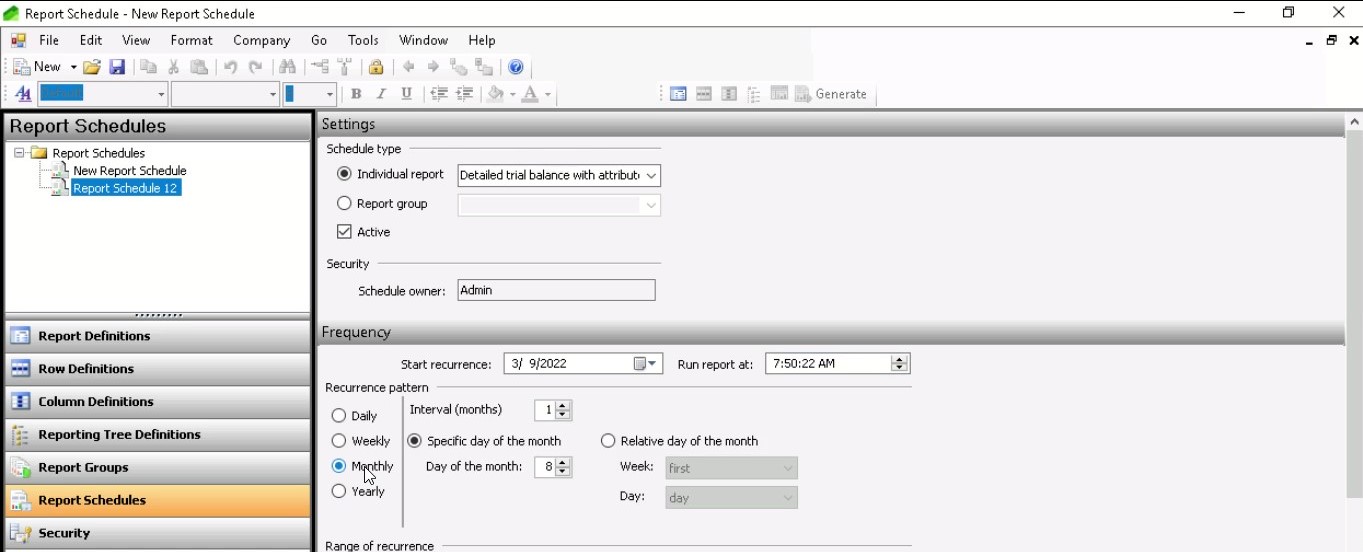

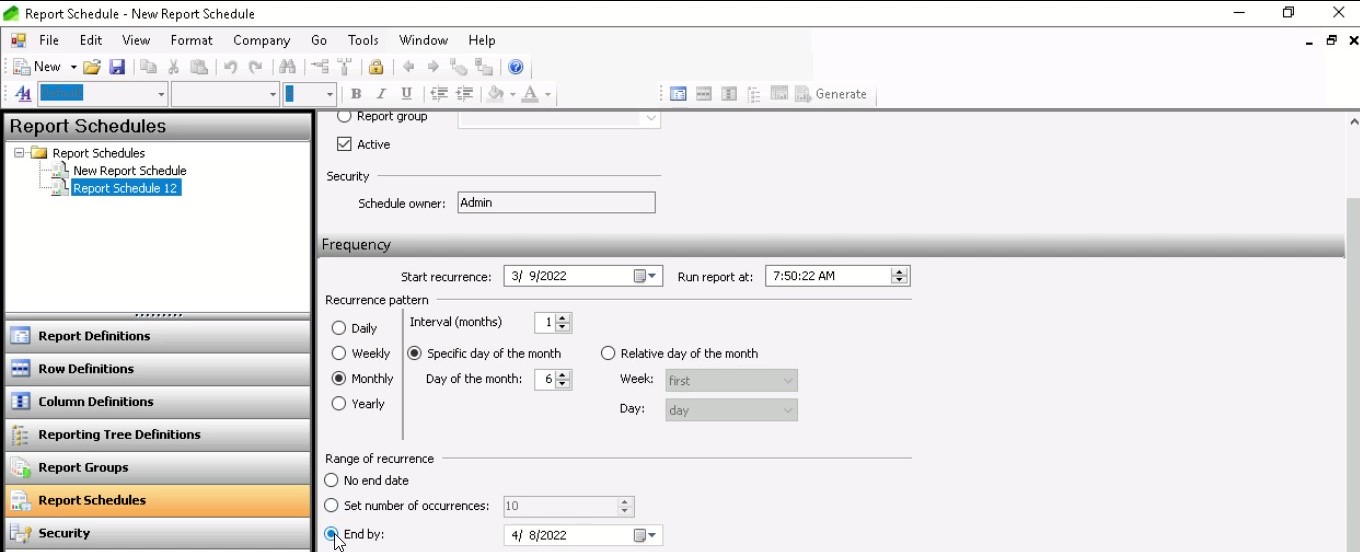

In the Recurrence pattern area, specify how often the report is run.

Step 8

In the Range of recurrence area, select when the report should stop being generated.

Step 9

Select Save.

To copy and delete a report schedule, you must have the role of designer or administrator.

SUMMARY

By repeating the steps, you can generate report schedules and save them. Then, you and members can view them in the navigation pane under the report schedules as a report designer. Finally, use the folder to organize the reports available in the pane.

What Report Scheduling Can Offer Your Business

Efficiency

When Demand Gen Report polled 134 marketing leaders, it bought several marketing measurements into the light in favor of Financial Report Scheduling.

22% of these B2B marketers were unaware of the key performance indicators (KPIs), and 15% were unsure about where to begin.

These continual back-and-forth messages (for example, “What KPI should we use?” and “How do you prepare financial reports?”) take a lot of time, affecting the workflow and productivity.

Error Reduction

According to Demand Gen Report, 46% of financers struggle with understanding chaotic data.

Every month, departments in agencies typically work with tons of calculations.

Financers make mistakes when manually entering this messy data into a Microsoft Excel spreadsheet.

These mistakes make data ambiguous and impact the sales team’s performance. A miscalculated figure in a report could result in an unproductive sales approach and have a long-term effect on the company’s bottom line.

At Dynatuners, we work from scratch to lower errors and streamline financial performance by linking all data sources in a single report and sending it at a predetermined time.

Organization

According to the Demand Gen Report, a whopping 51% of B2B companies struggled to connect and analyze data across many systems and platforms.

Finance report scheduling, once again, eliminates this significant difficulty. You can automatically connect all data sources in a single report and schedule it with the correct implementation.

Can’t locate a data source in your Dynamics 365 Finance and Operations or any other CRM?

Don’t worry; we can help you configure your own data using CSV files with business process automation. Also, tune your workspace to automatically refreshes it once a month, saving you the time and effort of importing data again.

The figure below, shows our core actions while handling report scheduling.

Why Choose Us?

When running an extensive report or a daily or often requested report, scheduling is helpful to ensure that the information is readily available when you need it. At Dynatuners, we make sure that these reports get on time through report scheduling. Here are some prominent takeaways you get while working with us:

- We make it possible to run repetitive reports without re-enter parameter information each time.

- We can help you send reports directly to relevant people through email on specific dates and times.

- Our team can manage extensive reports during off-peak hours to minimize affecting live system performance.

- We can configure your CRM to provide report status as they run.

- Through customization, we can tweak your workspace so that System Administrators or Super Users can schedule reports for distribution via email, hard copy printing, or saving to disc.

Final Thoughts

Scheduling is a bit of a black hole for many companies. It can be tough to figure out how the schedule is put together, while many of the businesses think maybe it gets done by a scheduler in a back office using some type of voodoo.

Given the significance mentioned, this seems unusual. MRP and ERP systems are here to streamline scheduling. However, they rarely operate since the data in the system is frequently incorrect.

At Instructor Brandon | Dynatuners, we always seek innovative methods to improve your competitiveness and suit your Microsoft Dynamics 365 requirements. Our offerings are founded on defined procedures, industry experience, and product understanding. If you have any questions about finance report scheduling, d365 financial reports, data correction, or report scheduling, our technical solutions experts are here to make your pain disappear so don’t hesitate to Contact Us.

[sc_fs_multi_faq headline-0=”h2″ question-0=”What are the financial reporting requirements? ” answer-0=”Financial statements must include the following fundamental elements: fair presentation, going concern, accrual basis, materiality and aggregation, and no offsetting. In addition, financial statements must be prepared at least once a year, include comparable data from the prior year, and be consistent. ” image-0=”” headline-1=”h2″ question-1=”What are scheduled reports? ” answer-1=”Scheduled reports are those that begin automatically at a predetermined time. They run in the background, and the results are available afterwards. For example, you can specify that a report with a significant impact on system performance should run only at night when no one is using the system. ” image-1=”” headline-2=”h2″ question-2=”What do financial reporting teams do? ” answer-2=”Financial Reporting teams organize the preparation of quarterly financial statements, numerous financial studies, regulatory filings and surveys, and the external audit of the annual financial accounts. ” image-2=”” count=”3″ html=”true” css_class=””]

2953

2953