Dynamics 365 Reporting, Dynamics 365 Tutorials, Dynamics Operations Training, Microsoft Dynamics 365 Developer (F&S) Training Series

D365 Advanced Bank Reconciliation: Insights into Import Setup for BAI2 Statements

Set up the Advanced Bank Reconciliation Import Process

Audit Process | Financial Data | Data Exchange | Data Entity | Accounting Records

This blog post describes how you may streamline and simplify the reconciliation of your bank accounts using BAI2 in order to expedite reconciliation, expedite the closes, and make accounting simpler.

“Use Advanced Bank Reconciliation (ABR) to conduct data consistency checks and decrease the bank reconciliation procedure from hours to minutes in a few simple steps.”

Reconciling bank statements involves comparing the figures on a bank statement to the Cash account of a business or vice versa. This report’s value is that it allows you to compare bank reports with your company’s cash account records in order to identify any anomalies. Because you may write hundreds of checks each month and make a number of deposits, there may be discrepancies between your company’s bank statement and cash account.

In this blog post, you will learn how to configure Automated Bank Reconciliation in Microsoft Dynamics 365 Finance. Who dislikes automation? Discover how Dynamics 365 facilitates automated bank reconciliation by importing bank data and matching criteria. This approach will typically clear 95% of all financial transactions, leaving a tiny percentage for human interaction and processing. So, if you wish to quit wasting time with manual bank reconciliations, this post is for you. If you’d want to learn more about Dynamics 365, you can also check out our blogs for additional information.

Automated Bank Reconciliation is a relatively new feature that helps expedite the accounting process by comparing your bank statement or bank account with accounting documents. As a result, you eliminate the need to manually enter your bank account transactions and eliminate the related time and expense. The bank reconciliation tool in Microsoft Dynamics 365 allows you to import electronic bank statements and automatically reconcile them with bank transactions.

SUMMARY

Microsoft Dynamics 365 permits the importation of electronic bank statements and their reconciliation with bank transactions. This article covers how to establish your import capability for bank statements. Dynamics 365 supports three default bank statement formats: ISO20022, MT940, and BAI2.

The Big Idea

With the advent of digitalization in every industry, conventional banking practices have been radically altered. For example, the bank has replaced manual operations, such as mailing physical copies of bank statements to consumers, with electronic delivery of bank statements. Now, banks worldwide have adopted standard formats, which benefit them and their clients. BAI2 format is one of them, and it has been effectively accepted by all ERP systems.

Advanced Bank Reconciliation is a set of improvements to bank account reconciliation. Some of its helpful features include the following:

Simplified Reconciliation for Bank Accounts

Simplification and more easily reconcile your bank accounts within the system with the suite of improvements such as:

- A helpful backdating report to run your reconciliation “as at” a set date

- Quicker reconciling by marking off entries as you go

- Print out a reconciliation statement to PDF or a printer

- More straightforward setup for bank statement imports and export

- More comprehensive support for more bank statement formats

Made a bank reconciliation mistake?

Undo bank statements and make any changes you need with the Undo Reconciliation feature.

One-click application of reconciliation differences

Use the one-click post and application to save you time by auto-posting the expense into the selected account and marking the line in the bank statement as reconciled.

Better bank statement import

We’ve made the bank statement import better with broader support for more file formats and a more straightforward setup within the system. Learn in a hands-on, real-world setting in our custom-built labs, enroll now.

SUMMARY

Advanced Bank Reconciliation is a collection of enhancements to the process of account reconciliation. Streamline and simplify the reconciliation of your bank accounts inside the system. Post and application with a single click to save time by automatically posting the expenditure to the appropriate account and marking the bank statement line as reconciled.

What is BAI2?

Corporates utilize the BAI2 format to input bank statements into the system, which will be used for reconciliation. The text-based BAI2 file format is a standard set of coded instructions. It includes information on AP Payments (negotiable and invalid status) and Receipts (remittance status).

All corporations must reconcile their Book Bank Balance with their Bank Balance.

Generic reasons

- Method of manual reconciliation

- A significant number of Payments and Receipts

- The bank is not giving timely Bank statements

Transaction level reasons

- Suppliers that fail to deposit the cheque on time

- Customers have sent funds straight into the Bank Account without giving any information

- Check for a bounced check or insufficient balance

- In the circumstances above, the Accountant finds it challenging to reconcile the accounts

Reasons to use the BAI2 format

- The creation of a standard format based on business requirements

- Acknowledged by the majority of American banks

- Use-friendly

- Minimum maintenance

- Useful even if the bank is changed

Are you ready to take your career to the next level? Explore our D365 beginner level courses.

As a result of digitalization, reconciling the Book Bank Balance with the Bank Balance has become simpler. A standard format for bank statements, such as BAI2, is an excellent solution. It is simple to apply, facilitates reconciliation, accelerates the Period closure, and makes the job of accountants easier.

SUMMARY

BAI2 is a standard set of encoded instructions for file formats. It contains details about AP Payments (negotiable and invalid status) and Receipts (remittance status). It is used by corporations to enter bank statements into the system, which are then utilized for reconciliation.

Functional Walkthrough of Set up the Import of BAI2 Bank Statements

Define bank statement format processing group for BAI2 through data entity framework

Step 1

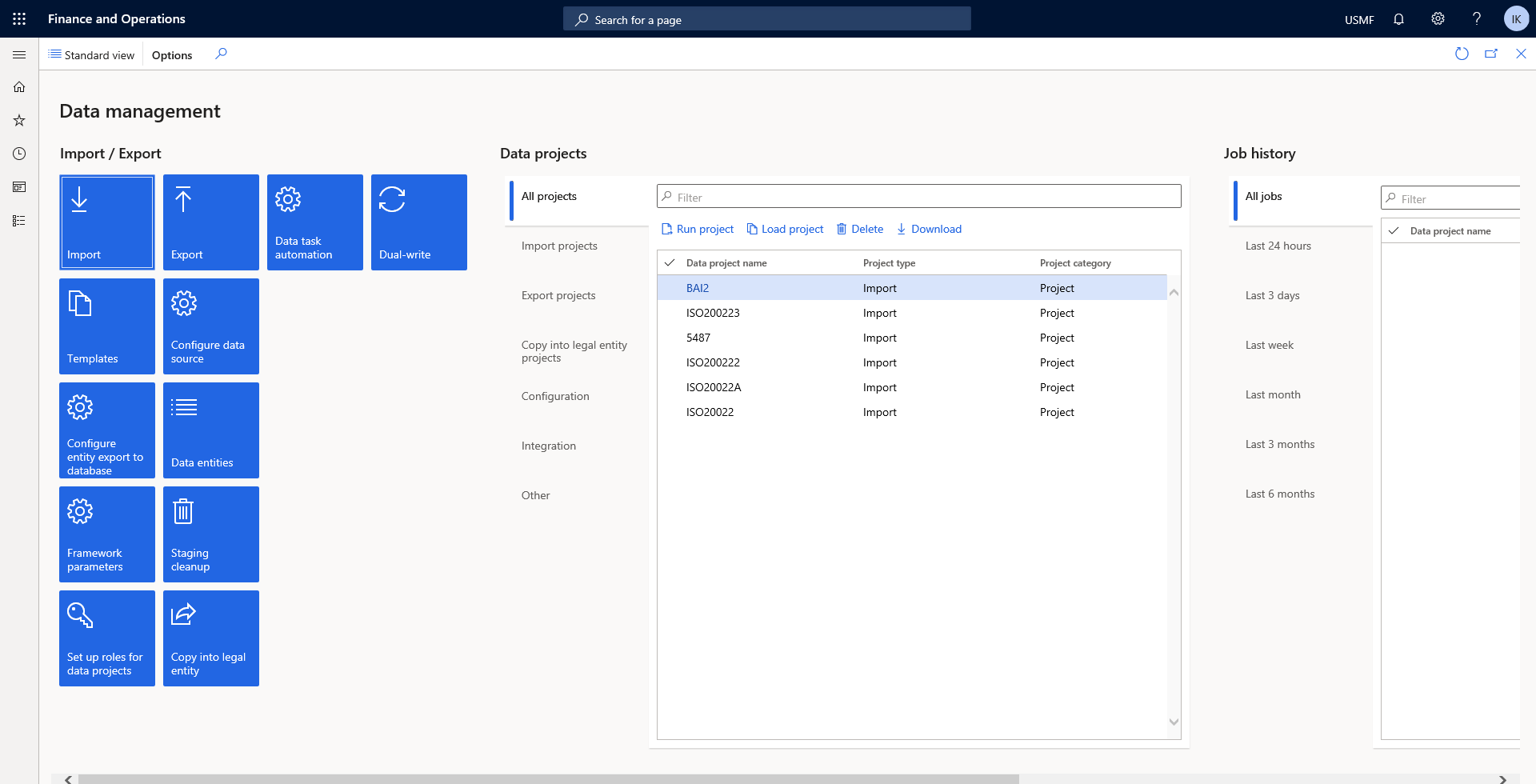

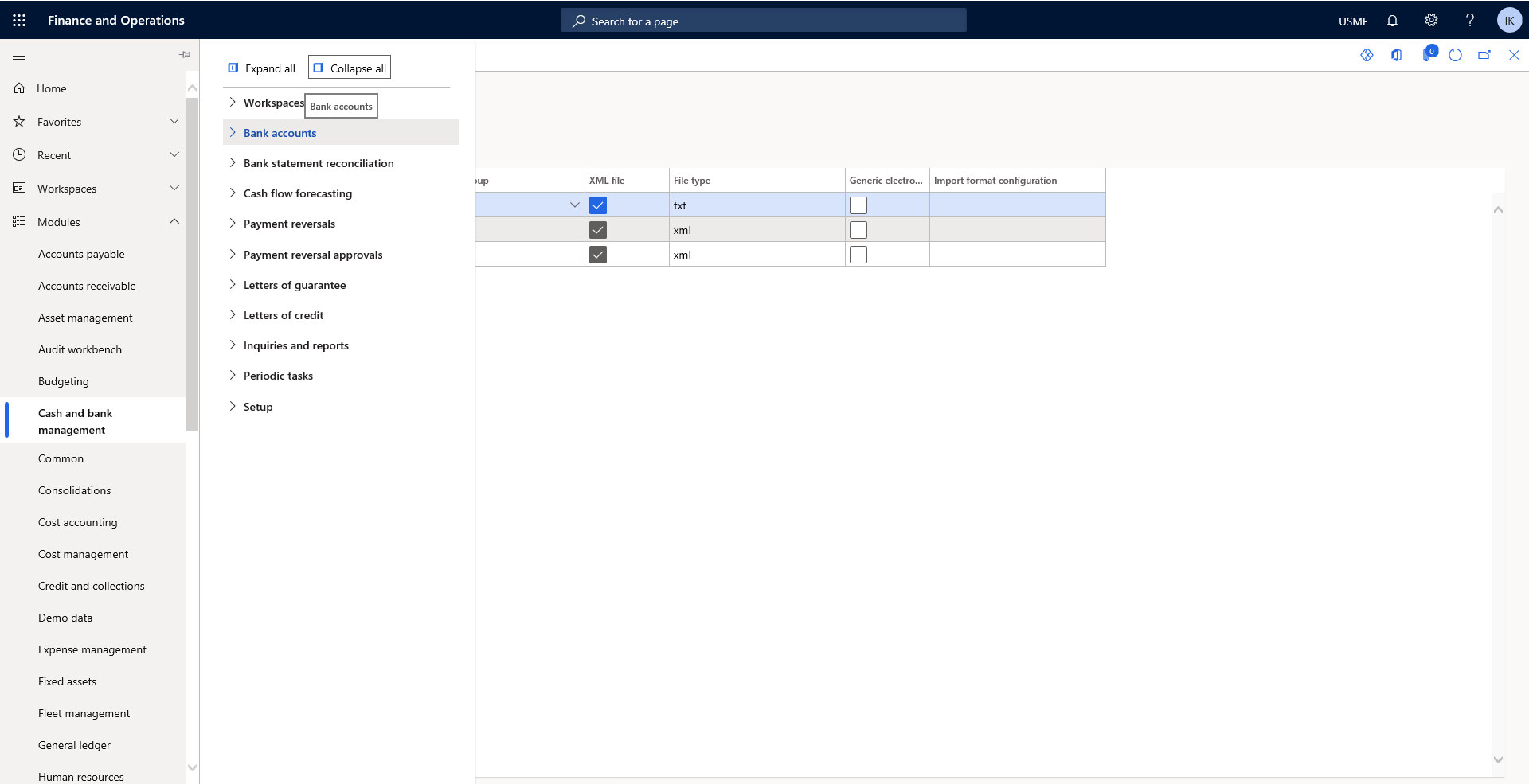

Go to Workspaces > Data management.

Step 2

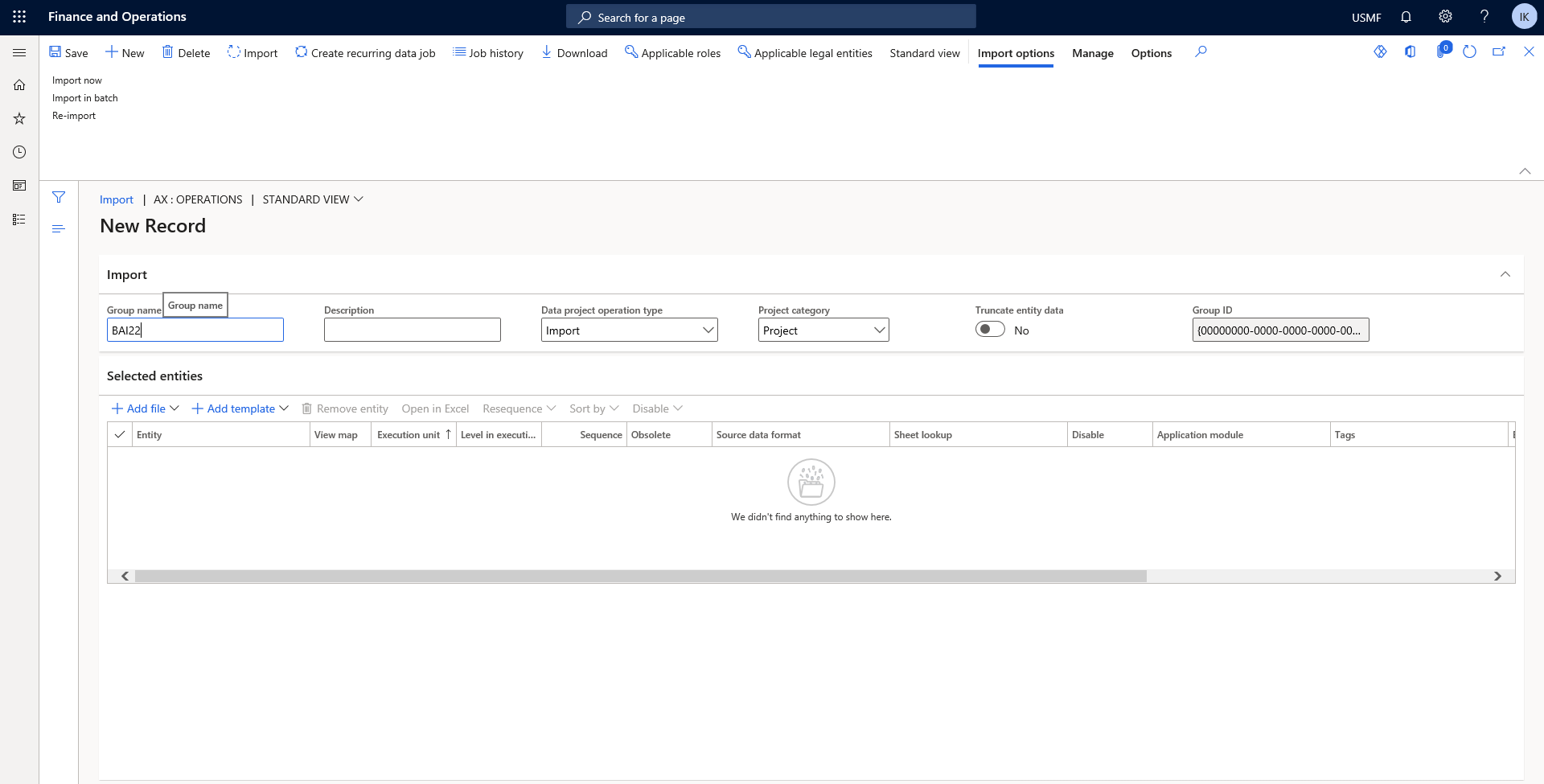

Click Import.

Step 3

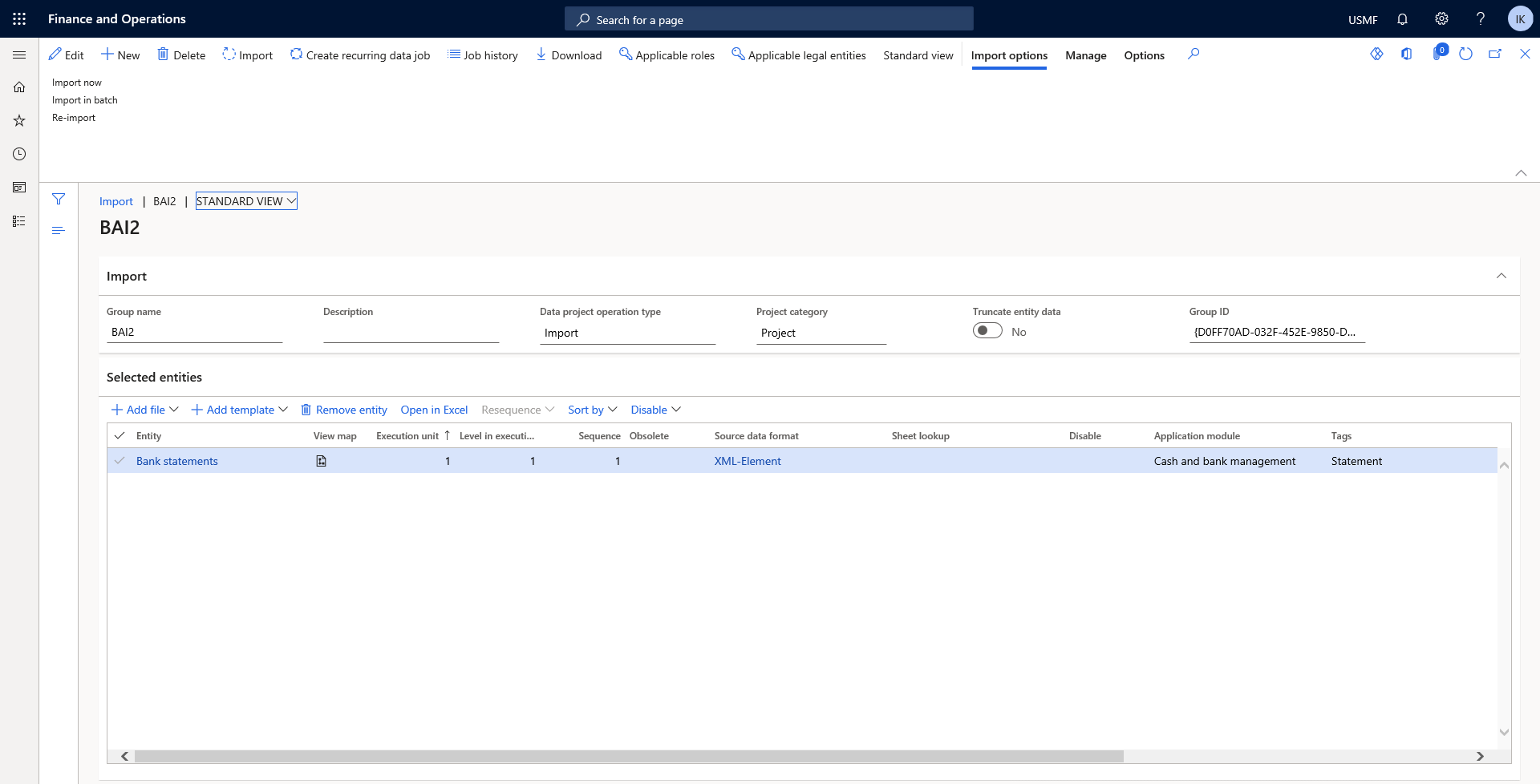

Enter a name for the format, such as BAI2.

Step 4

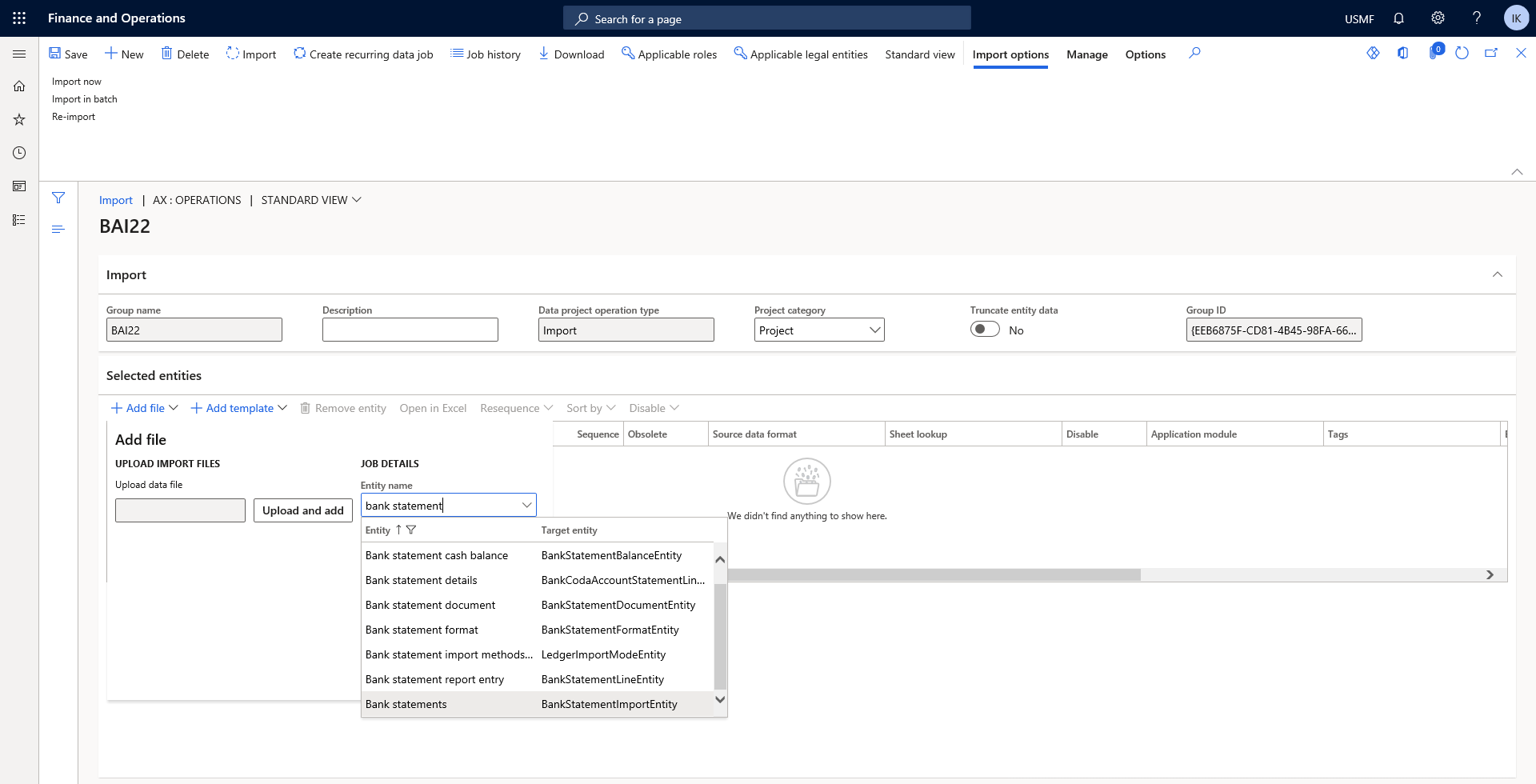

Set the Source data format field to XML-Element.

Step 5

Set the Entity name field to Bank statements.

Step 6

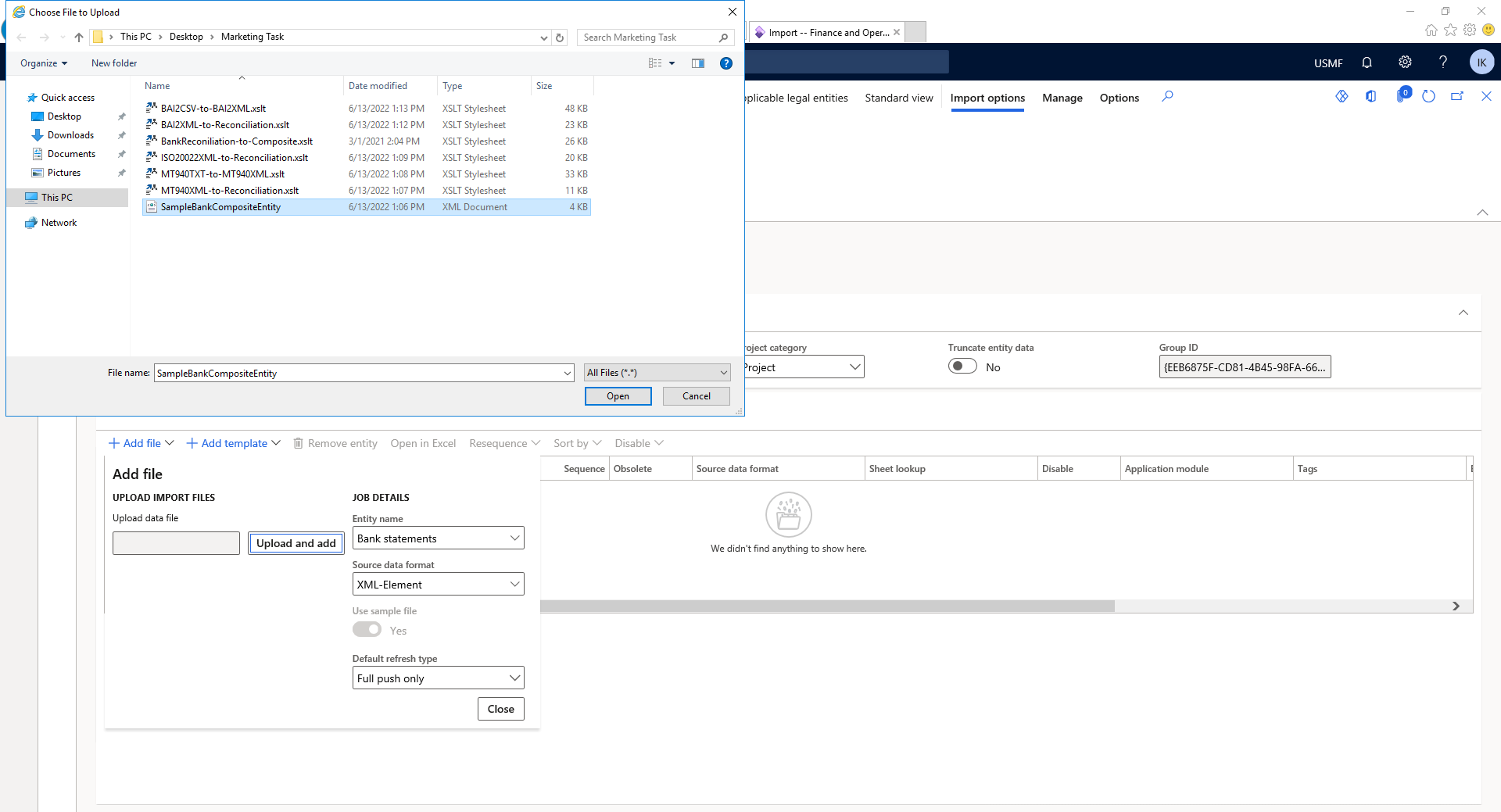

To upload import files, click Upload, and then browse to select the SampleBankCompositeEntity.xml file that you saved earlier.

Step 7

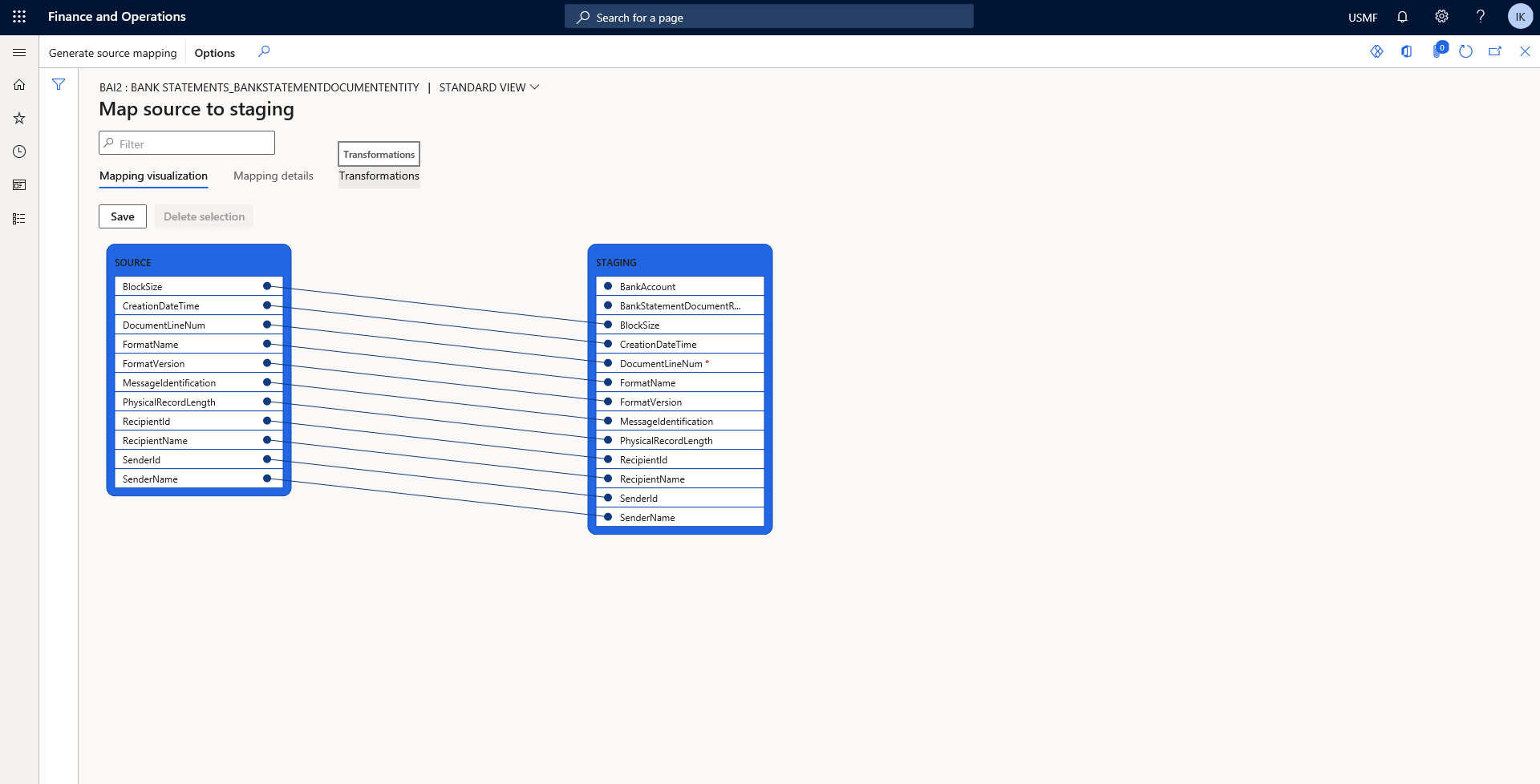

Click the View map action for the entity.

Step 8

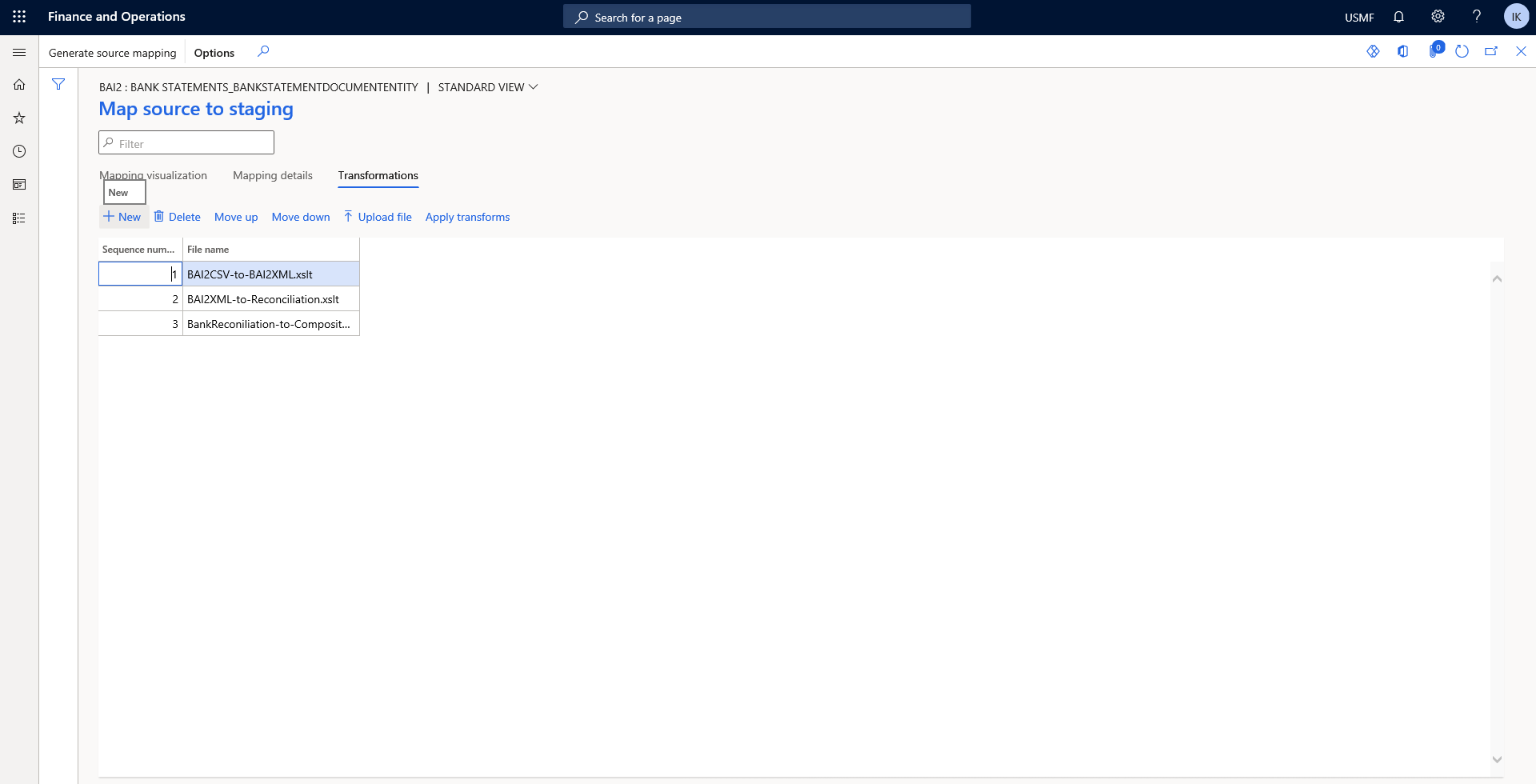

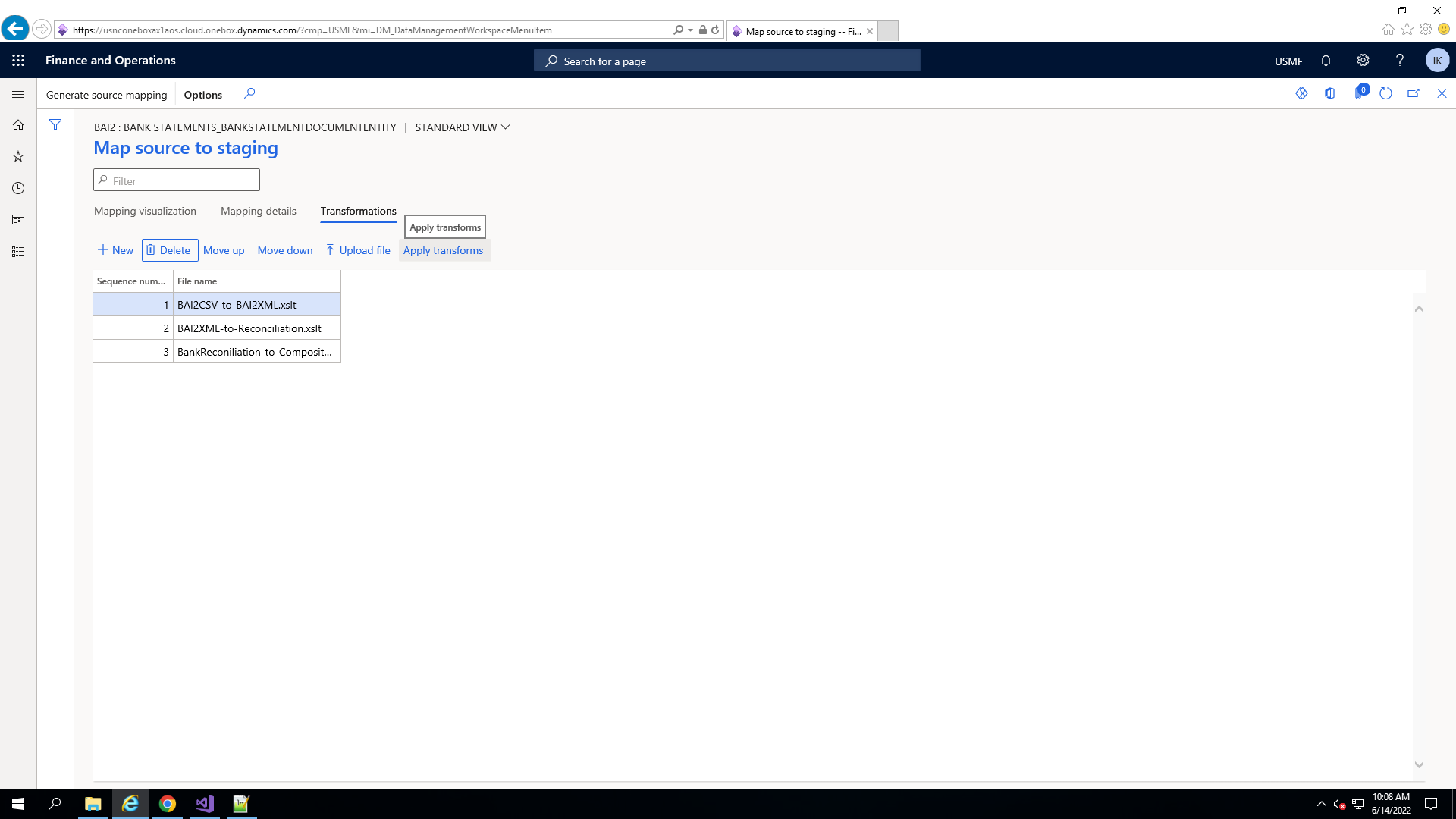

On the Transformations tab, click New.

Step 9

For sequence number 1, click Upload file, and select the BA12CSV-to-BA12XML.xslt file that you saved earlier. For sequence number 2, click Upload file, and select the BAI2XML-to-Reconciliation.xslt file that you saved earlier.

Step 10

Click New.

Step 11

For sequence number 3, click Upload file, and select the BankReconciliation-to-Composite.xslt file that you saved earlier.

Step 12

Click Apply transforms.

Define bank statement format rules for BAI2

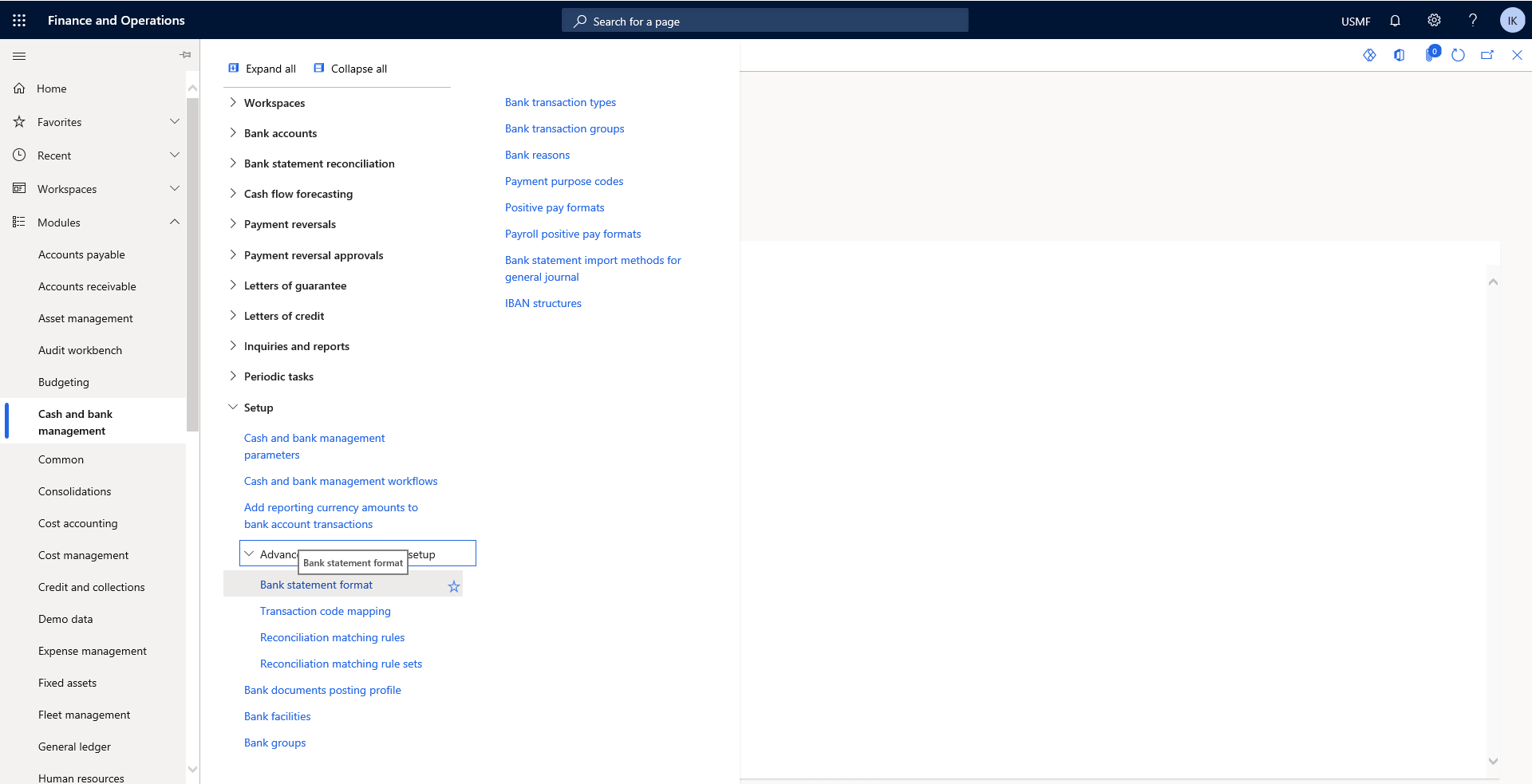

Step 1

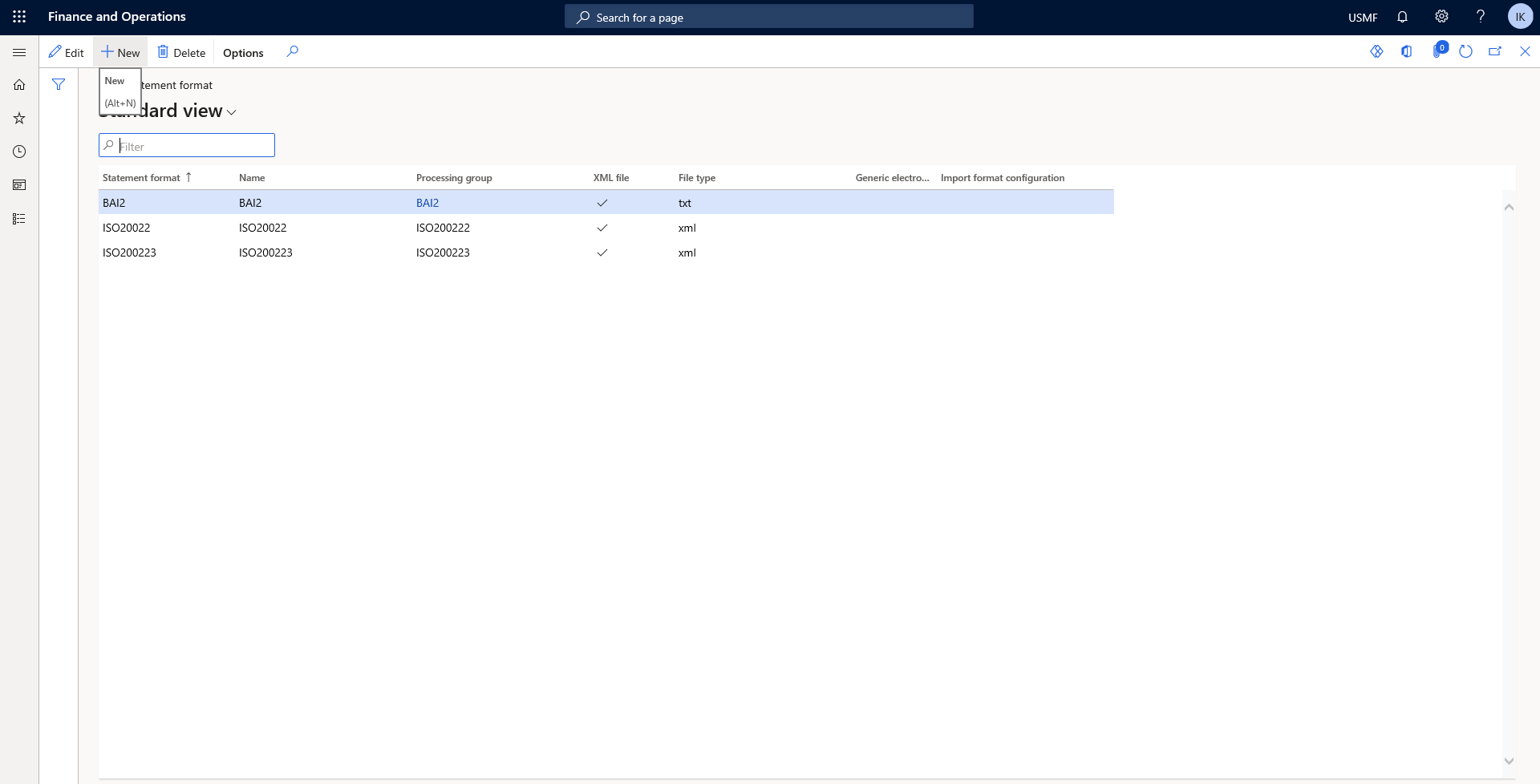

Go to Cash and bank management > Setup > Advanced bank reconciliation setup > Bank statement format.

Step 2

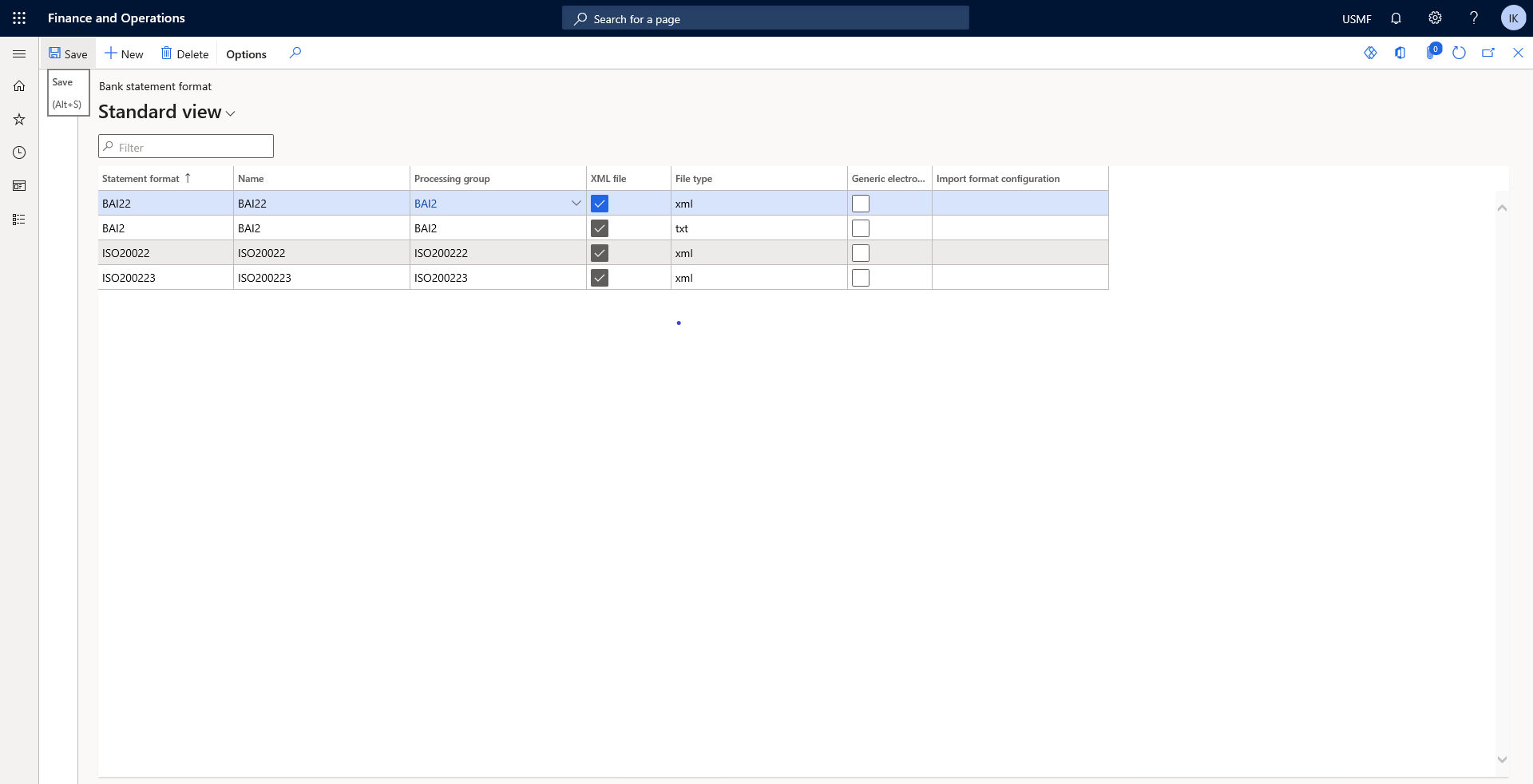

Click New.

Step 3

Specify a statement format, such as BAI2.

Step 4

Enter a name for the format.

Step 5

Set the Processing group field to the group, such as BAI2.

Step 6

Set the File type field to txt and click Save.

Advanced bank reconciliation and statement format set up on bank account

Step 1

Go to Cash and bank management > Bank accounts.

Step 2

Select the bank account.

Step 3

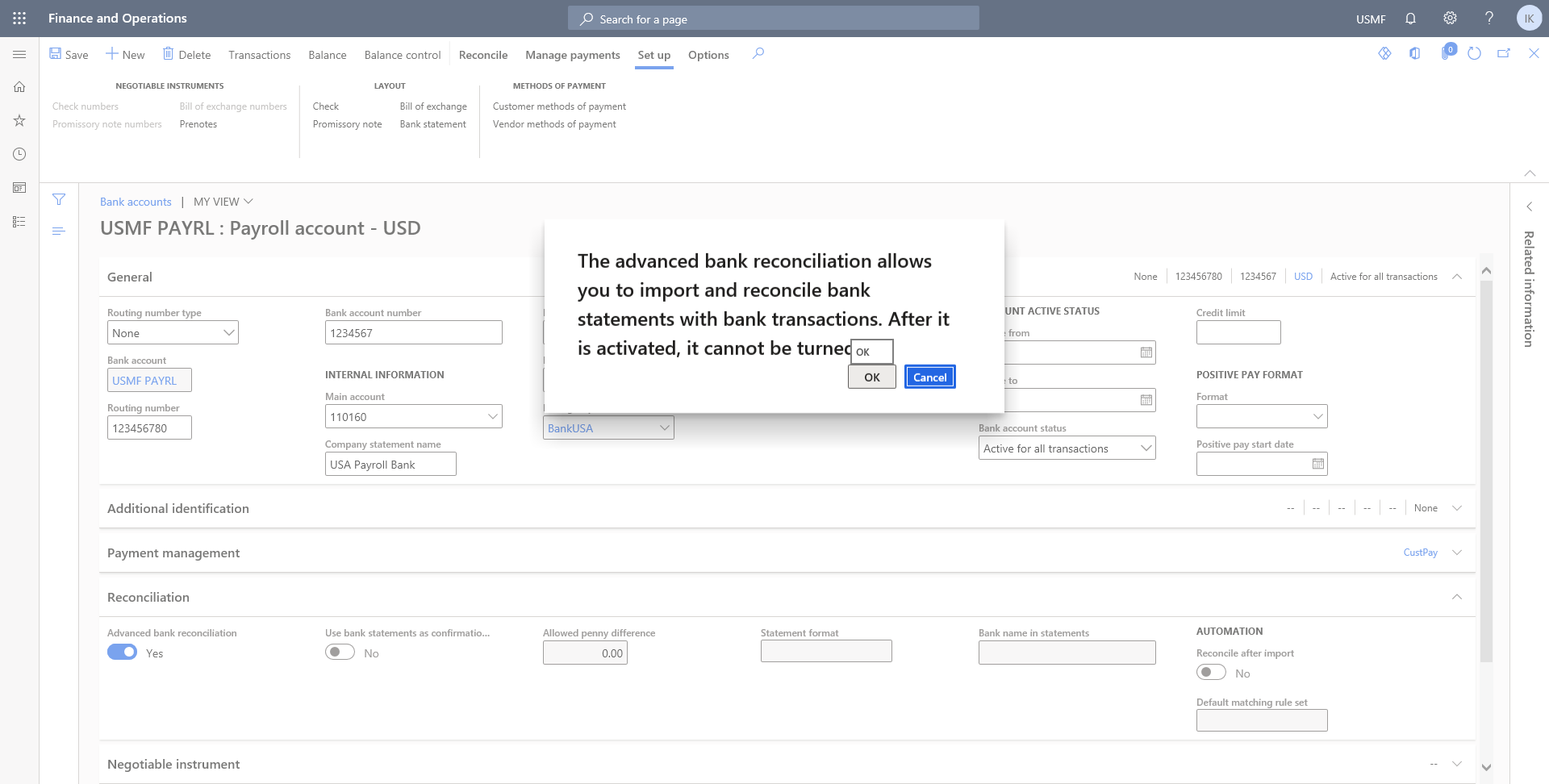

On the Reconciliation tab, set the Advanced bank reconciliation option to Yes.

Step 4

Click OK.

Step 5

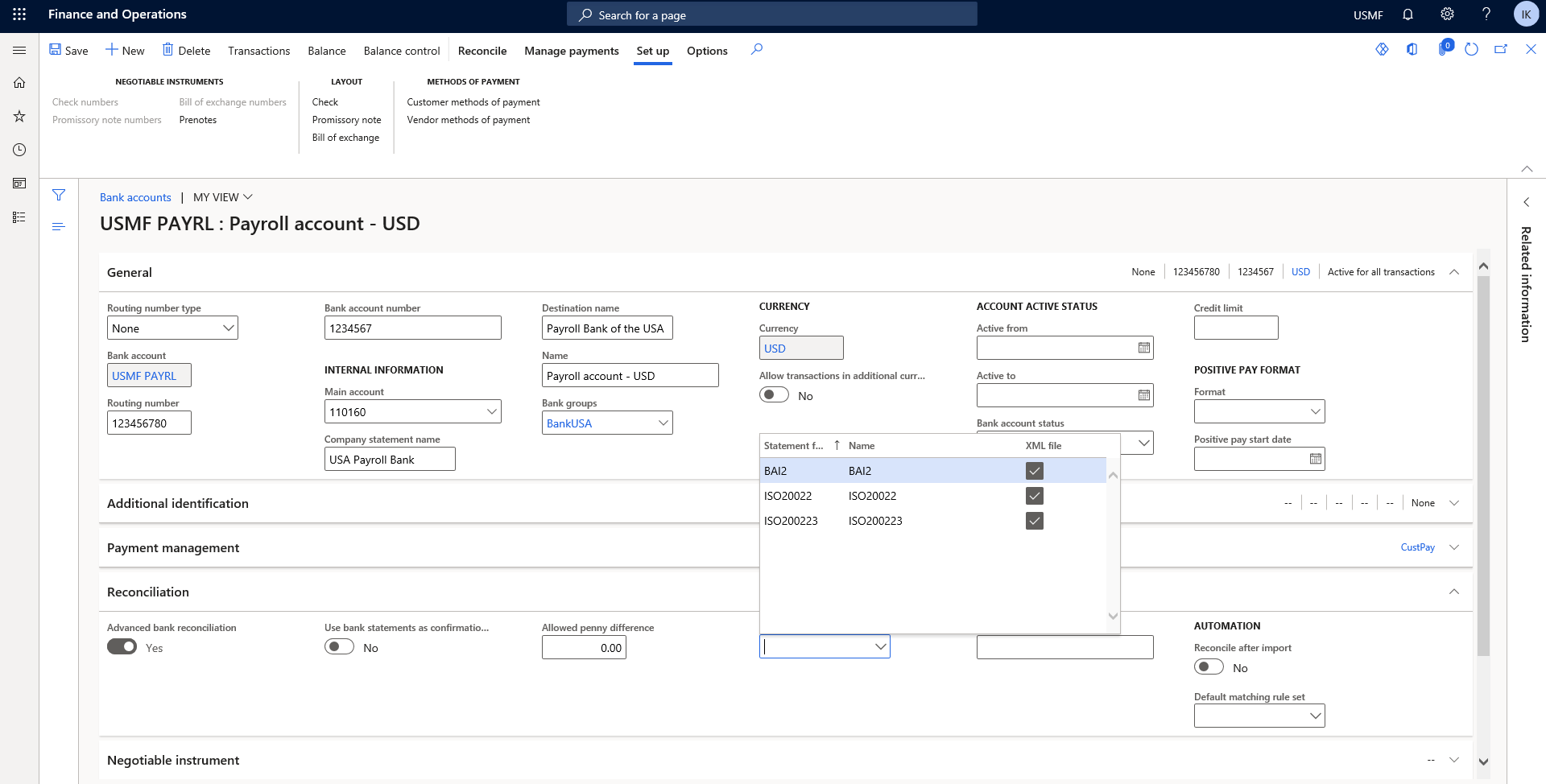

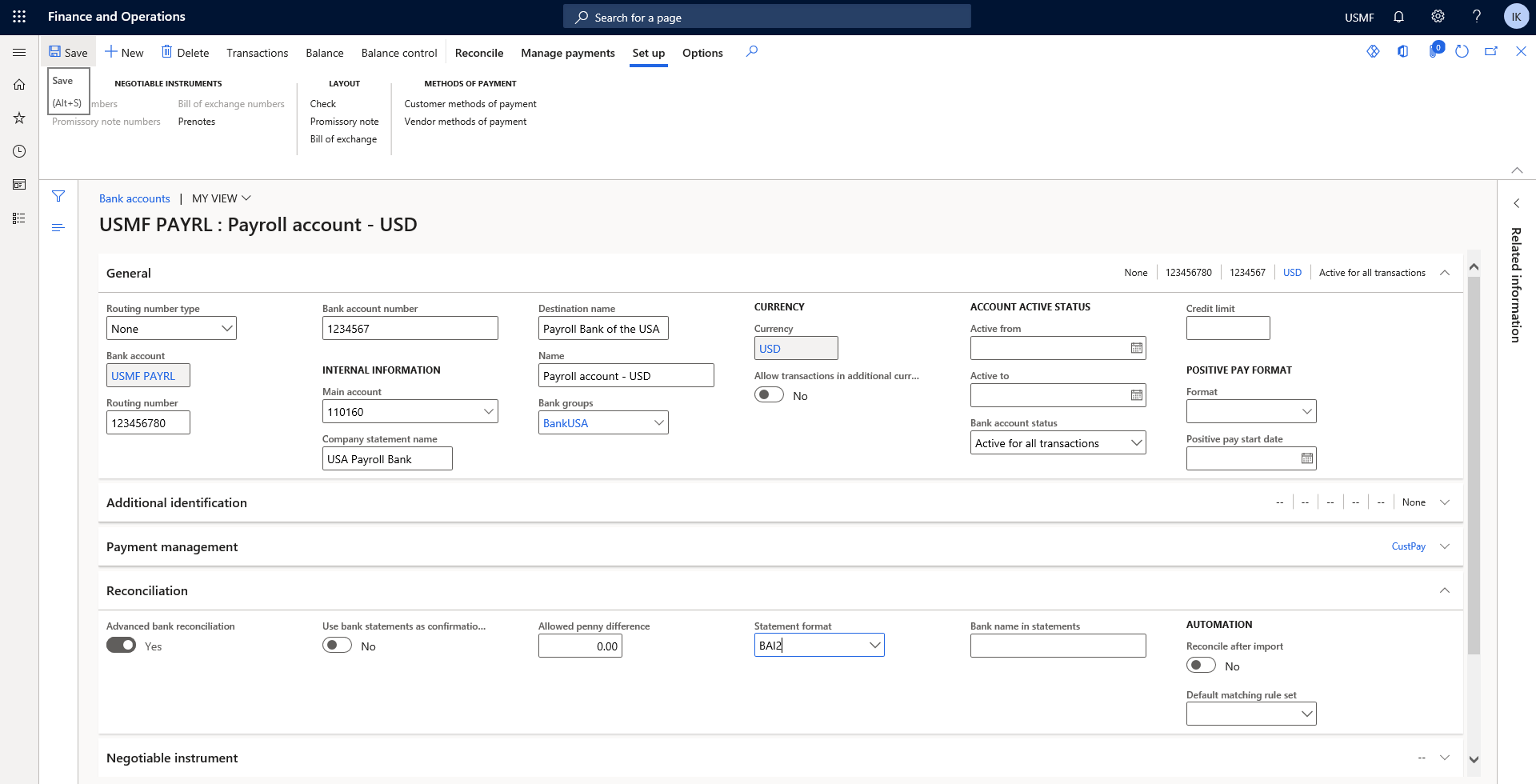

Set the Statement format field, such as BAI2.

Step 6

Click Save.

Configure the Import of Bank Statements BAI2

In Microsoft Dynamics Ax and D365 for Finance and Operations, the Bank Reconciliation for a statement may be marked as reconciled even if there are no matching amounts. A statement’s bank reconciliation may be declared reconciled at any moment, even if there are still unmatched bank statement lines. The mismatched transactions will be immediately sent to the following worksheet for reconciliation as odd bank statement transactions. Note that a bank statement reconciliation cannot be undone after it has been declared as reconciled. As a result, you won’t be able to make changes to this reconciliation. It will no longer be editable.

A crucial component of banking, business treasuries, and finance processes is reconciliation. Whether your business deals with a few banks or dozens of bank accounts, the ability to automate cash management with visibility over these bank accounts is essential.

You may do the following with the Cash & Bank Automate Function:

- Import bank statements instantly

- Use a fully-automated solution to reconcile bank statements

- Use programmable rules to optimise matching and mapping

- Increase information of all financial institutions and businesses

- Generate reconciling transactions automatically

The cringe-inducing and headache-inducing situation surrounding the bank reconciliation procedure is one that you are probably all too acquainted with as a user of Microsoft Dynamics 365 Finance.

Maintaining balance in your bank and ledgers might be difficult at best. Regardless of how few or many accounts you have, this is applicable. Finding a discrepancy manually may sometimes be a laborious process that proceeds slowly. It is extremely expensive to manually investigate thousands or hundreds of transactions. For businesses with several bank accounts and transactions, this adds up to a substantial expenditure very rapidly. Should you require any additional information or help, feel free to get in touch with our support center.

Automatic Reconciliation

Reconciliation software continually searches for matches and inconsistencies in the background. There is no longer a need to wait until the end of the period to learn all at once how many transactions need to be manually inspected.

Your balance sheets are always up to date since it is automated. Additionally, your CFO will be able to make better financial choices thanks to a real-time perspective of the actual cash flow across all bank accounts.

Error Reduction

By drastically lowering manual human error, you may make even greater financial savings. And with the exceptions discovered, our programme provides you with a thorough summary to identify the precise problem at hand. You may easily and promptly combine your bank accounts. Adding or altering your bank accounts is easy, regardless of where they are situated abroad.

Security

All of your information is safe since our solution establishes a closed loop of communication between your Microsoft Dynamics 365 Finance and Operations and your bank accounts. Use these dashboards for Dynamics 365 to inspire your own work.

SUMMARY

A statement’s Bank Reconciliation may be declared as reconciled even if there are no matching sums. CFOs will get a real-time snapshot of all bank accounts’ actual cash availability. This minimizes the amount of manual human mistakes dramatically, allowing you to save even more money.

Final Thoughts: D365 Advanced Bank Reconciliation

Microsoft’s Dynamics 365 Finance is a primary product supplied as part of Microsoft’s Dynamics 365 Finance and Operations application package. Offering enterprises a consolidated financial management software solution, Dynamics 365 Finance is built on a complete collection of services that include financial reporting in real-time, AI-driven insights, and integrated analytics. Dynamics 365 Finance improves agility and efficiency in enterprises. Through allows users to close books quicker, maintain worldwide compliance, and boost profitability by utilizing predictive intelligence. As an evergreen cloud solution, Dynamics 365 continually gets upgrades and new features. New features are given to the public via wave releases that occur twice yearly. In August, Microsoft announced its Wave 1 of new features for Dynamics 365, including numerous new enhancements to Dynamics 365 Finance. New features concentrate primarily on boosting automation and intelligence capabilities. This is powered by machine learning to boost predictive skills. This post will focus on the new features released by Microsoft and explain why we should all be enthusiastic about them! Using New Advanced Bank Reconciliation Statement Time matching feature connected to banking, let’s configure the end date for a bank reconciliation statement to be the same as the start date for a later bank statement. There was previously a problem in Dynamics 365 Finance when banks defined overlapping endpoints and beginning points for consecutive periods (perhaps at midnight), which could not be handled.

This will help stop transactions from being wrongly thrown out owing to time zone discrepancies generating misunderstandings about dates.

| Sr. |

Reconciliation Services with D365 |

|||

| Benefit | Yes | No | ||

|

1. |

Up-to-Date Actionable Data | ✓ | ||

|

2. |

Summaries and Reports | ✓ | ||

|

3. |

Verified Deposits and Payees | ✓ | ||

|

4. |

Stale and Uncleared Check Reviews | ✓ | ||

|

5. |

Early Detection of Bank and User Errors | ✓ | ||

SUMMARY

Microsoft’s Dynamics 365 Finance is comprised of an exhaustive set of services. Real-time financial reporting, AI-driven insights, and integrated analytics are among the new features. Utilizing the new Advanced Bank Reconciliation Statement will prevent transactions from being erroneously discarded due to time zone differences.

At Instructor Brandon | Dynatuners, we always seek innovative methods to improve your competitiveness and suit your Microsoft Dynamics 365 requirements. Our offerings are founded on defined procedures, industry experience, and product understanding. If you’re interested in consulting with our specialists on how we can help you manage your banking issues perfectly, don’t hesitate to Contact Us.

[sc_fs_multi_faq headline-0=”h2″ question-0=”What are four different forms of bank reconciliation? ” answer-0=”There are five primary account reconciliation types: bank reconciliation, customer reconciliation, vendor reconciliation, intercompany reconciliation, and business-specific reconciliation. ” image-0=”” headline-1=”h2″ question-1=”What is the d365 bank reconciliation statement? ” answer-1=”A bank reconciliation is the process of comparing the cash account balance and bank account balance of a business (displayed on the bank account statement). Typically, a business performs bank reconciliations monthly. ” image-1=”” headline-2=”h2″ question-2=”What journal entry is used for bank reconciliation? ” answer-2=”The bank fee journal entries would debit Bank Service Fees and Credit Cash. The journal entry for a returned customer check owing to insufficient funds debits Accounts Receivable and Credits Cash. ” image-2=”” count=”3″ html=”true” css_class=””]

6567

6567