Dynamics 365 Tutorials, Dynamics Operations Training, Microsoft Dynamics 365 Developer (F&S) Training Series

D365 Chronological Invoice Numbers: Tricks to Leverage Financial Transactions

Chronological Invoice and Voucher Numbers in Dynamics 365

Invoice Voucher | Credit Note | General Ledger Accounting | Invoicing Process | Posting Date

This blog describes how identifying purchase expenditures and liabilities by utilizing chronological invoice numbers and vouchers in accounts receivable in Dynamics 365 benefits an organization’s accounting system.

“Every small business should have an efficient and consistent process for paying the invoices, discover how voucher transactions can help make all the difference.”

Consider that you operate a small firm that regularly makes several payments to its suppliers and service providers. How do you believe you could efficiently monitor, handle, and record the payments for your business? A voucher is any written evidence confirming the entries recorded in the account books and demonstrating the accounting correctness of the transaction. A bill, invoice, receipt, salary and earnings sheet, pay-in-slip counterfoil, cheque book counterfoil, or trust deed, for instance.

What is a Voucher?

A voucher is a redeemable transaction bond with a set monetary value that may only be used on specific grounds or for particular commodities. This category includes housing, transportation, and food coupons, among others. It is crucial to highlight that the voucher system is used not only to process payments but also to purchase products and services. When an organization makes a payment, a voucher is generated. Consequently, vouchers are produced for additional disbursement operations such as cash purchases, salary payment, replenishment of petty cash and other funds, payment of debts and other obligations, and even dividend payment.

After receiving an invoice from a supplier, a voucher is generated. It must be marked “paid” when a check or electronic payment is made to a supplier, and it must be preserved together with supporting papers.

A payment run technique is executed in account payable systems to generate payments that match unpaid vouchers. The voucher may be used to amend an account in accounts receivable. Also known as a journal voucher, the voucher may be used to amend accounts under the general ledger. Looking for useful knowledge? Enhance your skill set with relevant and useful topics by learning from our group learning programs.

SUMMARY

A voucher is a redeemable transaction bond with a fixed monetary value that may only be utilized under certain conditions. This category contains, among others, coupons for accommodation, transit, and food. A “payment run” is done in account payable systems to create payments corresponding to outstanding vouchers.

Components of Voucher

This is most often seen in manual payment schemes, where it serves as part of the control mechanism. Typical voucher content includes the following:

- Identification number of the vendor

- The amount due

- The due date of the payment

- Accounts payable to reflect the requirements

- Valid early payment discount provisions

- The approval stamp

Types of Voucher

There are variety of voucher kinds in accounting. The following are:

- Debit or Payment voucher

- Credit or Receipt coupon

- Supporting voucher

- Non-cash or Transfer voucher (Journal voucher)

Benefits

Listed below are the advantages of retaining vouchers:

- The usage of vouchers helps maintain more control over the payables process

- Multiple invoices may be paid simultaneously, minimizing the number of checks

- It may be pre-numbered and streamlines the audit trail for payables

- Invoice approval is separated from invoice payment to maximize efficiency and facilitate planning

- The cashier is responsible for collecting bills and reports to the treasurer

Journal Entries for Voucher Transactions

When creating a voucher, the system creates journal entries to represent the necessary purchase expenditures and liabilities in the general ledger. After the system creates journal entries, the access may be reviewed and posted to the general ledger. You may allocate a single expenditure to many accounts when creating a voucher. You may also disperse an expenditure that was incurred during the submission of a purchase order. The system creates journal entries depending on the specified distribution amounts and accounts. To confirm the integrity of your data, you may check that the accounts payable ledger and general ledger have identical voucher amounts. Are you ready to take your career to the next level? Explore our D365 beginner level courses.

SUMMARY

In accounting, vouchers are used to maintain control over the payables process. The typical voucher comprises the vendor’s identification number, the amount owed, and the payment date. When a voucher is created, the system generates general ledger journal entries to indicate purchase expenditures and liabilities. In addition, the preceding section describes the vouchers’ components, variants, and advantages.

All About Invoice Numbers

The invoice number is an essential component. The numbering facilitates precise bill differentiation. Identification of sales and purchases is a critical component of your company’s financial system. You must provide a unique invoice number to each invoice, following your country’s regulatory standards. Typically, these impressive numbers are produced using a sequential numbering scheme. Depending on one’s area of residence, billing requirements may vary substantially. Consequently, they may affect the complexity and expense of tax compliance. If tax authorities determine that your organization is not in compliance with the applicable rules, this might lead to significant audit risks or even substantial penalties.

A well-designed invoice management system facilitates the monitoring and assessment of financial reporting and transactions. You may spend hours attempting to simplify it yourself, or you can use the D365 superior invoicing solution. With D365 financial application provides automated invoice numbering and automatic reconciliation. Therefore, each payment is validated automatically against the corresponding invoice.

D365 customers don’t have to ponder how to produce their invoice numbers. This allows them to dedicate their attention to more crucial company procedures. Learn in a hands-on, real-world setting in our custom-built labs, enroll now.

What Is an Invoice Number?

What is an invoice number? Let’s recall the function of invoices. These invoices identify and detail the services or products a client has bought from you, as well as the precise amount they must pay.

A sensible individual should consider professionalizing the invoicing procedure when attempting to grow a firm. The invoice number, often known as the “reference number” or “invoice ID,” is a unique number issued consistently to every invoice. It is a code of numbers or characters (or a combination of them).

It is challenging to assign invoice numbers, particularly if you have several customers. However, there are a variety of techniques for generating invoice numbers; you may select the one that seems most appropriate for your small company.

SUMMARY

Identification of sales and purchases is a crucial element of your organization’s financial system. Each invoice must have a unique number in line with your country’s statutory requirements. There are several methods for generating invoice numbers; you may select the one that looks most suitable for your small business.

Four Principal Ways to Generate an Invoice Number

| Sr. |

Accounting KPIs |

|||

| KPI | Description | Formula | ||

|

1. |

Cost Per Invoice Processed | Determines overall departmental efficiency | Cost per invoice processed = Total accounts payable costs / Total number of invoices processed | |

|

2. |

Average Time Per Invoice Processed | Determines the average time if company processes invoices slowly | Time per invoice processed = Hours spent keying + Hours spent re-keying + Hours spent reviewing materials + Hours spent identifying route checkpoints + Hours spent on approvals + Hours on remitting + Hours on reconciling + Hours on communication statuses updates and approvals | |

|

3. |

Number of Invoices Processed / Employee / Day | Counts the daily invoices processed by each accounting manager | Number of invoices processed per employee per day = Number of invoices processed per month/number of clerks or full-time equivalents (FTEs) processing them | |

|

4. |

Percent of Invoice Exceptions | Determine the irregularities, such as incorrect receipt dates, incorrect or absent purchase orders, and incorrect/duplicative PO and non-PO credit amounts | ||

There is no standard invoice numbering system that applies to all vendors. Therefore, the ultimate choice on which strategy to choose rests solely with you. Choose the method that seems to be the most practical and lucrative for your company. There are four standardized numbering systems used globally. Let’s get to know each of them better.

Sequential Method for Numbering Invoices

This format would create invoice numbers as follows: 001, 002, 003, etc. It is strongly encouraged to use 3 or 4 digits (in our case, 001 instead of 1) in the address. This will prevent future misunderstandings when the number of your customer’s increases and your firm continues to develop. Sequential numbering signifies that a unique number is generated for each freshly issued invoice by incrementing the invoice number by one. You may begin the invoice number with a few zeros (the most common method uses nine zeros), followed by the actual invoice number. When employing billing software, such as the service provided by FINOM, the system automatically assigns invoice numbers to each new transaction. When you attempt to input a previously saved number, the service will not let it.

Chronological Method of Invoice Numbering

Using chronological order invoice numbers is another approach. In addition to a unique number, a chronological invoice number also specifies the date of issue. This strategy is used to prevent disambiguation, guaranteeing that invoices from the same day will not have multiple digits. Typically, chronological invoice numbers appear as 20210928-001, 20210928-002, etc. Consequently, you generate more specific and informative invoice numbers that include the invoice date. For example, let’s examine the illustration below:

Number of Invoice: 20210928-001

Calender Format: YYYYMMDD-001

This indicates that it will be the first bill released on September 28, 2021. The order number is uniquely identified by the final three numbers, which increase by one with each subsequent sale.

There are several forms of sequential numbering. September 28, 2021, for instance, may alternatively be represented as 28092021-001 (DDMMYYYY), 09282021-001 (MMDDYYYY), etc.

The customer’s number may be added to a chronological invoice to make it more customized. For example, if the customer number is 50 (CC), the invoice identifier would appear as follows:

Number of Invoice: 20210928-50-001

Date-based Format: YYYYMMDD-CC-001

Numbering of Client Invoices

As stated before, you may also issue unique customer numbers to your customers. These digits may be added to the invoice number to construct your method for numbering client invoices. For example, consider a client whose individual customer number is 50. In this instance, a system based on client numbers would generate invoices such as 50-001, 50-002, etc. Likewise, dates may be transformed into invoice numbers based on customer numbers. The reference number in this instance begins with the client number. After that, you should provide the optional issue date and sequence number. Always append the sequence number at the end of your invoice number. This simple precaution helps company owners track the number of invoices sent.

This is how a sale for a client with customer number 50 might appear on September 28, 2021:

Number of Invoice: 50-001

Date and Invoice Number: 50-20210928-001

Numbering Invoices Based on a Project

Another alternative for referencing invoices is project-based invoice numbering, which has many similarities with customer invoice numbering. In this instance, company owners provide project numbers as unique identifiers for a specific project. For example, if a project is numbered 183, associated invoices maybe 183-01, 183-02, etc. This numbering technique will be particularly advantageous for small firms that operate on a wide variety of projects or provide services to organizations that want invoices to include project numbers. If you want to learn more about Dynamics 365, you can also check out our blogs for additional information.

SUMMARY

Globally, four distinct invoice numbering methods are in use. Choose the one that seems most feasible and profitable for your business. The customer’s number may be appended to personalize a chronological invoice number. You may also provide consumers with unique customer numbers. These digits may be added to the invoice number to create your system for numbering customer invoices.

Set up Chronological Invoice and Voucher Numbers

Accounts Receivable Parameters

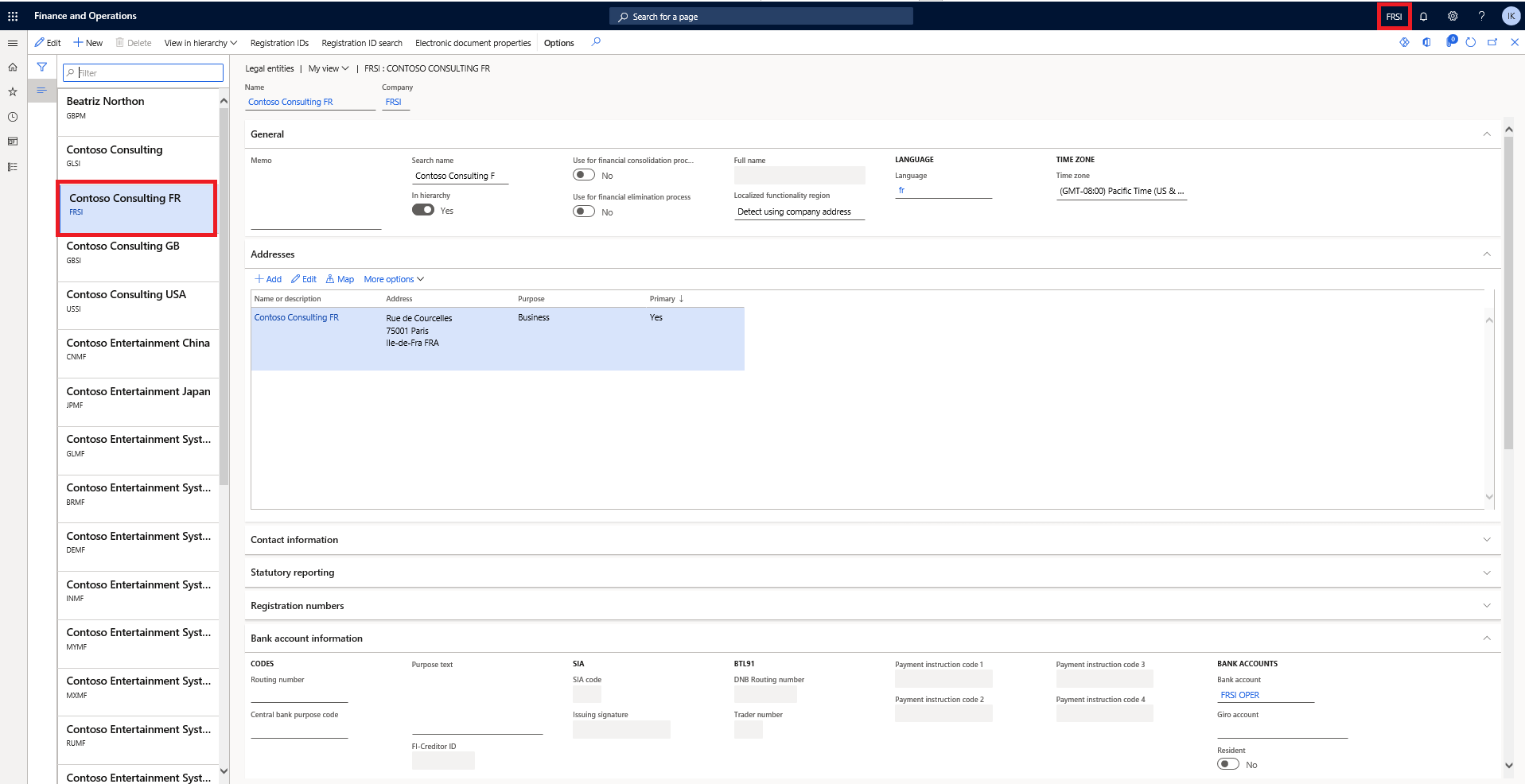

Note: Regarding country/region, the primary address of the legal entity must be in France.

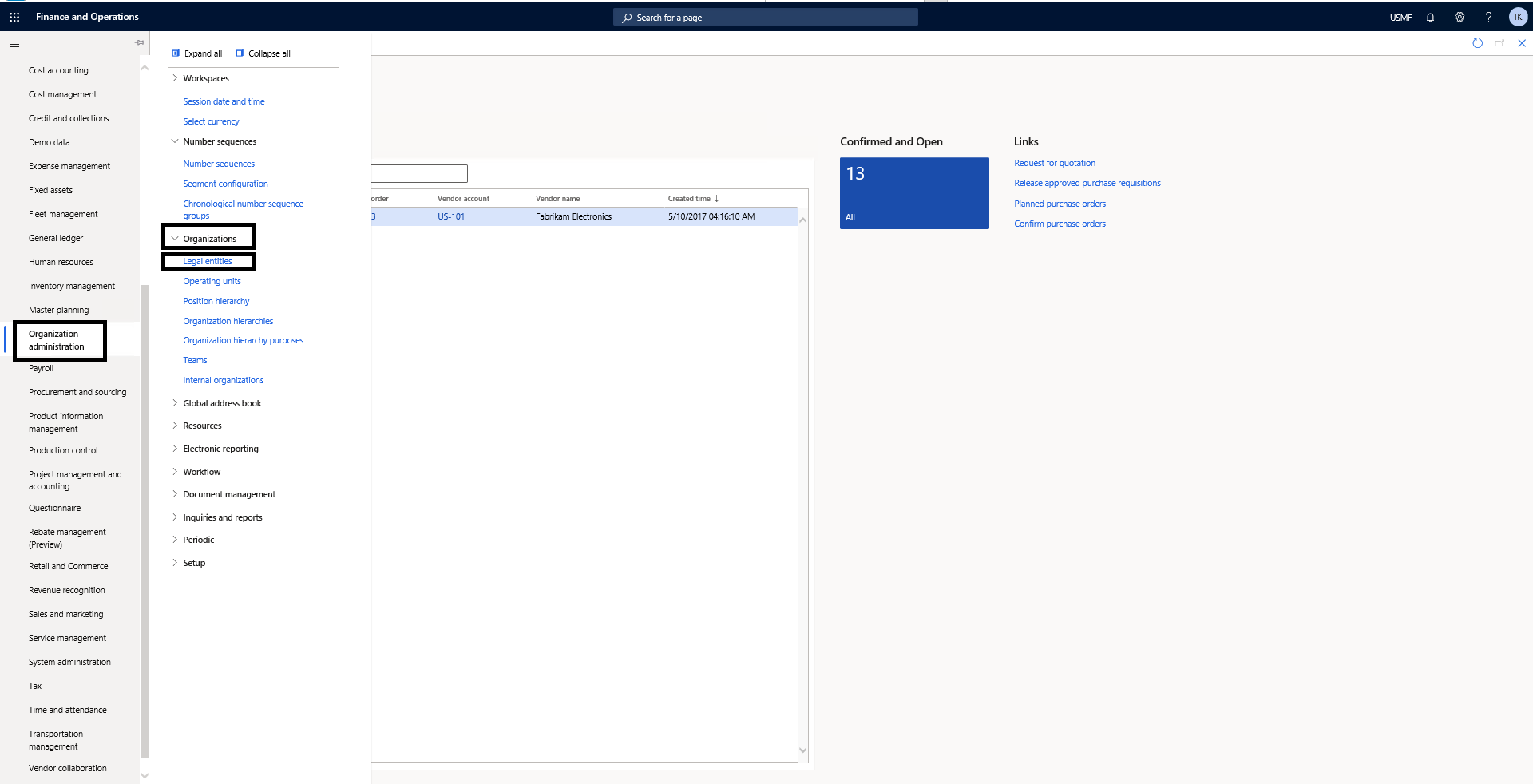

Step 1

Organization Administration > Organization > Legal Entities.

Step 2

After clicking on Legal Entities, check all and find whose Primary address is France. If you cannot find any legal entities whose primary address is France create a new Legal entity by clicking NEW in the action panel.

Step 3

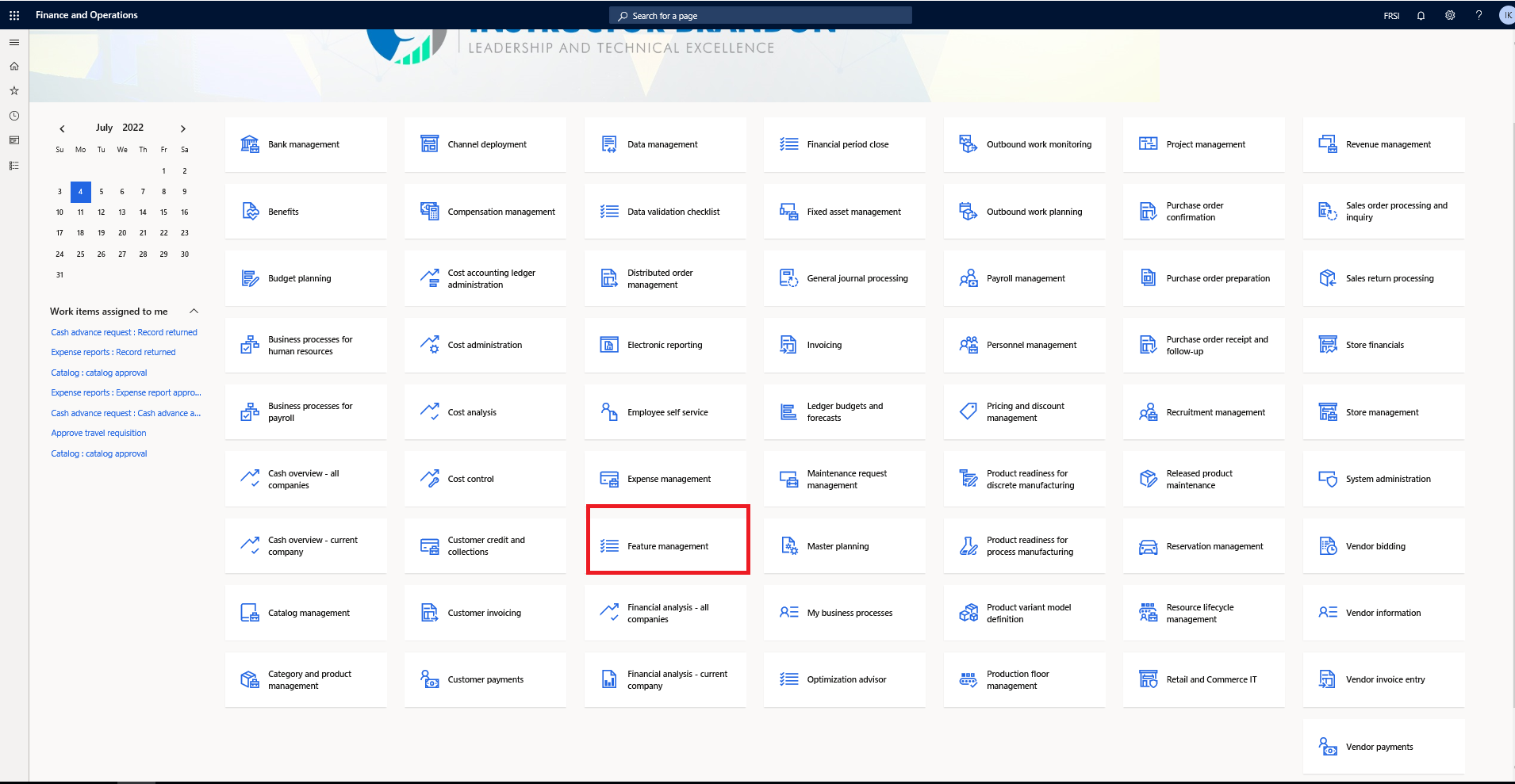

After the above step, go to the HOME PAGE of the D365 environment.

Step 4

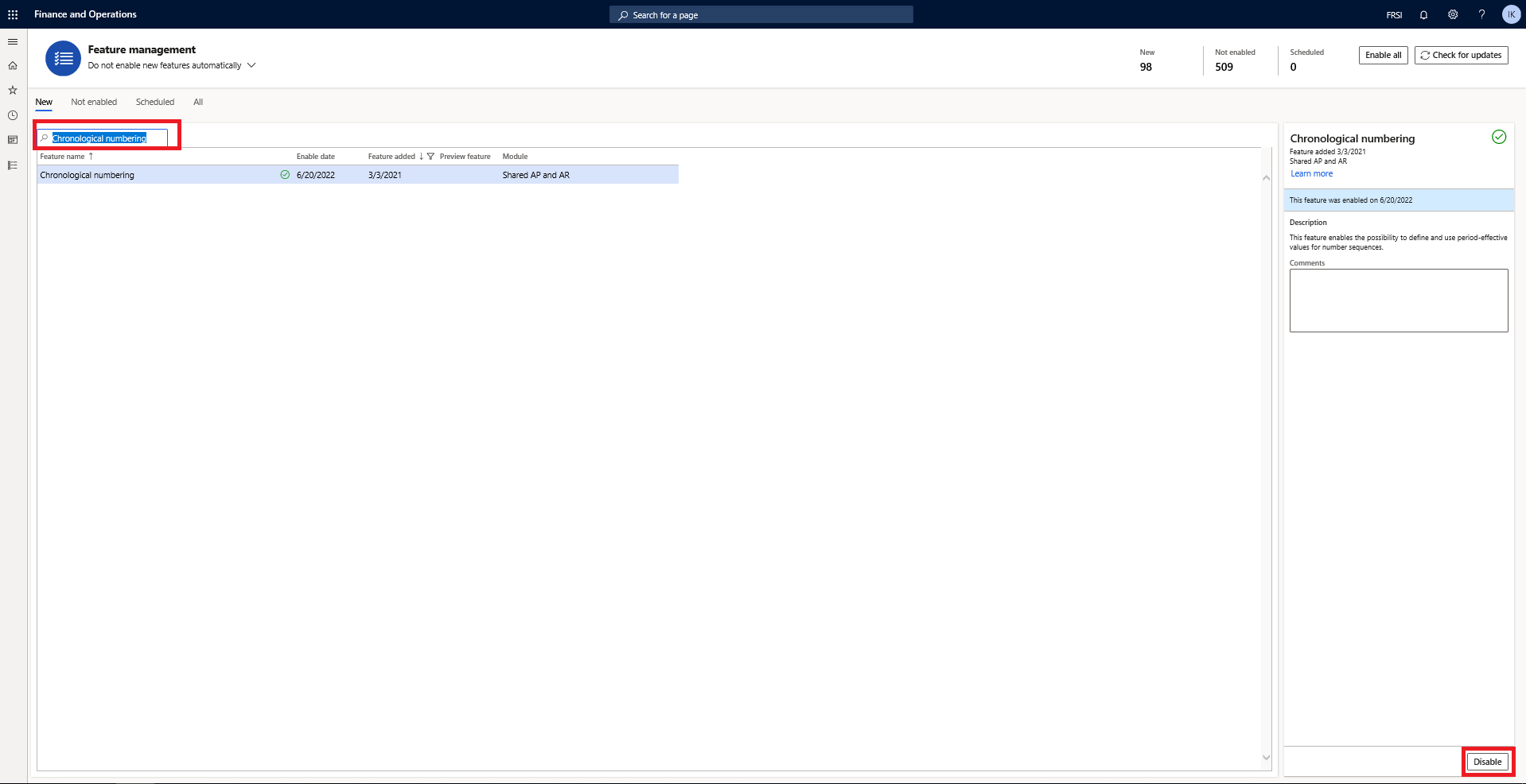

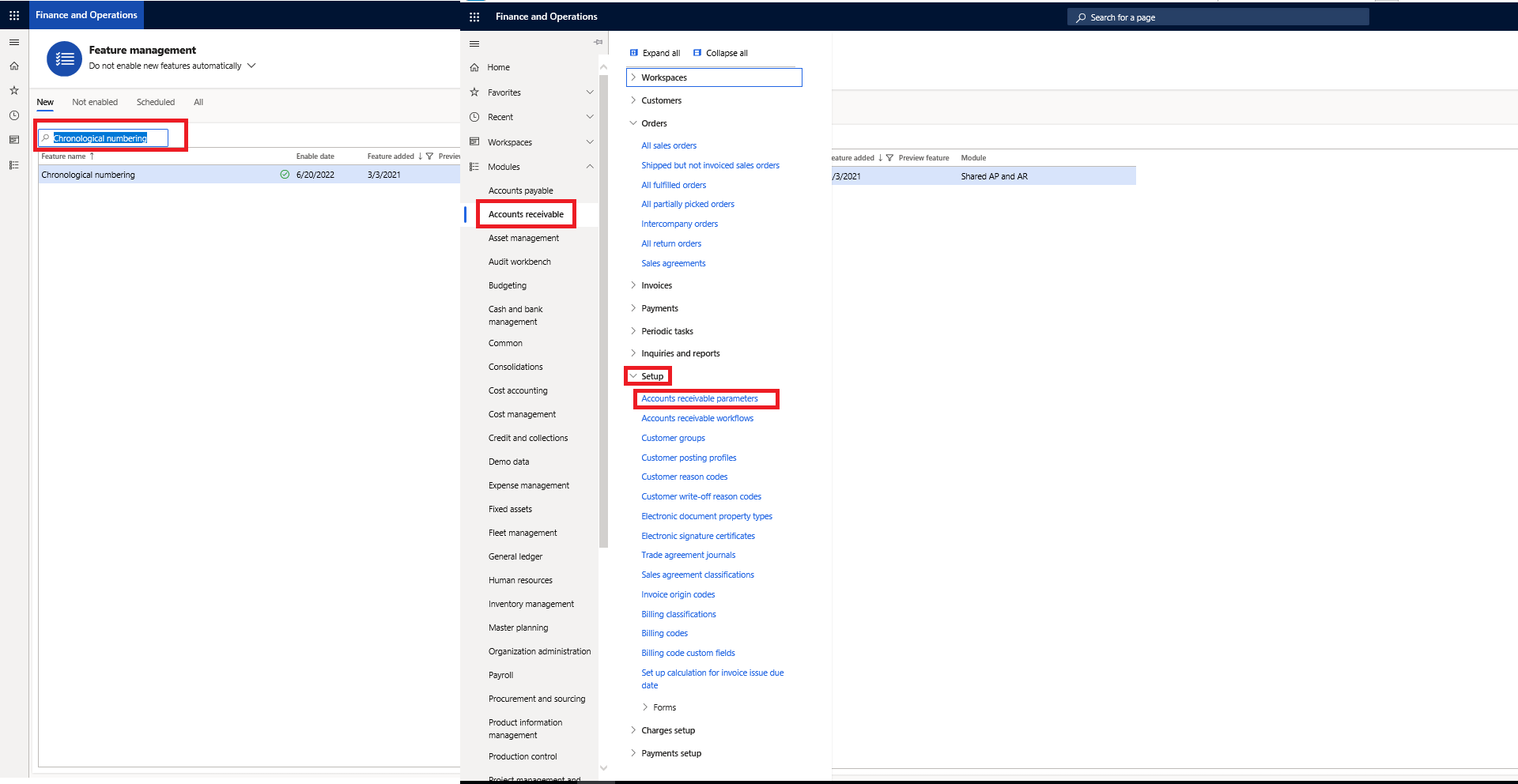

Click on the Feature Management and Check that the Chronological numbering option is enabled.

Step 5

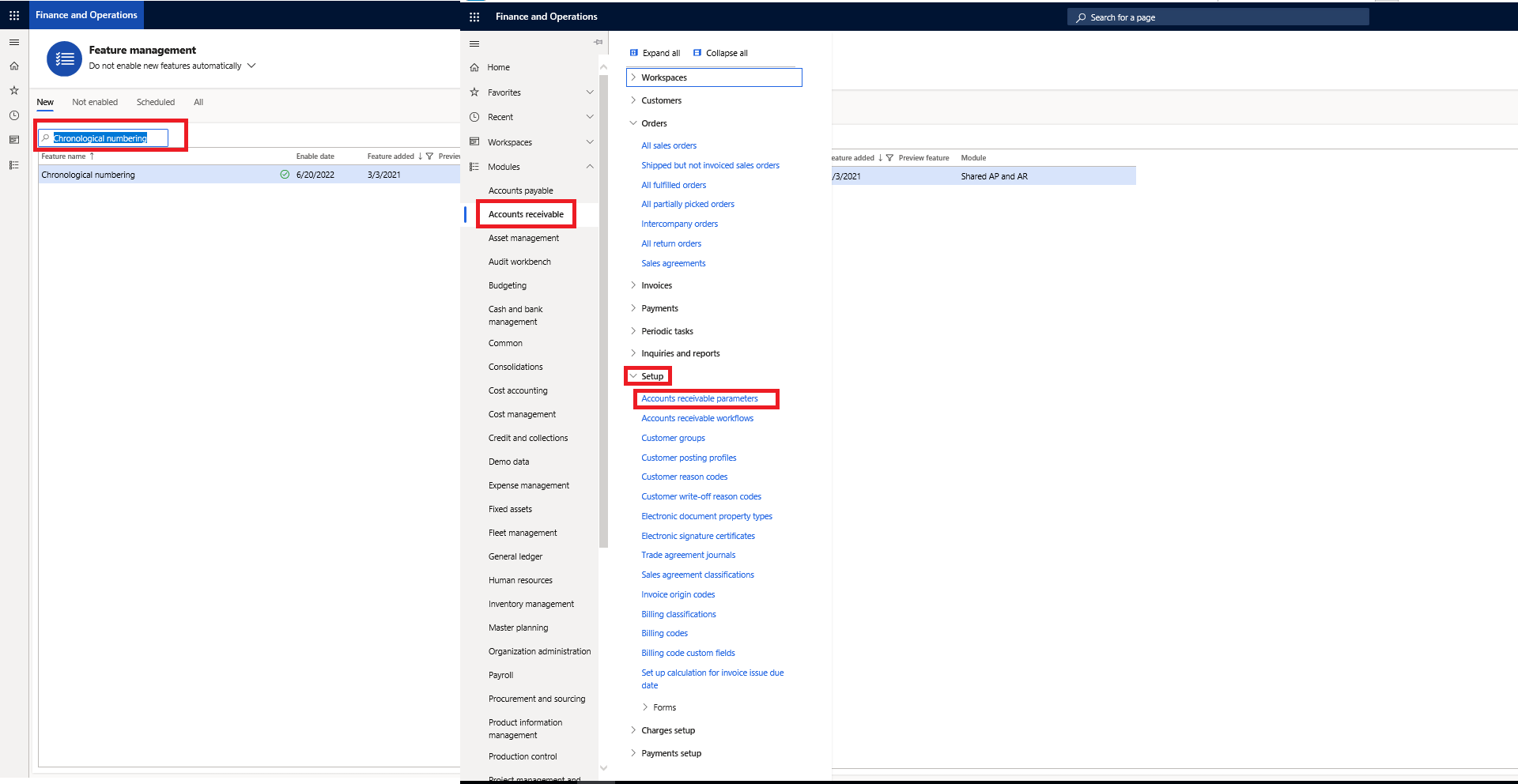

Accounts receivable > Setup > Accounts receivable parameters.

Step 6

Click on Accounts receivable parameters.

Step 7

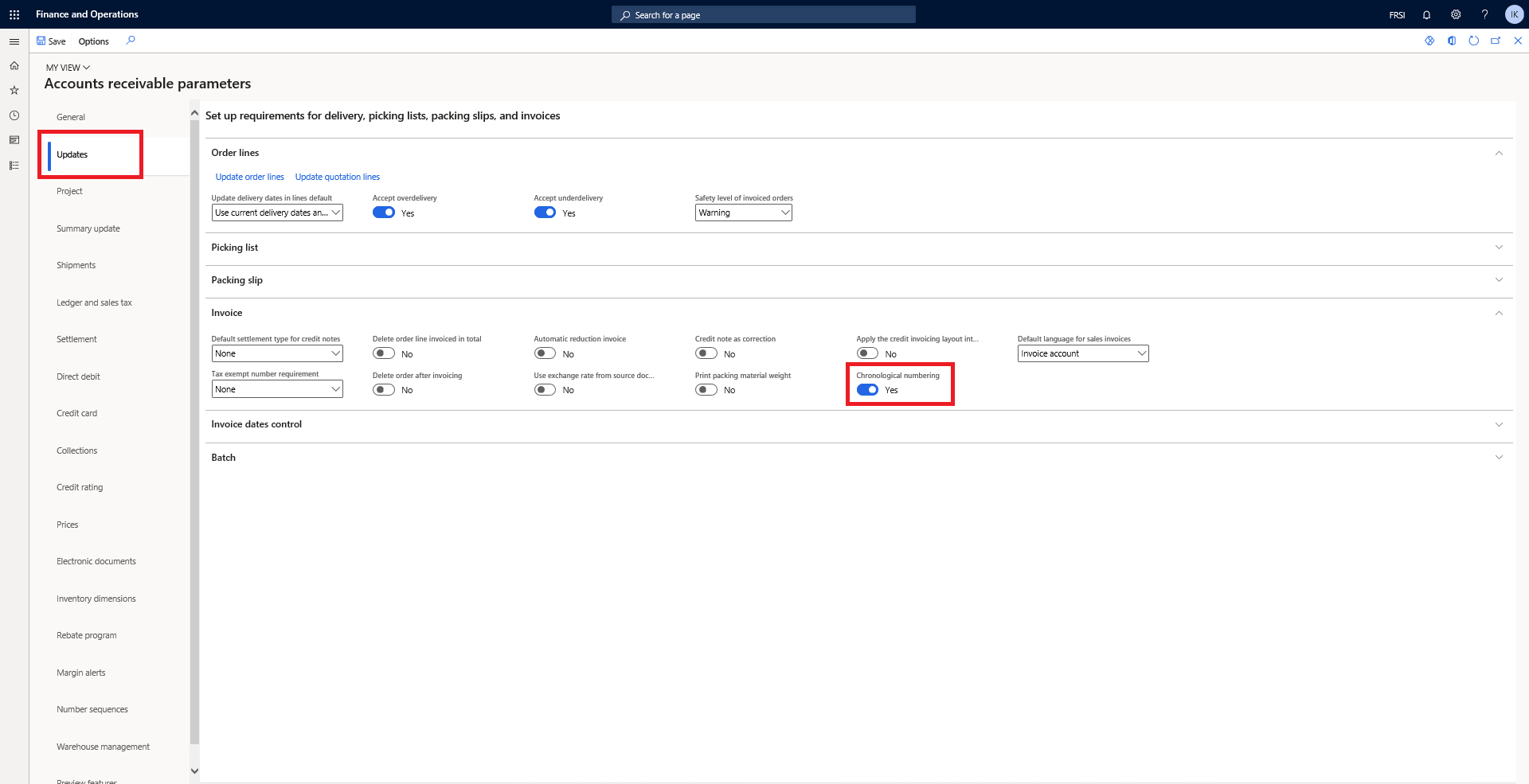

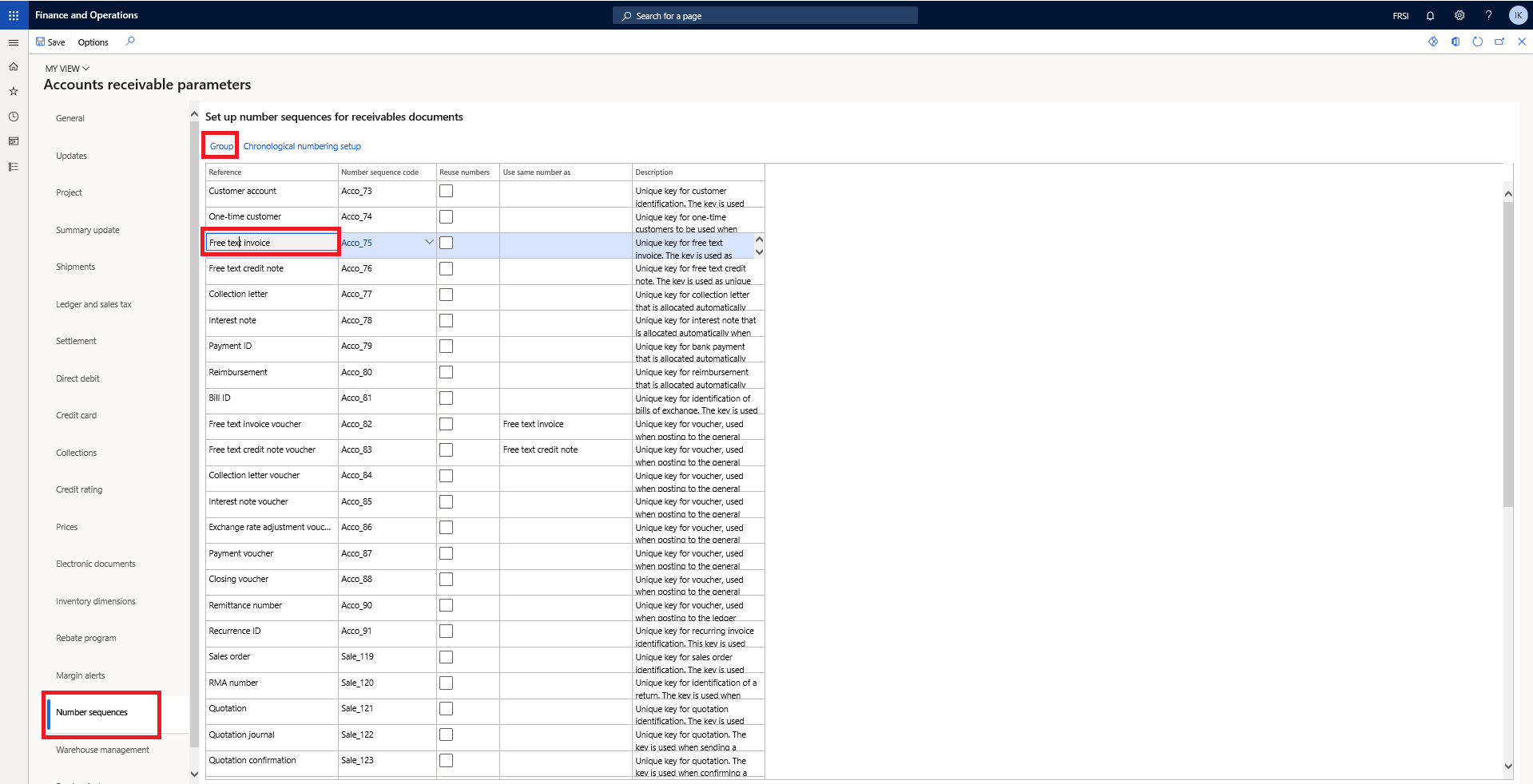

Click on UPDATE and check the Chronological numbering check box is YES.

Step 8

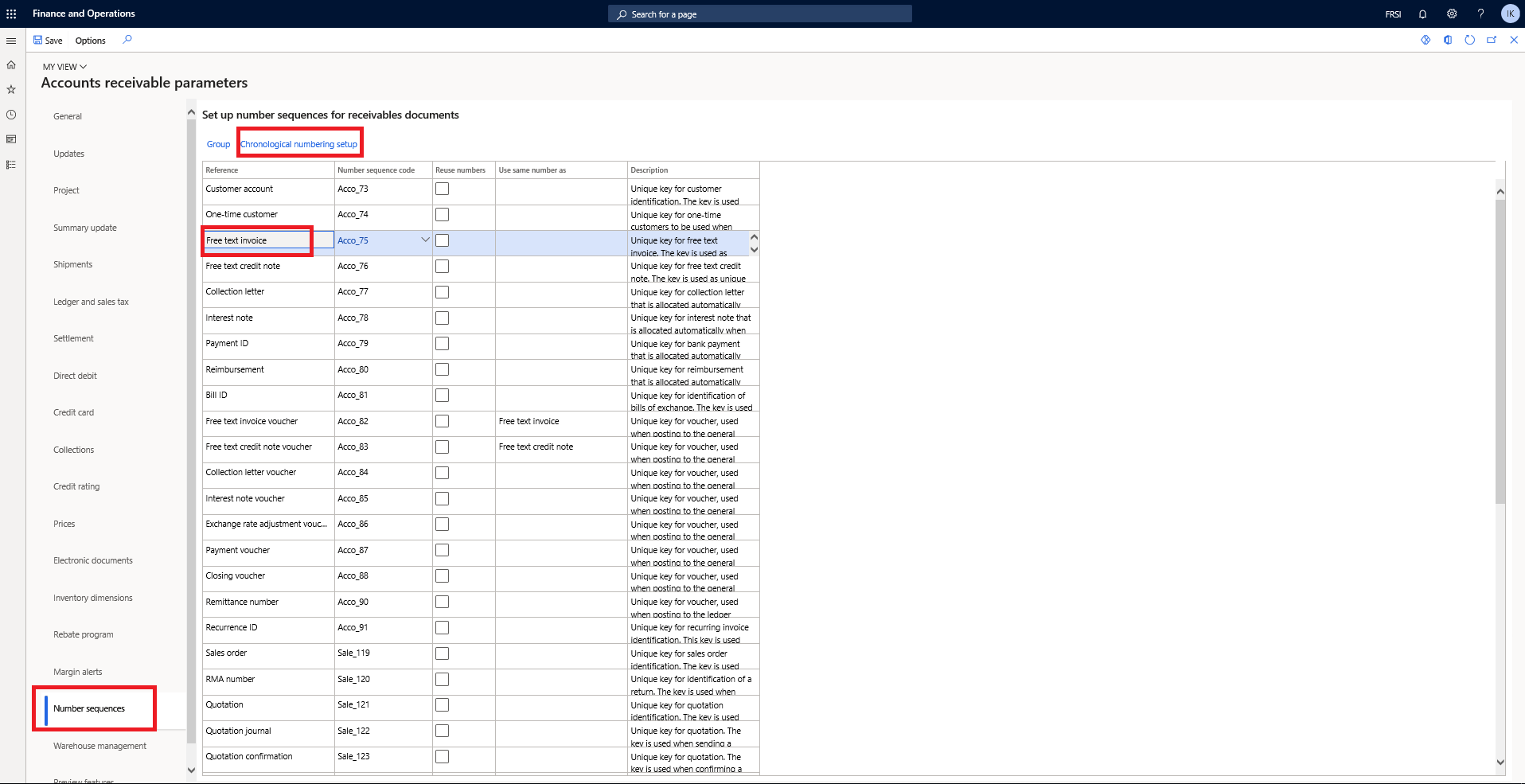

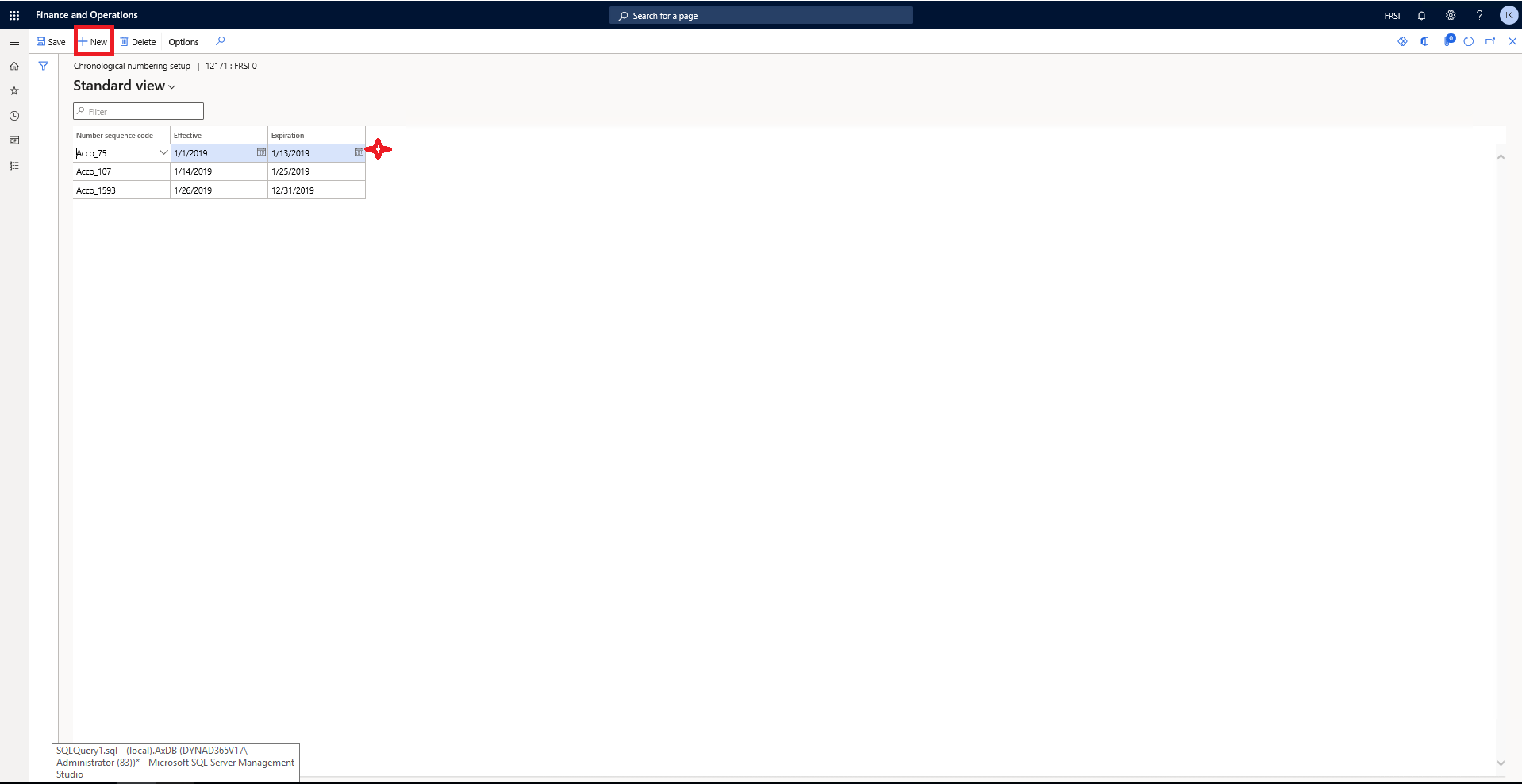

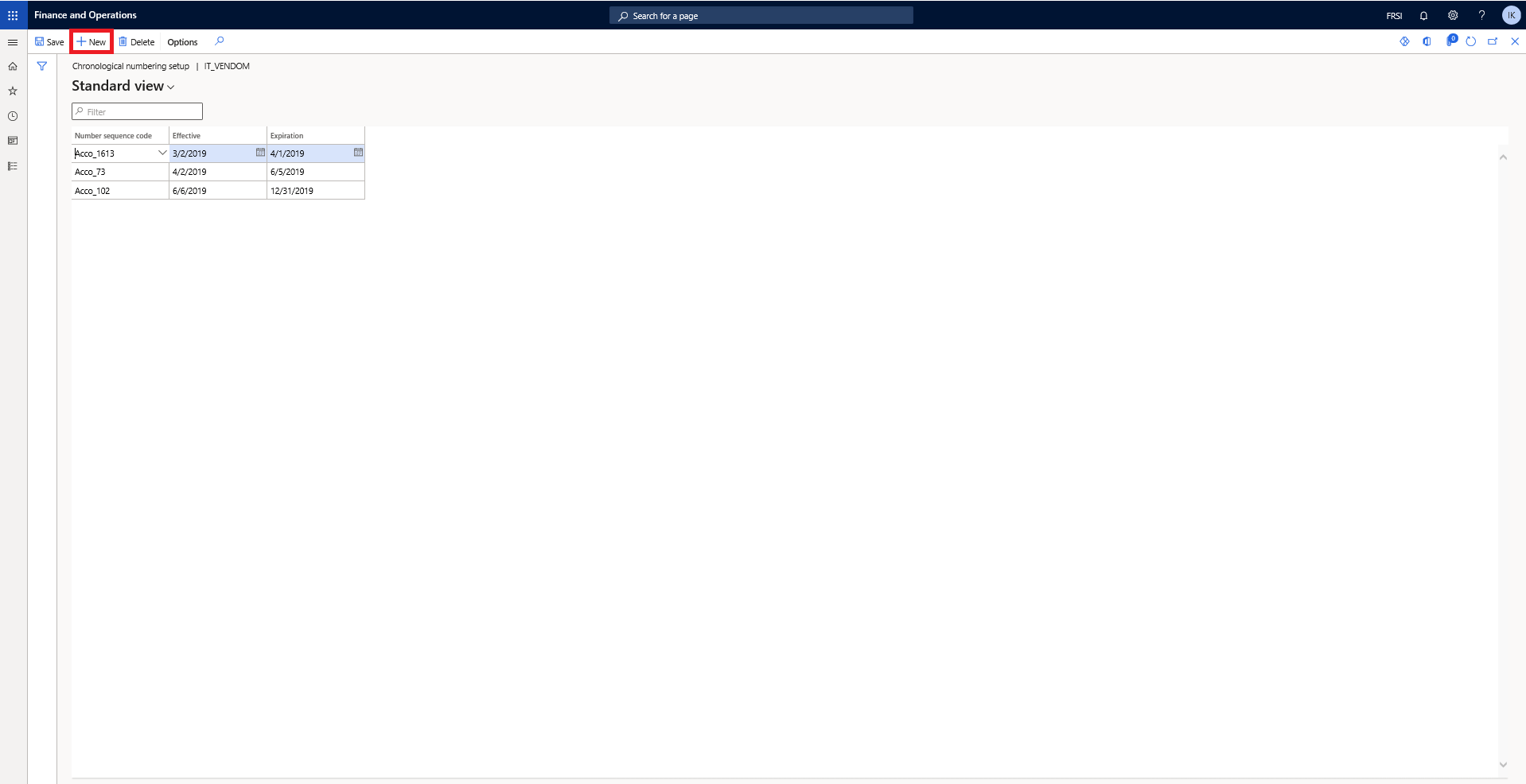

Click on Number Sequence > Free Text Invoice > Chronological numbering setup.

Step 9

Click on the New button in the Action Panel and add the data.

Number Sequence Groups

Step 1

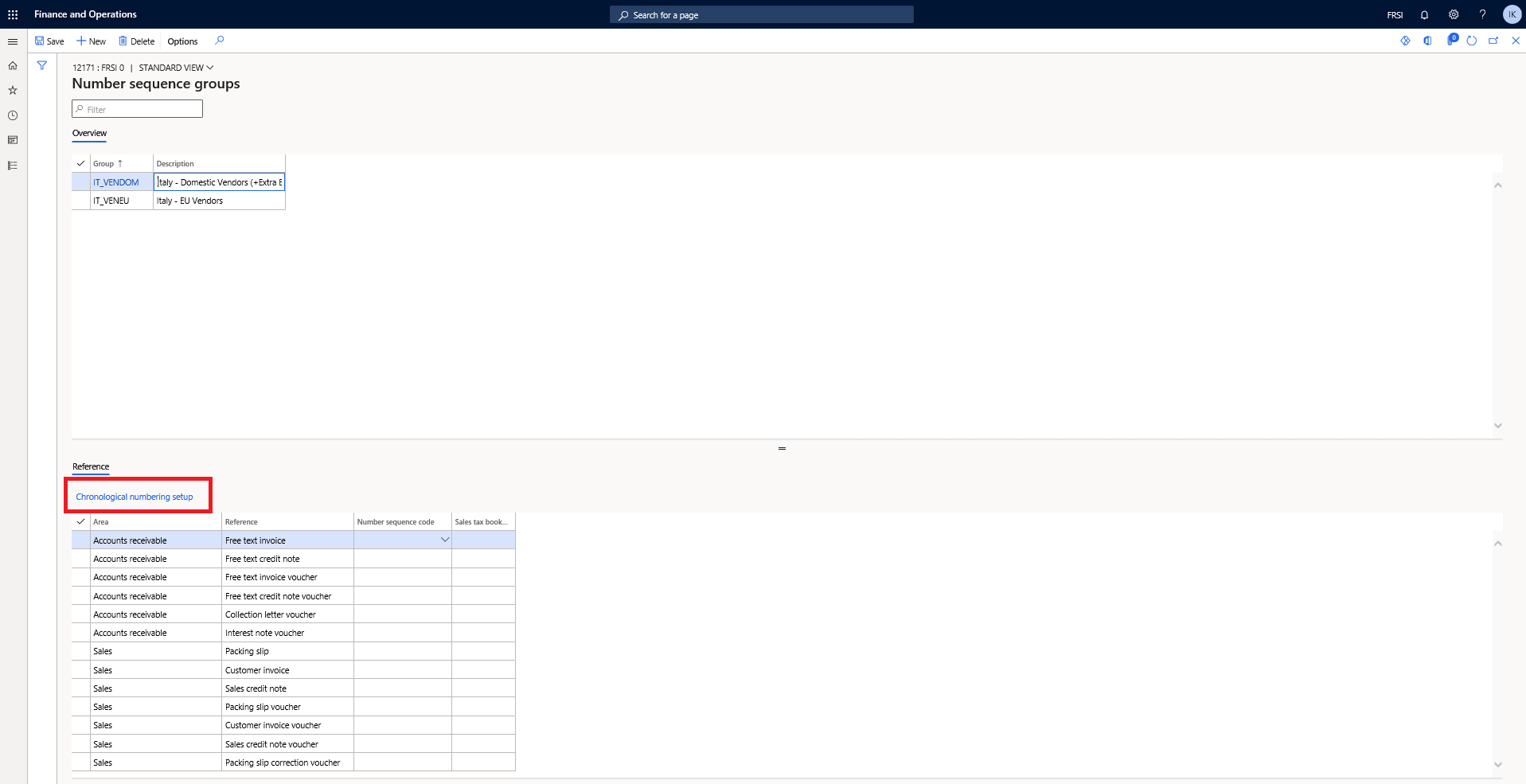

Accounts receivable > Accounts receivable parameter.

Step 2

Number sequences > Free text Invoice > Group.

Step 3

Click on Group > Chronological numbering setup.

Step 4

Click on New and add data.

SUMMARY

The preceding instructions outline how to create and utilize chronological invoice and voucher numbers in accounts receivable.

Final Thoughts: Significance of Invoice Numbers to Your Company?

Small companies benefit from assigning unique numbers to invoices for various reasons. They are essential management tools that allow you to monitor many elements and maintain a profitable firm. Moreover, invoice numbering is often mandated by law. A unique number assigned to each invoice permits the following:

Monitor Payments

When a customer has issues with a bill issued many months ago, the account may be quickly located if the vendor has a reliable numbering system. Without a rational numbering scheme, it may be very time-consuming for both the supplier and the consumer to find previous invoices. Invoice numbers are a fantastic tool that can be supported by any accounting software and come in useful when establishing a new invoice, saving suppliers time and effort. Without an invoice number, sorting your invoices by work type or customer context will be difficult. However, it would help if you recognized that these particulars are not unique to each invoice.

Moreover, invoice numbers allow you to determine whether bills have not yet been paid quickly. So that you may anticipate your income and manage your budget and spending appropriately.

Remove Duplicate Payments

If you double-charge your clients or issue an inaccurate invoice, your firm might suffer substantial reputational, financial, and time-related damages. Unique invoice numbers guarantee that you will not seek duplicate payments from your clients, aiding in gaining their confidence and establishing an image of a trustworthy organization with an impeccable reputation. If no invoice number is provided, it is practically hard to locate the correct invoice.

This might be problematic when you must rapidly confirm payment from a customer, respond to a client’s concern about the invoice, or transmit a specific invoice to the accounting department. In addition, you do not need to remember details such as the sort of service rendered or the items supplied, nor do you need to recall the job’s price. You take care of your future self by providing a unique reference number on the bill, making the search through your data exceedingly simple and user-friendly.

Appear Professional and Offer Definitive Services

Depending on the jurisdiction, you may or may not be required to produce invoice identifiers. Nonetheless, most clients prefer to urge their inclusion on bills since reference numbers provide openness and demonstrate your expertise. From your customers’ perspective, the more structured your firm and its invoicing system are, the more legitimate and professional you seem.

Simplify Tax Time

The tax office utilizes invoice numbers to compare invoices to your company’s sales and expenses. As company owners must often fulfill several orders and ship items to a large number of individuals each year, it is preferable to have a detailed understanding of how many consumers were invoiced and how much income was generated. Adopting a sequential reference numbering system makes it much simpler to accomplish this essential duty. The consecutive invoice numbers provide the actual number of invoices issued over a specific period. Accountants enjoy invoice numbering since it alleviates their stress throughout tax season. Calculating your entity’s revenue and managing payments becomes a breeze. Should you require any additional information or help, feel free to get in touch with our support center.

SUMMARY

Numerous benefits accrue to small businesses that issue unique invoice numbers. They are crucial management tools that enable you to monitor various factors and keep your business successful. A significant number also assures that you will not request repeated payments from your customers, boosting their faith in your industry. The more organized your business and billing system, the more accurate and credible you seem. Adopting a sequential reference numbering scheme makes it much easier to do this essential task. Accountants like invoice numbering because it reduces their burden throughout tax season.

At Instructor Brandon | Dynatuners, we always seek innovative methods to improve your competitiveness and suit your Microsoft Dynamics 365 requirements. Our offerings are founded on defined procedures, industry experience, and product understanding. Moreover, if you’re interested to consult with our technical solutions experts on how we may help you to consolidate voucher transactions using Dynamics 365, we are here to tune your workspace in the right way so it may fit your requirements, to get more information on it Contact Us.

How can I add an invoice number to a journal voucher?

Go to Gateway of Tally > Accounts Info. > Voucher Types > Create. Method of Voucher Numbering? - Automatic (Manual Override). By choosing this option, you may auto-number your coupons and also manually override the auto-numbering as needed

Is payment voucher same as invoice?

A voucher is a written document on the basis of which the organization keeps accounting records. In contrast, an invoice is characterized as a written business document provided to a buyer by the seller. It specifies the transaction information of the sale of goods or services.

How do you record vouchers in bookkeeping?

The entire amount of all the vouchers that have outstanding amounts owing are reported as accounts payable on the balance sheet. Once the coupon has been paid, the evidence of payment is included with the voucher and registered as a paid voucher.

2923

2923