Dynamics 365 Reporting, Dynamics 365 Tutorials, Dynamics Operations Training, Microsoft Dynamics 365 Developer (F&S) Training Series

A Complete Guide to Simplify Expense Reports and Automate Reimbursement Using Dynamics 365 Redesigned Expense Management

Simplify Expense Reports & Automate Reimbursement by D365

Expense Management | Reimbursement Automation | Expense Reports

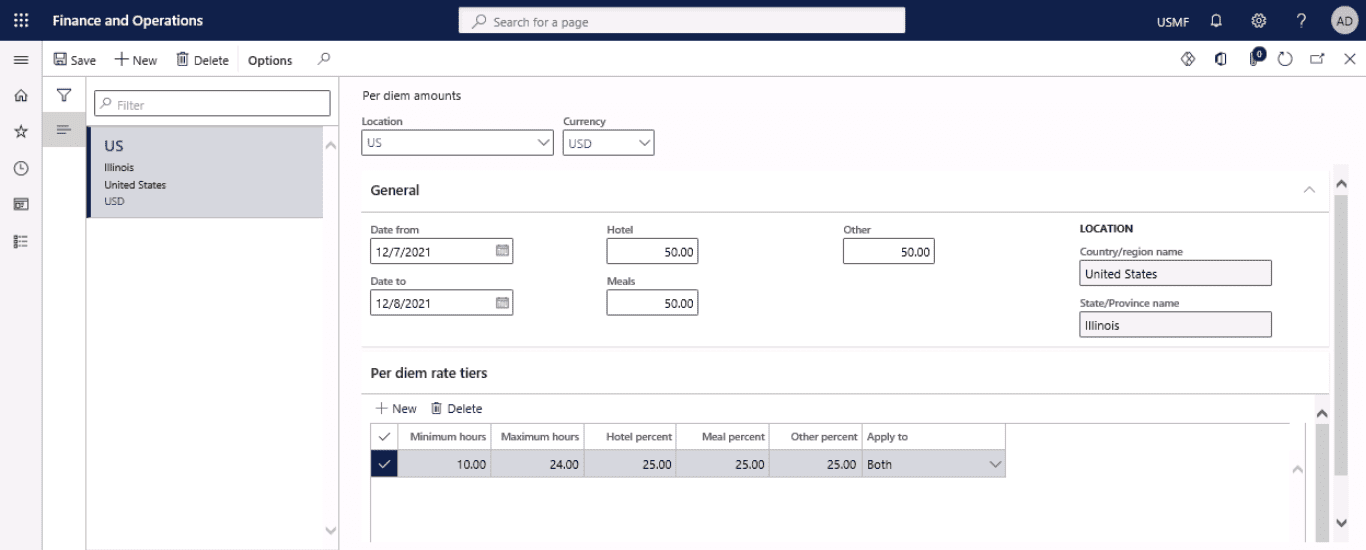

Maintaining business expenses is among the worst nightmares for firms struggling to put everything together. However, ensuing precise expense reports can turn those nightmares into impeccable growth of your firm.

Microsoft Dynamics 365 product line offers a redesigned expense management tool with integrated workflow. With its finance and operations cloud-based resource planning system, large enterprises can simply report and compile expenses.

If you are redirected to this blog, chances are that your firm is running into some expense miscalculations.

To give an overview of this blog, you will learn about making expense categories, setting per-diem rules, and creating expense reimbursement policy along with Dynamics 365 tools. So, let’s understand how these functionalities can help you sort your expenses.

If you want an employee to attend a conference or meet a client in another city, you need to have an overview of all expense approvals with detailed and sorted information.

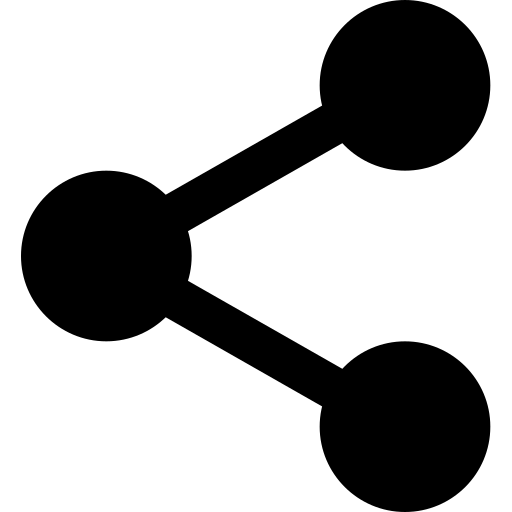

Getting Familiar with Business Expense Categories

Categorizing business expenses is a solid foundation of bookkeeping. Moreover, categorizing expense reports can make it easier to file taxes and might even help you deduct some of them. Such tax deductions can save you tons of dollars annually.

What is the Expense Category?

As the name suggests, it is sorting your business expenses into different categories. The Internal reserve service (IRS) describes business expense as “the cost of a trade or business”.

Categorizing expenses can help you deduct some of the payable taxes. For this, you need to track business expenses through ordinary and necessary groupings. So, your business could be eligible for tax compensation.

Here are the tax compensation terms defined by the IRS.

Generally, industries accept ordinary expenses as they are. In contrast, a necessary payment is appropriate or helpful for your business trades. However, there is some room for interpretation here. Consequently, the businessmen are open to making operation-centric decisions while abiding by the laws of the IRS.

As a part of normal functioning of business operations, you might have been incurring some of the ordinary and necessary expenses already, such as:

- Rental and utility payments

- Supply payments

- Vehicle payments

- Employee payments (wages and salaries)

- Insurance payments

- Taxes

In contrast, there are some limitations to what business expenses can be categorized.

It sometimes becomes troublesome to differentiate between business related expenses and asset purchases. In the world of financial management, an asset is a resource carrying a value, and you can turn it into cash at any given time. Further, an asset can be tangible like any hardware, unlike a prepaid insurance policy.

So, if one of your purchases is anticipated to last longer than a year, it turns into a business asset. For example, you bought a piece of new furniture for your office lounge, this won’t be a business expense, as the table holds a value and will be an asset. While you can’t consider office furniture a business expense while auditing for taxes, you will more likely avoid depreciation cost or overtime value.

Back to square one, you have just made a purchase for your business enhancement. It’s a reasonable, appropriate, and helpful service for business development. How would you sort and group those purchases in your bookkeeping or Dynamics 365 expense reports?

Dynamics 365 Expense Reports

Here are a few categories for you to recognize:

- Rent or mortgage payments

- Home office costs

- Advertising and marketing

- Website and software expenses

- Entertainment

- Business meals and travel expenses

- Payroll

- Employee benefits

- Taxes

- Business insurance

- Business licenses and permits

- Interest payments and bank fees

- Membership fees

- Professional fees and business services

- Training and education

Categorizing these business expenses in your office log may seem effortless, while digitizing them through Dynamics 365 is a bit tricky. Here is how you can do it in Dynamics 365.

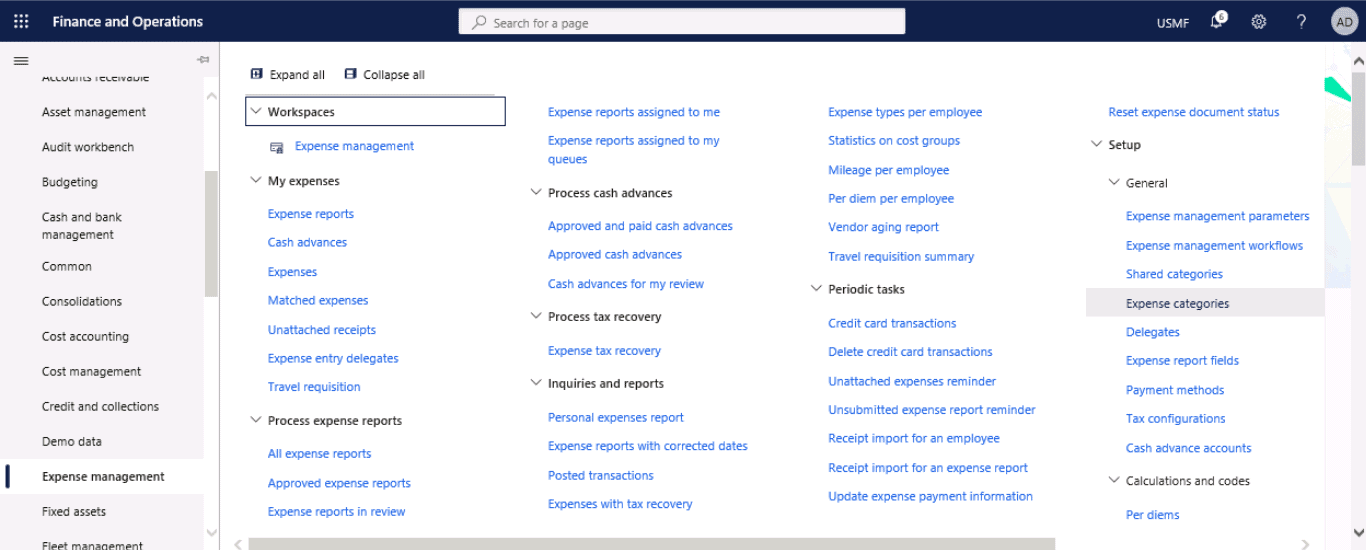

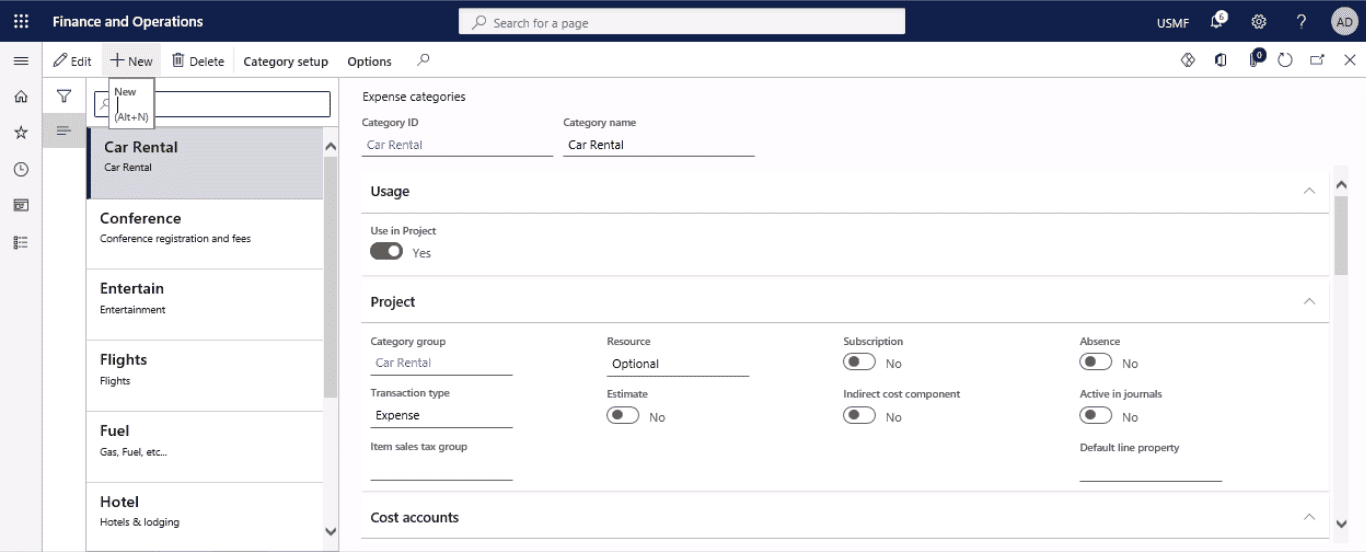

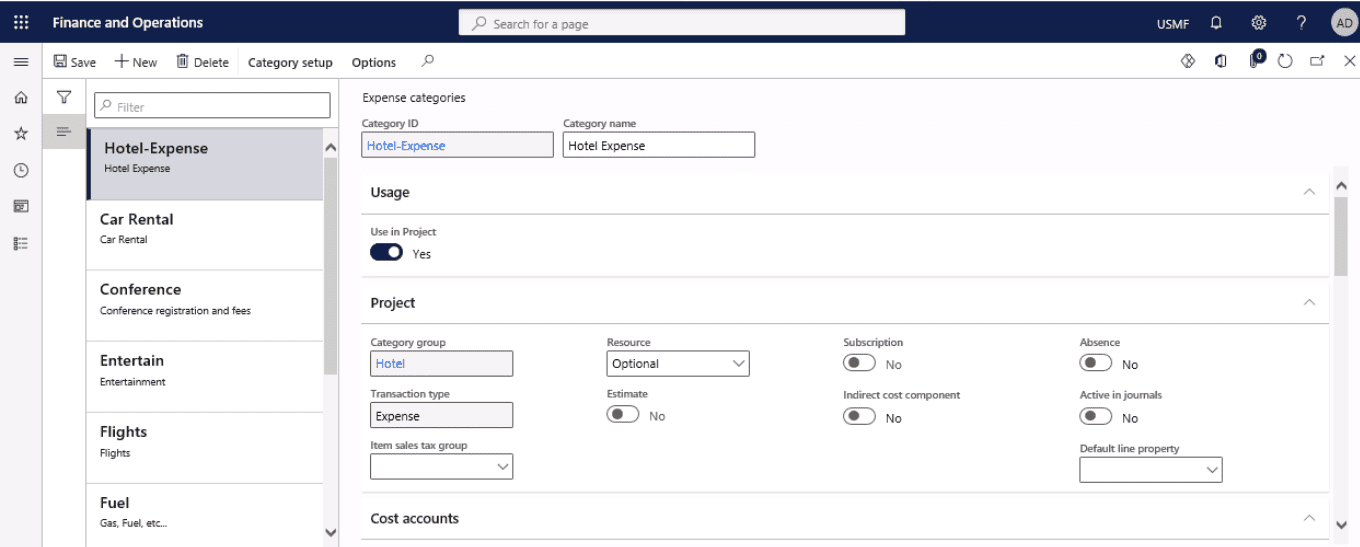

Creating Expense Categories in Dynamics 365 Operations

Step 1

Click Expense Management > Setup > General > Expense categories.

Step 2

Press New to create a new line.

Step 3

Select a category ID and enter a name for the category. Categories, and their IDs, must be created in the Categories form before expense categories can be created.

Step 4

Select whether to use the expense category in Project.

Step 5

To create subcategories for the expense category, click Add on the Subcategories tab.

Step 6

Enter a name and a brief description for the subcategory and select the default payment method.

SUMMARY

Before setting up expense categories through Dynamics 365, you need to know how you track business expenses. However, if there is an undersupply of such practices at your firm, we at Instructor Brandon guide our clients step-by-step for making their expense reporting paper-free.

Utilizing categories for employee expenses is an easy win for small startups or prominent enterprise owners. In addition, thorough bookkeeping will indeed have a ripple effect on your business development.

How to Manage Per Diem Rule in Dynamics 365 Finance and Operations

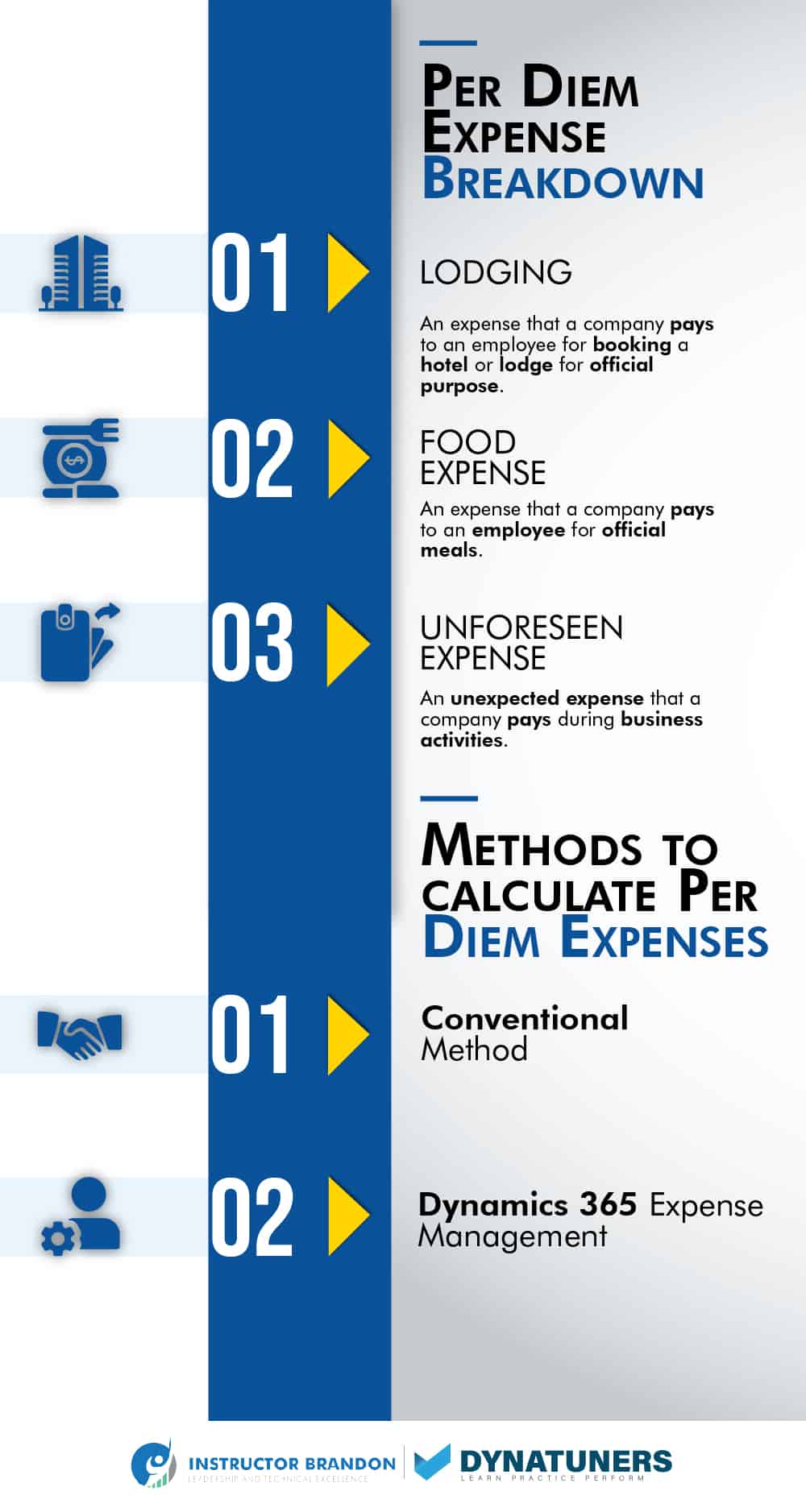

Per Diem is a Latin word for “per day,” meaning daily allowance in finance and operational terms. A specific amount an organization gives to its employee per day to manage expenses while traveling officially.

However, businesses can not cover every travel expense by Per Diem rule. For example, payments for car rentals and freights aren’t included in Per Diem and have their own spot in expenses reporting.

What Per Diem Covers

Employees are not eligible for transportations or mileage reimbursement while following Per Diem payment method. Only three sorts of expenses are covered under Per Diem rule:

- Lodging (hotel etc.)

- Food expenses

- Unforeseen expenses (dry cleaning etc.)

If employees require compensation for housing, meals, and incidentals (M&IE) charges, they will get it covered under Per Diem rule. For example, consider the case of an Ohio employee who must travel to New York to attend an official seminar. Your business would pay on Per Diem to cover the costs of hotel, food, and other expenses.

If employees do not have to pay for accommodation, you may pay a lower per diem fee solely covering M&IE. For example, if an employee stays with relatives, you will pay them per diem for food and incidentals.

How Per Diem Rule Works

Per Diem is a replacement for the expense reimbursement method. You provide the per diem rate instead of paying employees the precise amount they spent on a trip (actual expenditure).

You can offer per diem in advance for a team member’s work trip or you can even pay afterward, depending on your company’s policy.

Even if you pay your staff a predetermined per diem rate rather than real compensation, expense reports must align. However, your expense report template should not be thorough when you compensate employees using the actual expenditure approach.

Employees must submit expense reports within 60 days of spending their per diem allowance. The following payment information should be in the expenditure report:

- Date, time, and place

- Amount of expenses

- Purpose of expense

So, how do you pay your employees per diem? Employees should be paid a set per diem rate. You don’t have to approve or disapprove an employee’s expenses. An employee can usually keep any unused per diem money.

While calculating the per diem rate, it might seem like solving General Relativity on papers. D365 helps us to figure it as simply as possible.

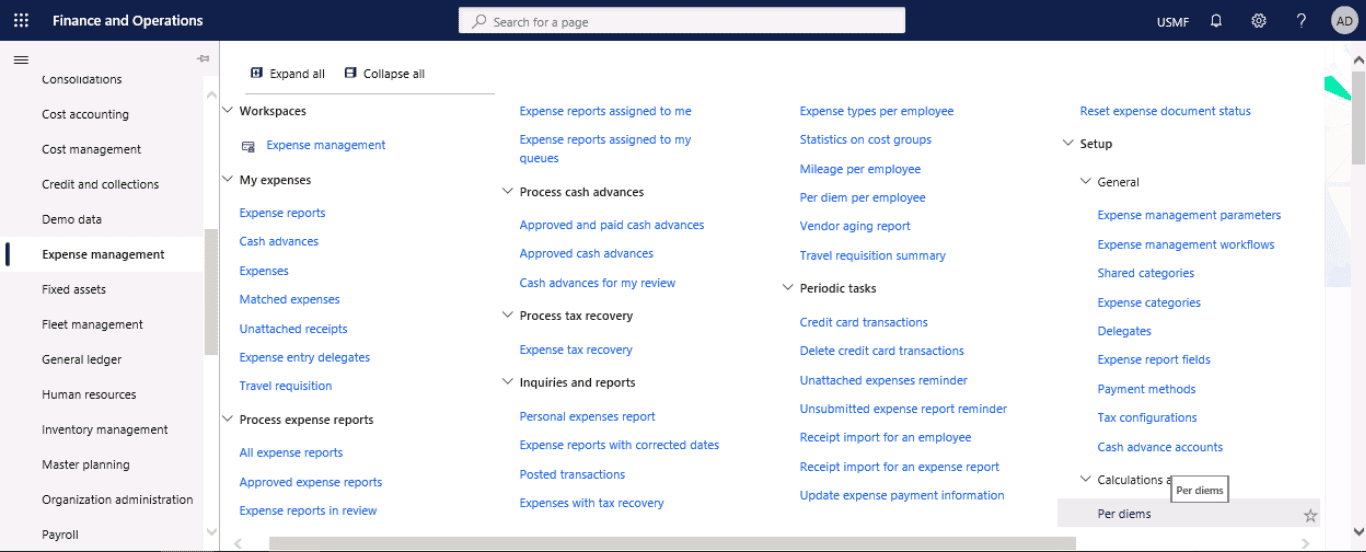

Creating Per Diem Rule in Dynamics 365

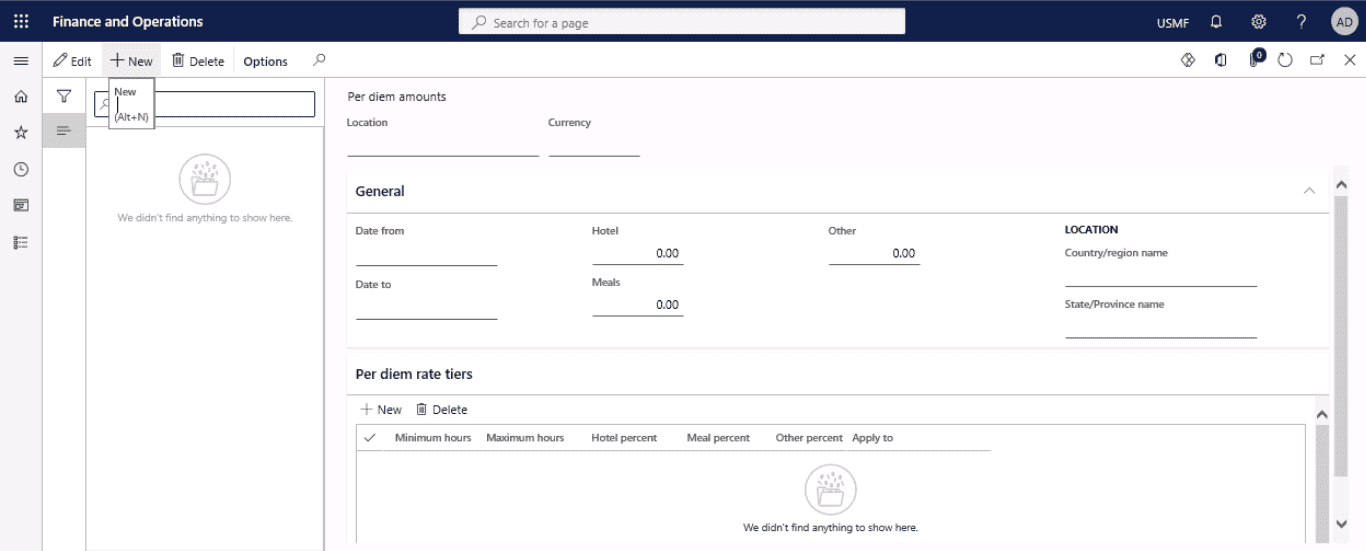

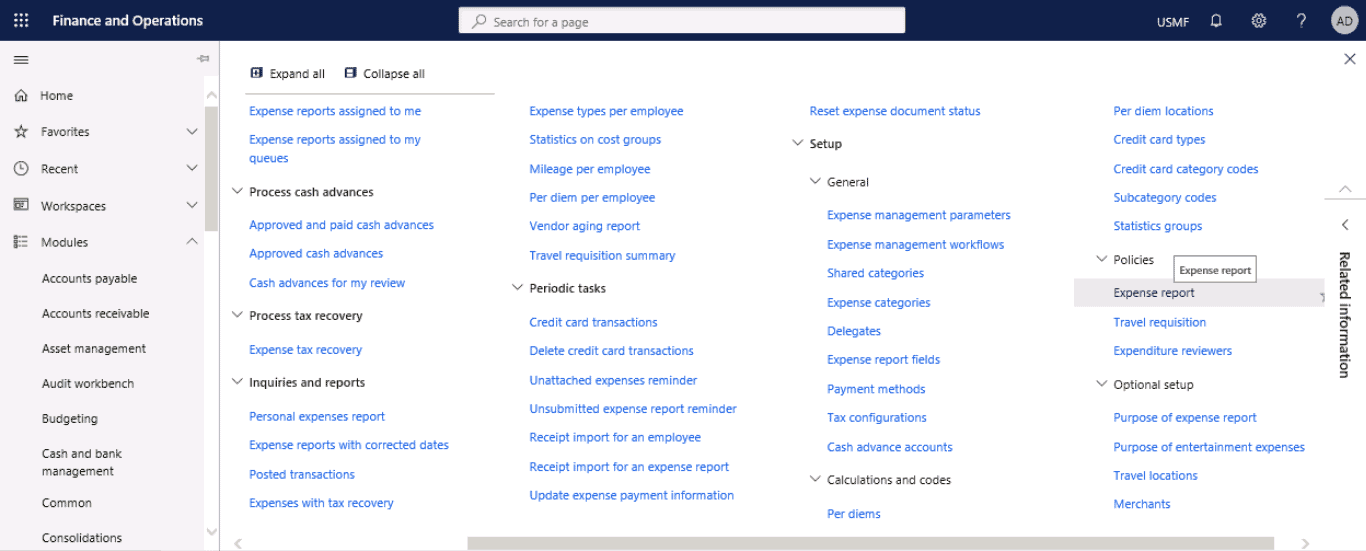

Step 1

Click Expense Management > Setup > Calculations & Codes > Per diems.

Step 2

Click New.

Step 3

In the Location and Currency fields, select the travel location and the currency that you want to apply.

Step 4

On the General FastTab, enter the start dates and the end dates for this per diem rule.

Step 5

Enter the per diem rate for hotels, meals, and other expenses that workers may incur when they travel. Click Save.

Step 6

If you want to reduce the per diem rate based on factors such as the first day, last day, or hours per day, click Per diem rate tiers, and then click New.

Step 7

Enter the minimum and maximum number of travel hours that the reduction can be applied to.

Step 8

Enter reductions in the per diem rate for hotels, meals, or other expenses that workers are authorized incur. Select whether you want to apply the reductions to the first day, the last day, or both.

Step 9

Close the forms to save your changes.

SUMMARY

Per diem is a stipend given to a worker on the road for work. You may set per diem rules for various travel circumstances in expense feature management. Per diem rates are determined by the time of year, the place of travel, or both. When a Per Diem rule is set, you may indicate a part of the per diem rate not to be applicable if a worker receives free meals or services. You can also limit the number of hours the per diem charge is relevant to a worker’s trip.

Modernize Your Expense Management with Policies

Any firm with workers incurring expenses must have a robust strategy to manage these charges. Even if you only have a few employees spending your company budget, you’ll need a guide to clarify what is and isn’t reimbursable.

You can take expenses under control while keeping your staff engaged and productive by drafting an expenditure management strategy. You can also reverse it as your company expands.

An expenditure policy is a collection of written instructions that precisely spell out tolerable spendings. Expense policies also makes it easier for the accounting department to determine whether a cost is reimbursable or not.

Expense policies specify when or how your workers may expect to get payback for their expenditures (usually within 30 days or fewer, depending on the firm) and what they can do if the payment is rejected.

Team members’ cost management and tracking is critical for every organization since they affect cash flow, taxes, and budgets. If correctly established and implemented, a spending management policy serves as a guide for employees and a safety net for the organization.

When a corporation fails to implement these policies, it can result in issues such as:

- Cash flow issues

- Confusion among managers and senior executives

- Expense fraud

- Poor tax management

There are several preventive measures that a firm can deploy by just setting up expense policies. So, here is quick way to set them up using Dynamics 365 Finance and Operations.

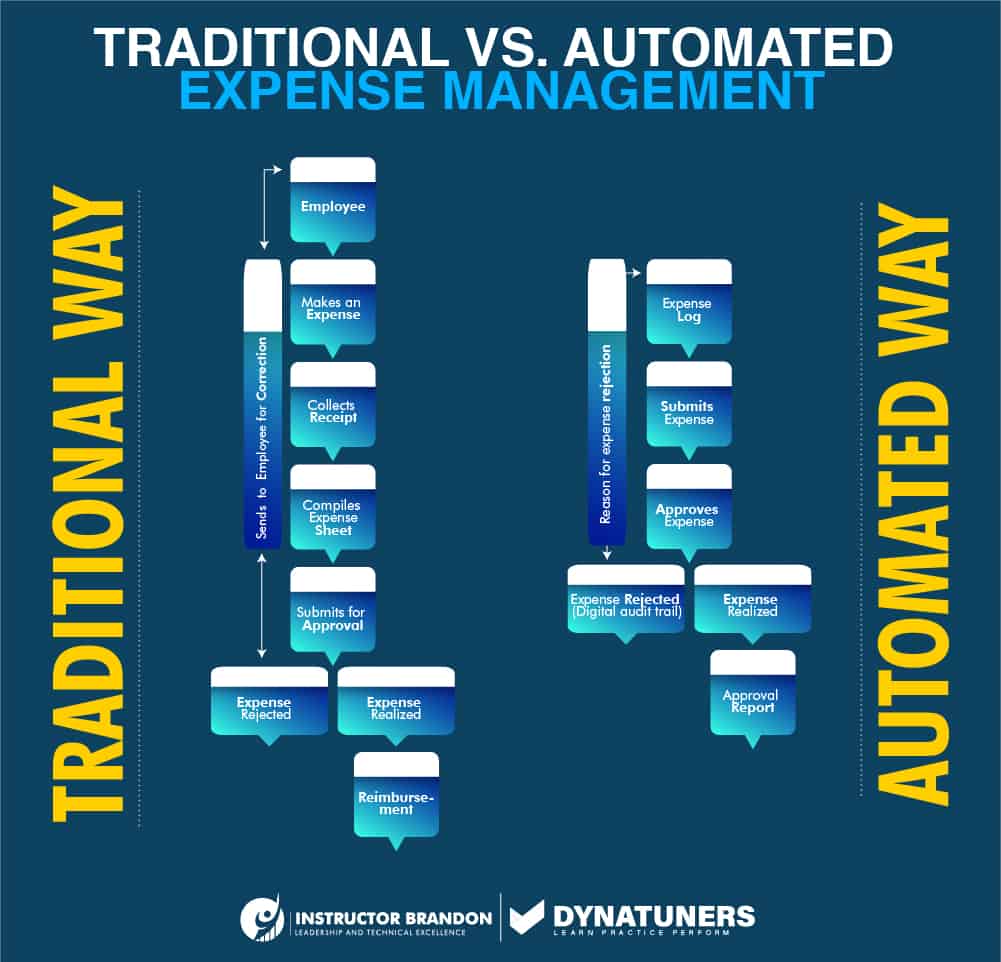

Setting up Expense Policies in Dynamics 365

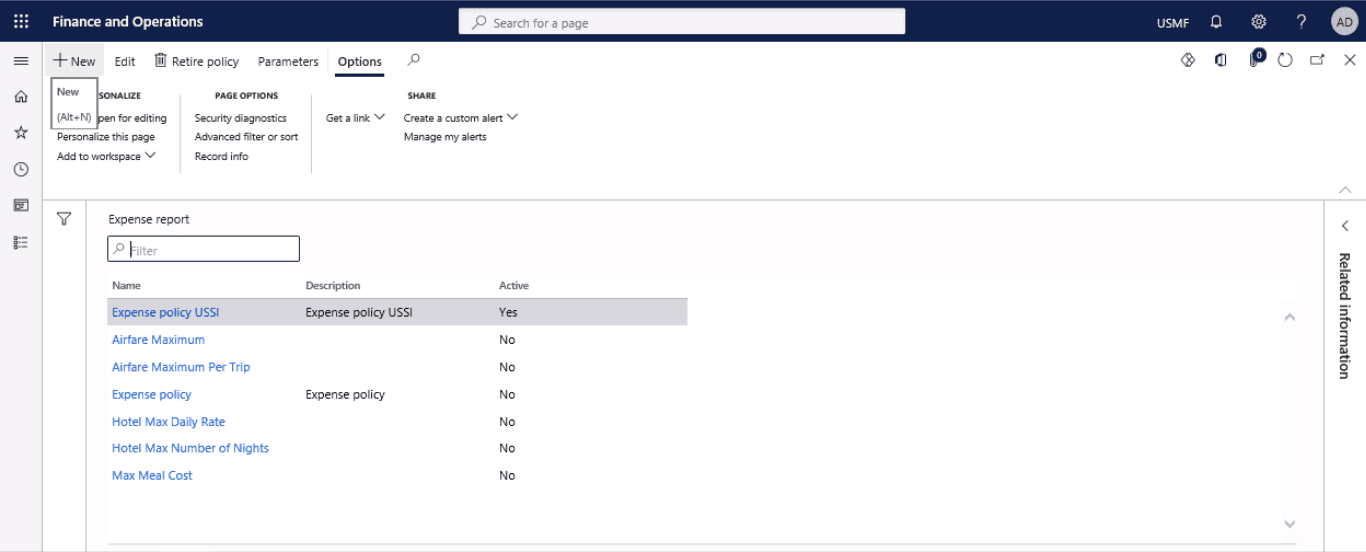

Step 1

Click Expense Management > Setup > Policies > Expense report.

Step 2

Click the Policy button in the New group to create a new policy.

Step 3

Enter a name and a description for the new policy.

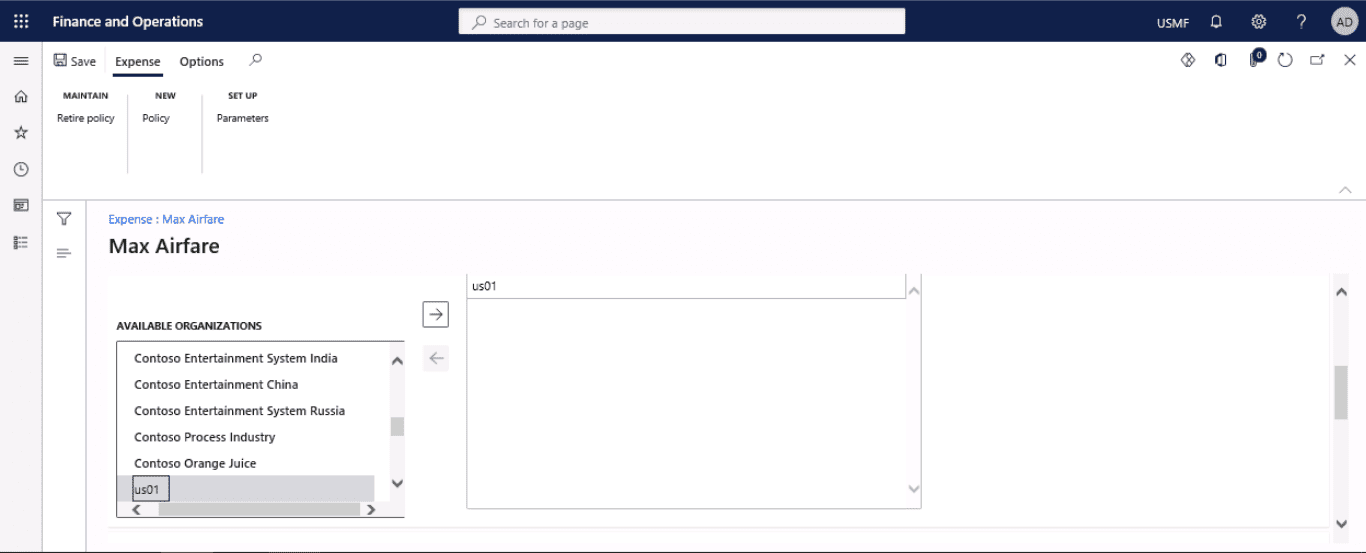

Step 4

On the Policy organizations tab, select the organizations that you want the policy to apply to.

Step 5

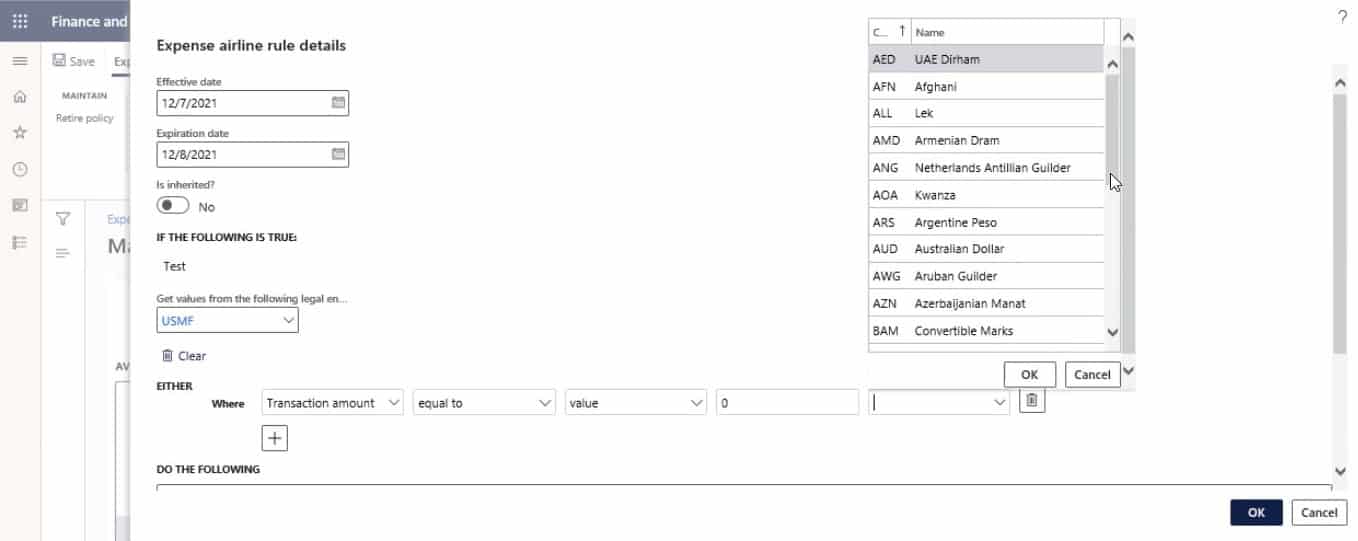

On the Policy rules tab, click Create policy rule.

Step 6

In the Expense form, in the Effective date and Expiration date fields, enter dates to set the period for which the policy will be active. If no end date is specified, the policy will remain active indefinitely.

Step 7

In the Do the following field, select the actions that are enabled when the policy is violated.

Step 8

Enter the message that the employee receives if the policy is violated. You can create this message in multiple languages, as needed.

SUMMARY

Creating expense reports isn’t the most thrilling part you’ll ever undertake. However, it is vital and will undoubtedly assist you in avoiding expense discrepancies in the future.

It’s also not that difficult. You only need to know what to mention and consider the unique issues that your company faces. The good news is, we can assist you in setting up and deploying your expense reports and policies in Dynamics 365, making all the hassle go away.

Choosing the Right Payment Method

Choosing the correct payment method for your business might be difficult with many alternatives available today. However, several payment methods are gaining popularity these days. Even if corporate credit cards are still the leading choice for organizations, one must consider their choice intelligently.

How do you choose the right one for your company?

Deploying the best payment options might be tricky for some, so we have put together a list of recommendations to assist you.

- Deploy a payment method that you can convert digitally for faster settlements and get more control over reporting.

- You can also go for mobile payment methods to prepare your cost reimbursement and expense reporting sustainable in the future.

- Align corporate policy with traveler behaviors so that credit card transactions are directed to the preferred payment methods.

Recognize the benefits and drawbacks of various corporate payment systems and select the one that best meets your company’s needs. For your ease, here are some of the pros and cons of different payment methods.

| Pros & Cons of Different Payment Methods | ||

| Payment Type | Pros | Cons |

| Cash | Standard and most accessible method of payment No payment fees |

Holding cash at your company or home can be dangerous Holding bills to pay employee expenses can tie up money you could use for other business purposes Counting and keeping track of money at the end of each day is time-consuming |

| Cheques | Suitable for frequent or more significant purchases Safer to disburse large payments |

Bank Cheques can take more times to process the amount |

| Debit, Credit, and Prepaid Cards | Quicker and more convenient for workers at checkout than cash or cheques You don’t have to keep cash on hand No hassle for fake cheques or cash Allows to make purchases more easily |

May include transaction fees

Requires to purchase or rent a device to accept payment |

| Mobile Payments | More reliable than card-based transactions in some areas | More time is required for the transaction to process before getting money in the account Implies a responsibility for fake or stolen payment information to make a purchase |

| Electronic Bank Transfers | Allows receiving large payments without extra fees A good option if you are managing a remote team |

May need to set up this type of transaction with your bank and the customer’s bank, which isn’t always easy |

Establishing Payment Methods in Dynamics 365

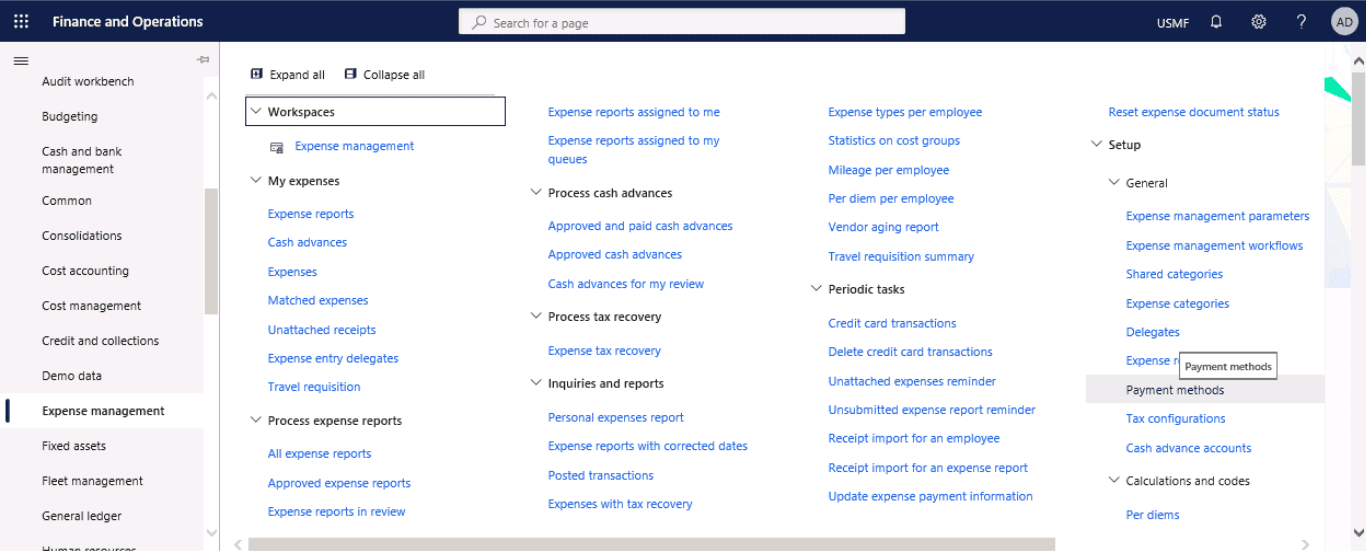

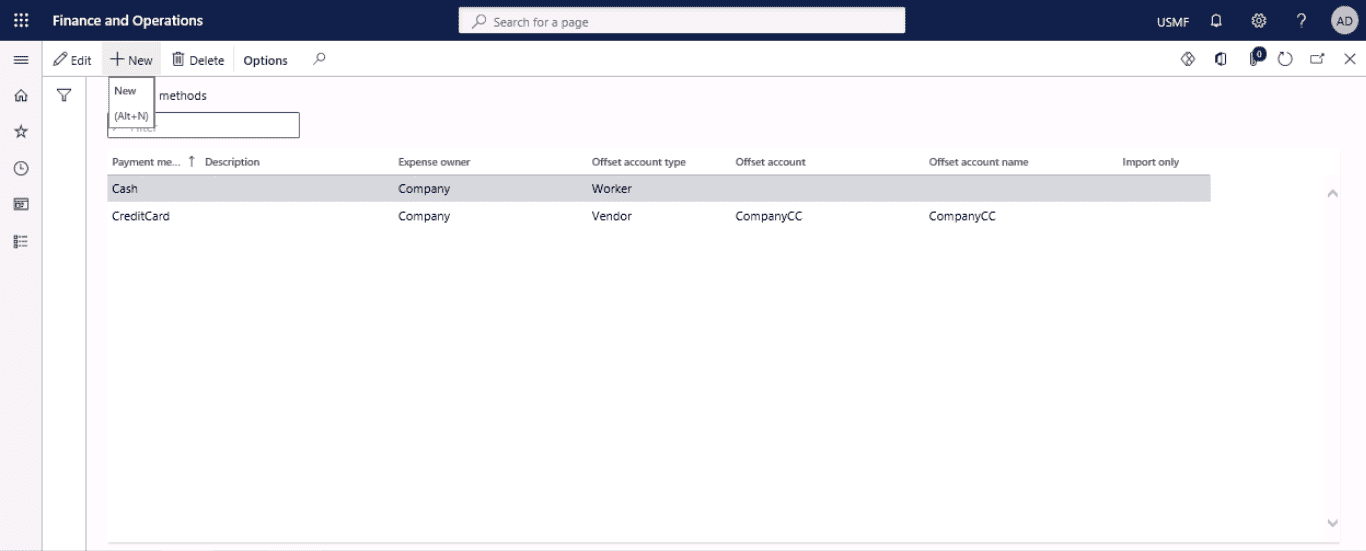

Step 1

Click Expense Management > Setup > General > Payment methods.

Step 2

Press New to create a new line.

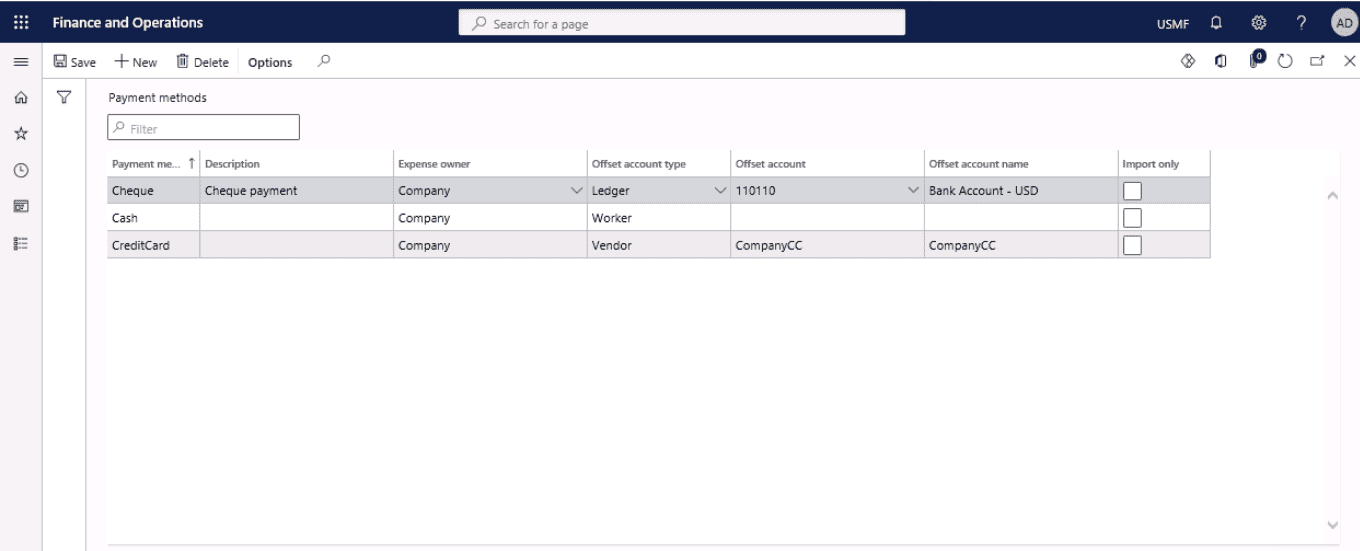

Step 3

In the Payment method field, enter the payment method for the transaction.

Step 4

In the Description field, enter a brief description of the payment method.

Step 5

In the Expense owner field, select the owner of this payment method. The available values are Company, Employee, and Customer – others.

Step 6

In the Offset account type field, select the type of offset account, if it is required. In the Offset account field, select the account number of the offset account. In the Offset account name field, select the name of the offset account

Step 7.

If the payment method is used only for imported transactions, select the Import only check box.

SUMMARY

As choosing the correct payment option for your business can be troublesome, we are here to assist you. We can help you switch your payment methods digitally for faster and automated settlement. With our assistance you will get more control over reporting and even align corporate policies with your company’s business traveler habits. Such implementations will help you sustain transaction date using Dynamics 365 payment methods.

At Instructor Brandon | Dynatuners, we always seek innovative methods to improve your competitiveness and suit your Microsoft Dynamics 365 requirements. Our offerings are founded on defined procedures, industry experience, and product understanding. If you’re interested to consult with our technical solutions experts on how we may help you manage your business expenses by creating expense policies, setting per diem rules, or creating expense categories, don’t hesitate to Contact Us.

How does expense management work?

Expense management tracks employees’ spending behavior and determines how the organization will reimburse them for the costs incurred. You can use a spreadsheet or Dynamics 365 system to process, pay, and audit your employee expenses.

Why do companies go for expense management?

Expense management software helps companies automate a time-consuming process, gain better control over employee expenditures (not general company expenses), and reduce errors.

How quickly should companies pay expenses?

As we mentioned earlier, 9 days from start to finish is the average time to process expenses. However, some companies have a lengthy process, and even the payment stage itself can add an unwelcome delay.

3385

3385