Supply Chain and Logistics Management

Inventory Closing and Adjustment with Microsoft Dynamics 365

Undoubtedly, with its Inventory Closing and adjustment features, Microsoft Dynamics 365 SCM has brought innumerable advantages for companies of all shapes and sizes. Therefore, when lacking necessary monitoring or the inventory tracking system fails, you’re not going to be that competitive. Hence, closing the gap with the rest of your competition, locally and globally, will be nothing but a dream. However, today’s business world is continuously growing, and the tools the workforce use must develop as well. Microsoft knows quite a bit about this, better than anyone in the industry, that’s why they can guarantee that their business solutions remain at the top of the technology game.

Furthermore, 2020 was a massive year for updates and improvements to Dynamics 365 and Supply Chain Management on this front. There are always exciting new extensions and innovations that both end-users and business owners should know about.

Real-time insights about the company’s resources, current inventory, warehouse processes, production, and distribution became essential in achieving high-performance levels for a supply chain. Therefore, Microsoft Dynamics 365 Supply Chain Management delivers this data while unifying the operations as a whole and across all the main areas, from receiving goods to shipping and distribution. Furthermore, I will describe an Inventory Closing and Adjustment. You will see some of their capabilities and benefits. Moreover, you will learn how they take the efficiency cost and inventory pricing game to the next level in Dynamics 365.

Points to consider in Inventory Closing and Adjustment with D365

In this post, we will discuss:

- What is Inventory Closing?

- What is Inventory Closing in Dynamics 365 SCM?

- Why is Inventory Closing Necessary?

- How do I Use Inventory Closing in Microsoft Dynamics 365?

- Takeaways: Inventory Closing and Adjustment with Dynamics 365

What is Inventory Closing?

Microsoft Dynamics 365 has many great built-in tools that will help you closing inventory each month without any complications. However, the problem lies in many users not even knowing the existence of these tools and their benefits.First, let’s dive into the technical and financial definition of Inventory Closing. Normally, a business will not sell all the goods bought through the current period. Consequently, the cost of acquisition is not directly deducted from sales revenue in the income statement’s trading section. Some of the goods purchased remain for sales, which are known as closing inventory.

Therefore, is closing inventory a current asset? Or is it part of the expense? Well, this is the reason why it is important for every business, not just from the operational inventory management point of view but also financially wise. Moreover, the cost of sales involve the opening inventory plus purchases, minus closing inventory. Hence, the closing inventory is really a deduction, or credit, in the statement of profit or loss. Nonetheless, it is a current asset, or debit, in the financial position statement.

Why is Inventory Closing Financially Important?

Usually, companies do not attempt to calculate or keep track of the purchase cost of goods sold at the time of sale. To record these transactions that involve inventory movements, they usually use accounts of purchases, sales, and returns (internal or external). Moreover, in these circumstances, companies define the value of the closing inventory only at the end of the period by counting physically. Therefore, it leads to inventory values and the cost of sales to remain unknown until the income statement’s transaction section is made at the end of the period.

Since this closing inventory remains unsold and extracted from purchases, it will convert into opening inventory later, for the next period specifically . Furthermore, If the goods and assets for resale are not sold by the end of the year, which is the definition of closing inventory, the cost of these goods will carry over to the period in which they are sold. However, this is crucial, because it means that these good’s cost is removed from the calculation of profit for the year of their purchase. Therefore, the cost will measure the profit for the year in which they were sold. Meanwhile, this closing inventory is shown as an asset and carried over to the next year as opening inventory.

Nevertheless, if these calculations are not detailed and automated, the company might work based on incorrect numbers or even, unknowingly operate, committing financial fraud.

3 Methods to Calculate Inventory Closing

We understand Closing inventory as ending inventory from the traditional or classical academic point of view. Nonetheless, it refers to the amount of inventory in stock at the end of the commercial year.

Businesses count inventory mainly in two ways:

- By the quantity of goods in stock

- By the financial value of goods in stock

Whichever the case, you will have units or dollars to show in your reports nonetheless. However, to be more specific (and fairer), Ending Inventory is a term that addresses the value of the stock remaining at the end of the commercial period. Simply, it results in the value of the beginning inventory, plus purchases, less the cost of goods sold.

What is Inventory Closing in Dynamics 365 SCM?

Businesses use Inventory Closing to deduct the right inventory cost prices; then, it is fundamental to guarantee precise results. Nevertheless, from my daily work with Dynamics 365, I can say problems related to inventory closing and costing closing are one of the main pain-points of any business implementation process. Oddly, users tend to manage inventory closing as some kind of black box. Therefore, depending on various reasons, it can deliver unusual results and/or need different times to run the same dataset.

Quite honestly, I believe that all of this generates by disseminating cost information across various parts of the documentation. Some costing characteristics are not specified accurately, which should be learned the hard way, either by a trial-and-error approach or learning X++ code for inventory costing.

Therefore, this is how it works in Dynamics 365:

- When you issue an inventory post, the system does not calculate the exact issue cost. Rather, the system utilizes an expected value for the issue cost. As such, it will be an approximate of the actual cost price.

- Moreover, through the inventory closing process, the real issue cost is determined through the corresponding inventory model settings. Furthermore, the system estimates the variation between the initial issue cost and the true issue cost, and then, the system records it into inventory transactions and inventory adjustments. Following that, it produces the postings for these adjustments.

- Why does this happen? Because usually, when posting an initial inventory issue, the system probably doesn’t have all the information (inventory profile) required to determine the true cost.

Why is Inventory Closing Necessary?

The inventory closing process is vital. It is vital, because your business needs to estimate the right costs and prices of your inventory. Although it’s important to remark that all inventory transactions are in the average cost, it is crucial that you finish before preparing the financial close. Furthermore, as several operations go through their month-end closing, it is essential to watch these closely. Moreover, we must make sure that once they’re done with their month-end tasks, you get that period closed with the accounting group only. Now, you can define that the general ledger updates to show the adjustments previously made.

Nevertheless, you cannot post in periods before the inventory closing day, with the exception of reversing a completed process. For example, if the inventory closing is programmed for the term that ends on a particular day, let’s say, February 28, you can’t post transactions that have an earlier date than that date.

Important Note:

How often the inventory closing process runs varies by company. However, transaction volume should help determine how often you decide to run inventory closing. Therefore, most companies run inventory closing as part of their month-end closing and reconciliation procedures.

What is the Purpose of Inventory Closing in MS Dynamics 365

What is the main purpose of doing inventory closing in D365? Well, I would say Inventory closing has three functions.

- Closes a period for inventory, so that it cannot make further inventory adjustments.

- Assigns the cost of receipts, for purchased or produced items to “issues.” For example, sales orders, using the rules of the item’s inventory model.

- Furthermore, it updates the cost of “issues” if the cost of the related “receipt” changed too.

Therefore, inventory closing is an activity performed in Dynamics 365 to represent the closing of the financial and/or fiscal period. As such, this serves to ensure the acuraccy of the inventory sub-ledger in relation to the date and value in the General Ledger. Moreover, done by settling the issues with the receipts, in principle with the inventory costing model.

How do I Use Inventory Closing and Adjustment in Microsoft Dynamics 365?

Financially, the product’s market worth or lowest value that the business owns will set your inventory closing base. At the beginning of the selected period, the stock’s value is added to the cost of acquisitions made for the inventory. Nonetheless, the company’s product market value is generally higher than the associated costs. Nevertheless, it can vary if the products grow outdated and encounter depreciation and/or become obsolete. In this situation, the market value can drop under the production costs for the products, generating a loss in asset value.

Step-by-Step Process of lnventory Closing + Adjustment

Close the time period

Stop people from posting to the inventory while trying to get everything reconciled, adjusted, and closed.

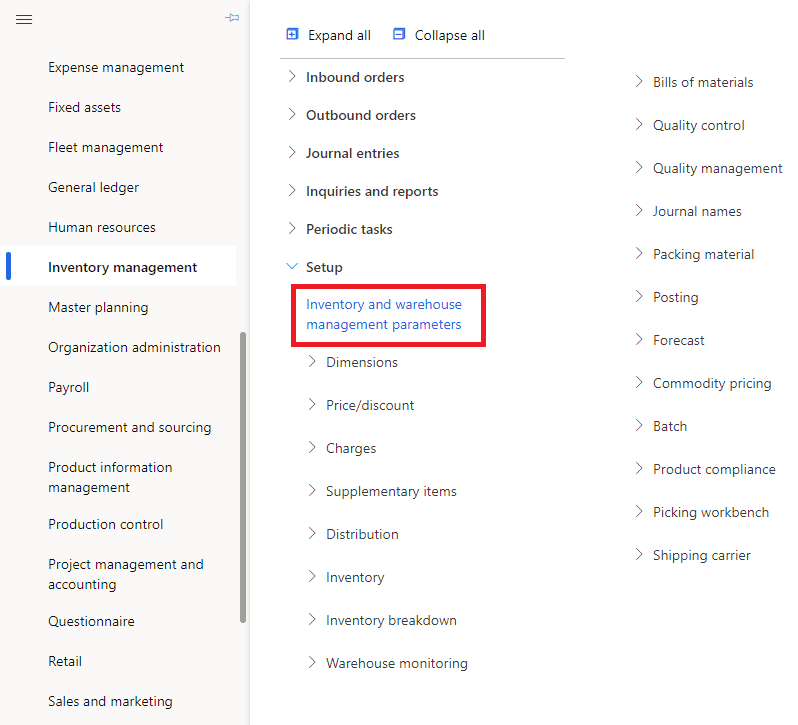

| 1. First, go to Inventory Management in the Finance and Operations module. Moreover, select Setup followed by Inventory and warehouse management parameters. |  |

|

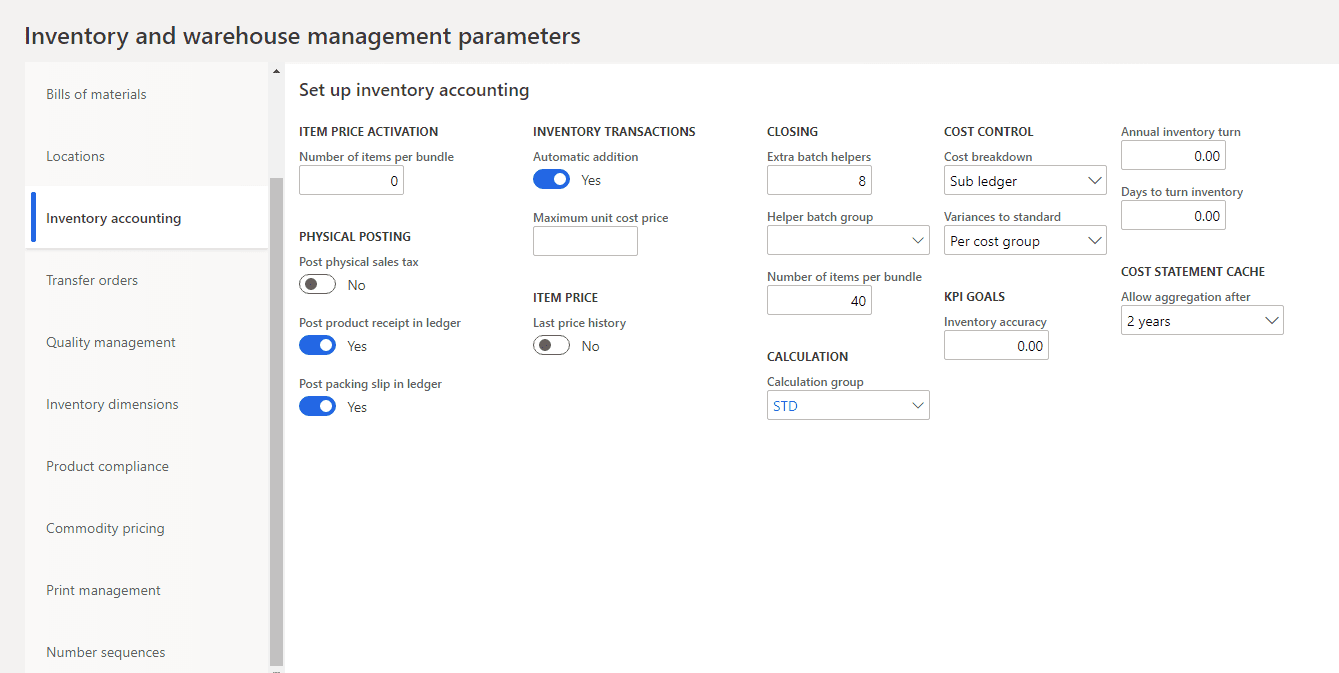

2. Following that, you will be able to adjust your Inventory accounting with different parameters. Make sure to turn the slider boxes for Automatic addition of Inventory transactions, as well as Post product receipt in ledger and Post packing slip in ledger. |

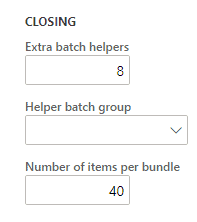

| 3. Now, you will be able to setup extra batch helpers, helper batch groups and number of items per bundle. |  |

|

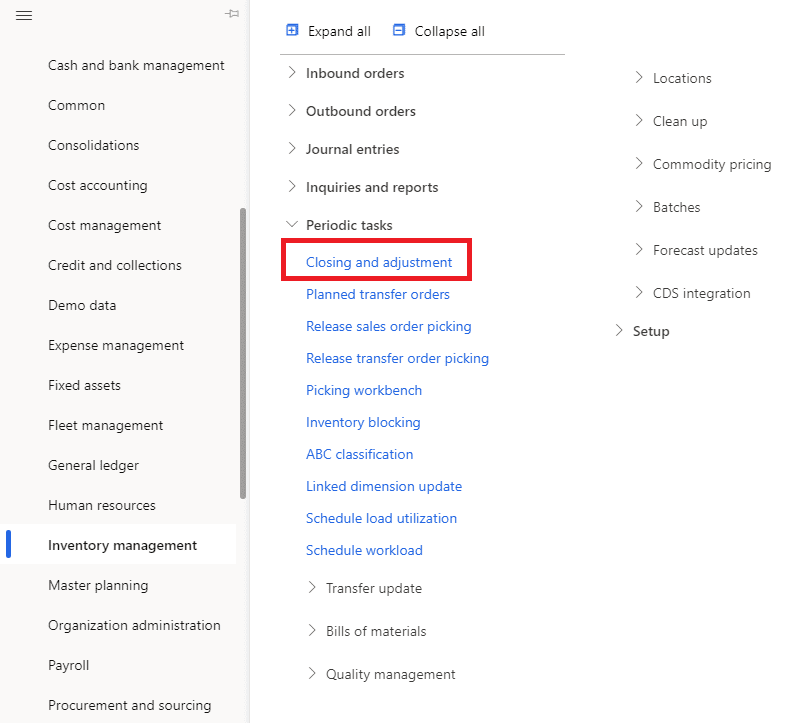

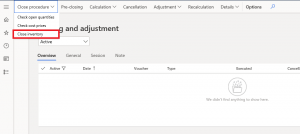

4. Next, select Periodic tasks followed by the Closing and Adjustment page. |

| 5. Following that, select the Close Procedure option, where you will see the Close Inventory option. |  |

|

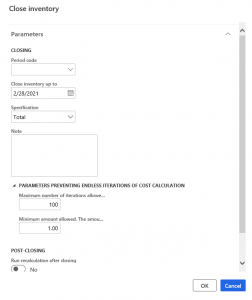

6. Therefore, you will be able to adjust several parameters of the closed period, including Parameters preventing endless iterations of cost calculation. Moreover, if you selected the date and the post-closing recalculation slider is off, you can click the OK button to finish the procedure. |

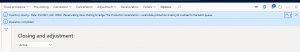

| 7. Finally, once you finished the procedure, going back to the Closing and adjustment page, you will see a message indicating that it has completed successfully. |  |

Takeaways: Inventory Closing and Adjustment with Dynamics 365

When it comes to your inventory close, this is what you absolutely must keep in mind (unless you want some legal troubles, of course):

- You must do your inventory close at the end of the month. Moreover, this is a necessary process for all inventory models, except moving average.

- Through the general ledger of Dynamics 365, a view of every unsettled item during the update will be available. Therefore, use this chance before finishing the closing procedure.

- Furthermore, it would be better to run the inventory close during off-peak hours, since your computing resources will have high demand during business hours.

- During an inventory closing, you might receive messages through your inventory close log. Be sure to check for messages with warnings, as these will notify you of any type of imbalances.

This post shows how vital is for a business to keep detailed track of their inventory. It carries over the new accounting period, and an inaccurate measure of stock value would continue to have negative financial and legal implications for your business’ success.

[sc_fs_multi_faq headline-0=”h3″ question-0=”What is Inventory Closing?” answer-0=”It denotes the sum of inventory left on stock at the end of the financial year. It has more to it, so keep going through this blog post to find more.” image-0=”” headline-1=”h3″ question-1=”What is Inventory Closing in Dynamics 365 SCM?” answer-1=”Inventory closing process in D365 involves issues to receipt settlement, calculation of the initial cost of issues, cost propagation via inventory movements graph, and finally, posting of adjustments. All of these have more values you need to learn. However, we will share a detailed guide in this blog post.” image-1=”” headline-2=”h3″ question-2=”Why is Inventory Closing Necessary?” answer-2=”It is always a must to keep track of your inventory. Still, closing inventory is vital to estimate, because it ensures the match between the stocks, sales and purchases, but also for audit requirements. Every method has detailed information about its composition and reach. Therefore, continue reading this blog post for more guidance. ” image-2=”” headline-3=”h3″ question-3=”What is the Purpose of Inventory Closing in D365?” answer-3=”It shows whether your business stuck, or not, to its budget. It also determines whether there are any problems with production costs or not. More of this topic is explained in this blog. Read along for a better understanding. ” image-3=”” headline-4=”h3″ question-4=”How do I Use Inventory Closing in D365?” answer-4=”The inventory model requires an inventory closing, but you must use an inventory closing eventually. Besides, you can use recalculations in between inventory closings that will mark receipts to issues. This means inventory closing can change which receipts are used to cost an issue. This is just an overview of some points; you will find more information in this blog.” image-4=”” count=”5″ html=”true” css_class=””]Thank you for reading part 11 of our Supply Chain Series. If you have any questions, you can leave us a comment in the section below and we will get back to you as soon as possible. Additionally, stay tuned for our next blog post where we will talk more about this and other related topics. Furthermore, if you want to learn how to leverage your business data using Supply Chain Management, you can reach out to us here. This has been Brandon Ahmad, founder of Instructor Brandon and Dynatuners.

12460

12460